Read our guide on the ASX 200 trading guide

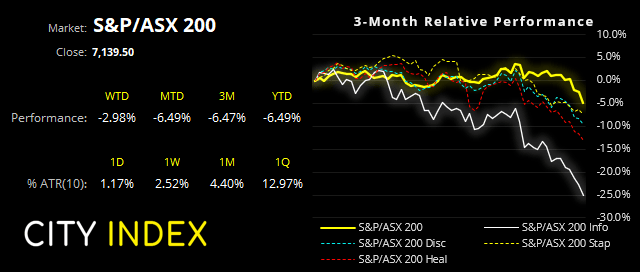

It has not been a good time to be long on the ASX 200. Since its YTD high, the index has fallen over 9%, half of which occurred over the past three sessions. Three of the past five days has seen the index fall over -1% in a day, two of which fell over -2%. Nice.

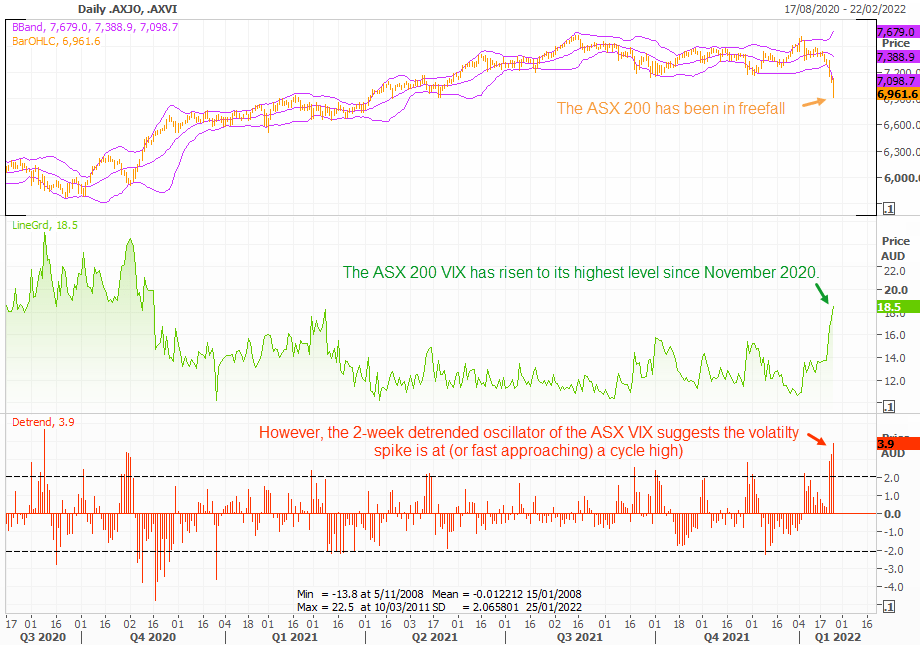

That said, the ASX is not alone as it has been swept along with a risk-off sentiment for equity traders globally. The Fed are set to hike rates several times this year and tensions between Russia and Ukraine persist which has been a large driver to the risk-off tone. Naturally this has seen the ASX 200 VIX (volatility index) and implied volatility exploder higher as investors rush for the exit and price in their worst fears.

Read our guide on the Volatility Index

As of Tuesday’s close, the ASX 200 VIX rose to an absolute level of 18.53 – a level not seen since November 2020. And this means that investors expect annualised volatility to reached 18.5% over the next 30-days. Yet perhaps the absolute level is not the best metric to assess near-term volatility. If we look at the 10-day detrended oscillator of the VIX it better shows the fluctuations of volatility cycle. And it currently suggests that the recent spike in volatility is at (or fast approaching) a cycle high.

Taking that into consideration, we are now questioning whether the worst of this leg lower is over, assuming it has not bottomed already. Of course, for any noteworthy turnaround we are going to need to see a rebound in global sentiment. And if this is the beginning of a bear market we also need to factor in the obligatory, volatile bounces during its white-knuckle ride. This means we are unsure whether any bounce could be of the dead-cat variety ahead of its next leg lower, or a v-bottom recovery. But as we highlight below, the ASX 200 has fallen sharpy into a key zone of support which may hold, at least initially.

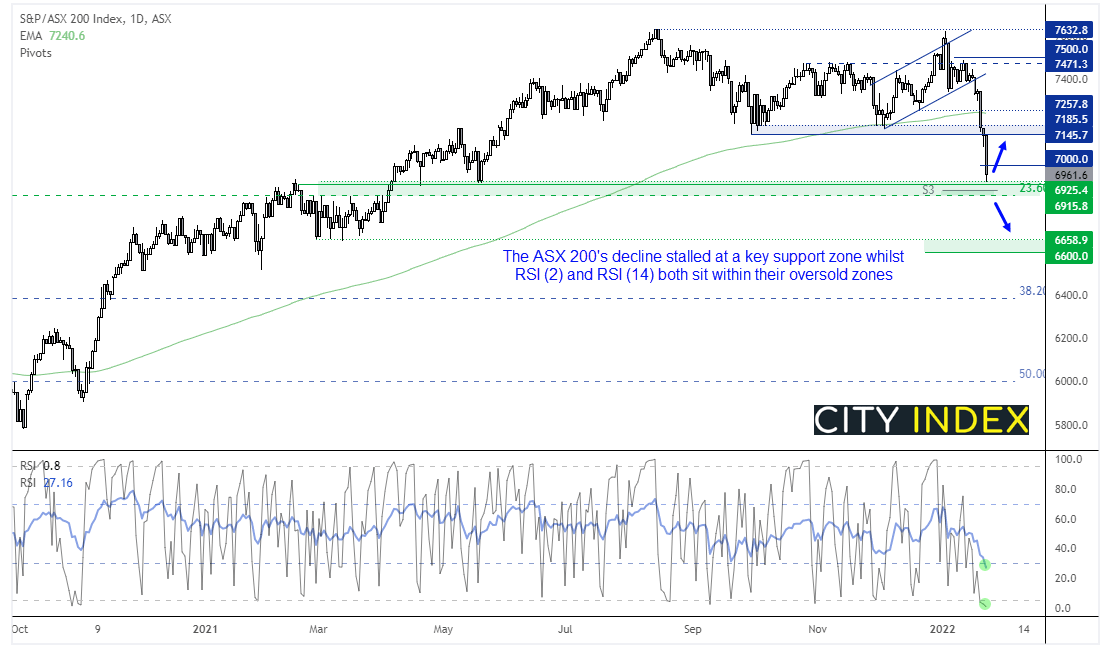

We can see on the daily chart that bearish momentum on the ASX 200 accelerated when prices broke beneath its 200-day eMA. Prices closed below 7,000 on Tuesday for the first time since May, further showing bears have having a picnic. Yet Friday’s low perfectly respected the 6925 support level, which is just above the monthly S3 pivot point and 23.8% Fibonacci retracement between the March 2020 low to all-time high. Furthermore, RSI (14) and RSI (2) are ‘oversold’. We use that term lightly because, due to the velocity of the bearish move, oscillators have nowhere else to be other than ‘oversold’. But the RSI (2) is 1.3, its most bearish level since March 2020, and this indicator setting is generally more reliable for producing oversold signals for quick fluctuations.

In a nutshell, we have technical clues that suggest the downside may be stretched over the near-term, coupled with a high reading on VIX (which is an indicator which generally does not stay high for long). If sentiment improves it could trigger a bounce from current levels yet, at the same time, we need to be on guard for a break lower of the support zone – which makes the zone around 6900 a pivotal level for traders to focus on for the remainder of the week.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade