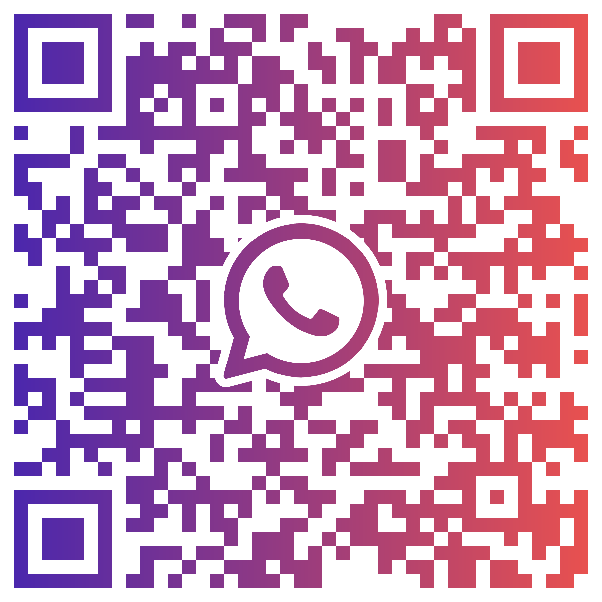

The RBA are expected to hike their overnight cash rate (OCR) by 25bp, which would see the OCR at a 10-year high of 3.6%. We noted in their February meeting that the statement had a hawkish tone, and that the wording suggested at least two more hikes are in the pipeline.

“Further increases in interest rates will be needed over the months ahead”. RBA statement, February 2023

Therefore, any adjustments to the wording of this sentence could be the difference between one or two more hikes from here – because a further increase over the months ahead would suggests one more hike is to follow, with a terminal rate at 3.85%.

What has happened since the RBA’s latest meeting?

With the likelihood that inflation has peaked, unemployment will slowly rise and growth will continue to soften, the case for the RBA to pause is certainly building. But the fly in the ointment is inflation above 7%, which means we’re likely to see at least two more hikes. But we can at least say with confidence that the RBA are much closer to the end of their tightening cycle, than the middle or the start.

Inflation may well have peaked, to the relief of many. At 7.2%, it remains historically high and more than twice the upper range of RBA’s 2-3% target inflation band, which clearly warrants further rate hikes. But as it has pulled back from a high of 8.4%, we can make a relatively safe assumption that peak inflation is behind us (and that there is no need for 50bp hikes).

GDP data was also soft. Q4 GDP rose just 0.5% compared with 0.7% expected, although the annual rate of 2.7% was in line with economists and the RBA’s own forecast. And if GDP continues to trend lower as expected, it weakens the case for higher interest rates.

Wage growth was below par. Q4’s wage price index rose just 0.8% q/q, below forecasts of 1% and clearly below the rate of inflation. This shows no evidence of the ‘wage spiral’ the RBA and all central banks fear, which again lessens the case for more aggressive rate hikes and brings forward hopes of a lower terminal rate and / or a pause.

Unemployment rose to an 8-month high. At 3.7%, unemployment in Australia remains historically low (the long-term average is 6.7%) but it suggests a cycle low may have been seen at 3.4% in October. It also points towards a soft landing as opposed to a crash. All in all, it suggests the economy can handle higher rates, but it should also be remembered that employment is a lagging indicator.

Building approvals plummeted in January. The -27.6% decline in building approvals in January shows that higher interest rates are spooking developers. Whilst this suggests a downturn in this sector of the economy, it is also inflationary because immigration is continuing to rise so competition for rentals will continue to push prices up (and feed back into headline inflation).

Expectations for the RBA’s March meeting:

- 27/28 economists polled by Reuters expect a 25bp hike tomorrow

- The same poll saw economists favour a terminal rate of 3.85% by June (which would leave room for a final 25bp hike in April, May or June)

- Cash rate futures imply a 75% chance of a 25bp tomorrow

- Cash rate futures have fully priced in a terminal rate of 4.1% by August

What to look out for in the RBA’s cash rate statement tomorrow:

If the RBA tip their hat to inflation likely having peaked, it might encourage some excitement over a potential pause sooner than later. On that note, any mention of a pause in the statement would likely be as good as a pause itself, which could then weigh on the Australian dollar and send the ASX 200 higher. But I will probably look immediately at the final paragraph to see if they have dropped an ‘s’ from the line “Further increases in interest rates will be needed over the months ahead”, as it would imply there is only one more hike on the horizon.

But if we get another statement as hawkish as February’s, there may be some disappointment among investors, and that could weigh on the ASX 200 and support AUD pairs.

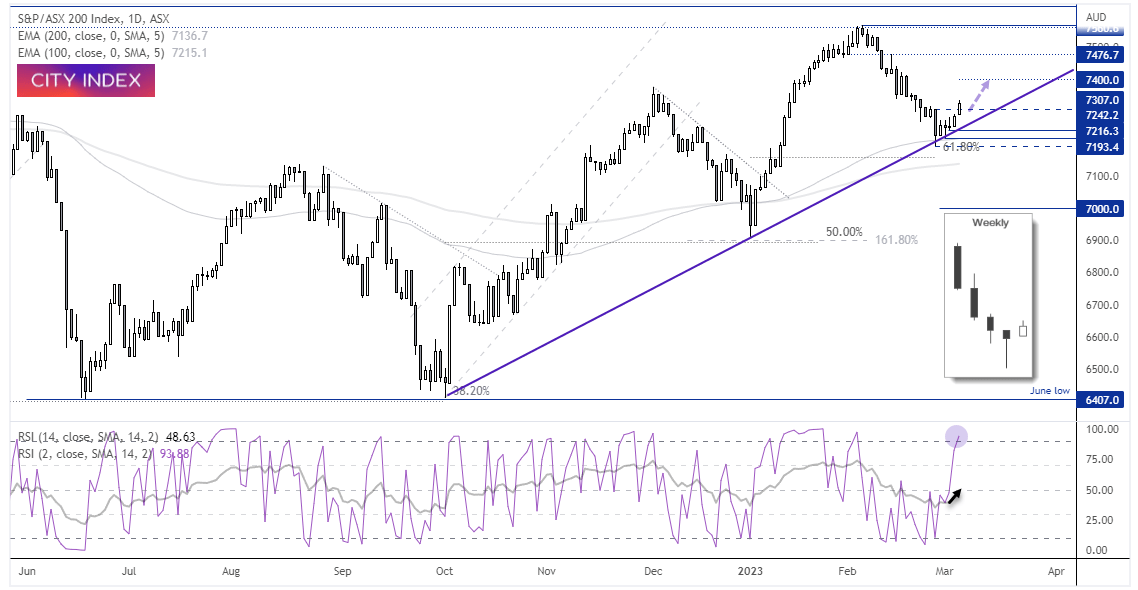

ASX 200 daily chart:

The pullback from the YTD highs saw the ASX drop back to trend support and the 100-day EMA. The index also retraced for four consecutive weeks (as it did between December and January last year), and form a bullish hammer last week - so a case is certainly building for a decent move higher.

The daily chart shows the index has broken above the 7307 high today, and I suspect it is now on its way to 7400 as a minimum (with a dovish or less hawkish tone in tomorrow’s statement likely to support such a move). But if we see a hawkish hike, perhaps it will help the ASX pull back, and help bulls seek bullish setups at a lower price above the trendline.

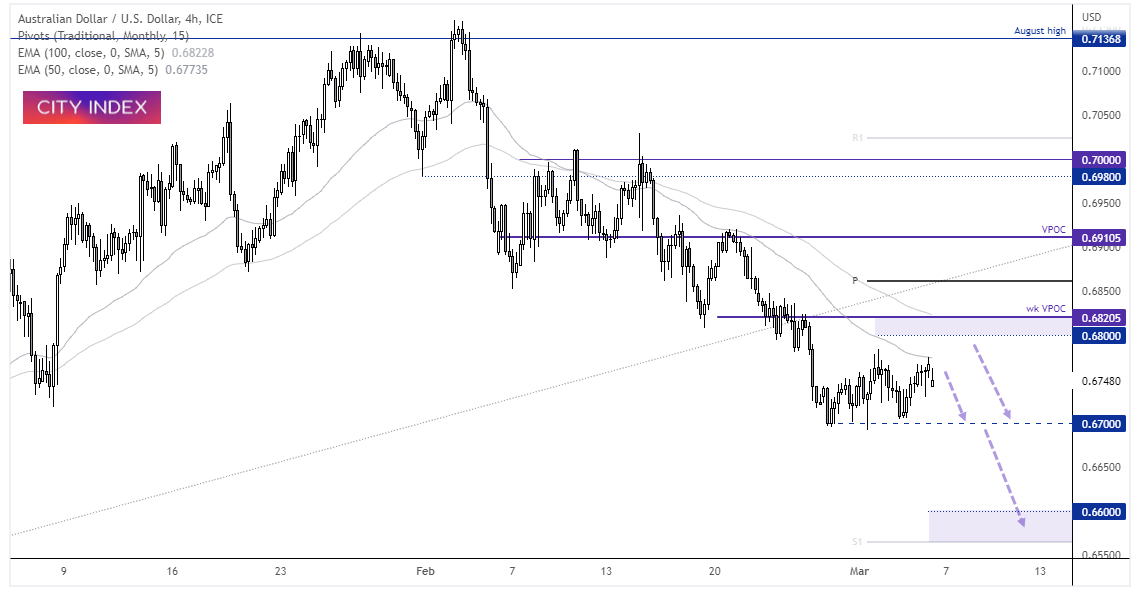

AUD/USD 4-hour chart:

AUD/USD is oscillating within a sideways range, having failed to break below 0.6700. Whilst China’s reopening has given the Aussie some support, the stronger US dollar is caping any upside. A hawkish hike could send the Aussie towards the 0.6800 level, near last week’s VPOC (volume point of control) at 0.6820 which can act as a magnet should prices rally. But as the trend remains bearish, we would seek bearish setups below 0.6850 should evidence of a swing high form, or wait for a break below 0.6700 to assumes trend continuation.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade