US futures

Dow futures +0.53% at 30298

S&P futures +0.58% at 3730

Nasdaq futures +0.5% at 11442

In Europe

FTSE +0.5% at 7115

Dax +0.52% at 13318

Euro Stoxx +0.62% at 3487

Learn more about trading indices

Stocks recover from last week’s selloff

US stocks are set to open higher today, on the first day of trading after the long weekend and after the steep losses last week.

High inflation and aggressive central bank tightening raised fears of recession last week sending stocks tumbling to levels last seen in 2020 in the pandemic. The S&P fell 5.8% dropping into a bear market, down over 20% from its early January record high. The fact that the market has entered a bear market doesn’t mean that it will stop falling.

In fact, today’s rise isn’t a risk reset at all, fundamentally nothing has changed since last week. It isn’t unusual for stocks to rise after a heavy selloff. Given that a recession isn’t fully priced in there could well be more decline to come.

Where we go from depends on what Fed Powell’s pre-released remarks for the monetary report testimony before Congress say and whether they spook the market further.

Goldman Sachs has upwardly revised its recession probability to 30% while Elon Musk is saying that it is more likely than not.

The economic calendar is quiet with US existing home sales.

In corporate news:

Tesla rises pre-market after Elon Musk said that an economic slowdown could result in a 10% cut in the number of workers on the payroll at the EV manufacturer, which equates to around 3% of the workforce.

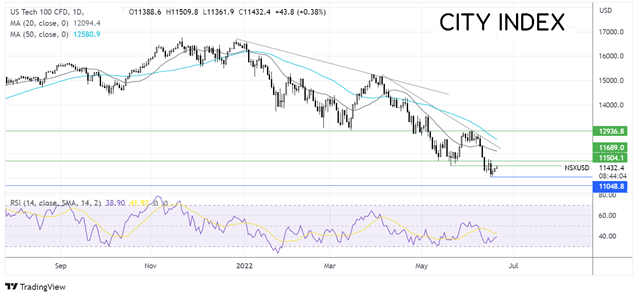

Where next for the Nasdaq?

The Nasdaq continues to trend lower, creating a series of lower lows and lower highs. The price trades below 20 & 50 sma, and the falling trendline. The price ran into support at 11035 the 2022 low and is attempting to climb higher. Even so, the RSI is bearish but remains out of oversold territory so there could be more downside to come. Sellers need to break below 11035 the 2022 low to open the door to 10680 the September 2020 low. Buyers will be looking for a move over 11480 the May 20 low and 11650 the May 12 low to expose the 20 sma at 12100.

FX markets – USD falls, JPY tumbles.

USD is falling, extending losses from the previous session as risk flows return. Investors are waiting for Fed Powell’s pre-prepared comments to be delivered at the semi-annual monetary policy report before Congress.

USDJPY is rising to a fresh 24-year high over 136.00, despite broad USD weakness. Investors are awaiting the release of BoJ minutes, which are expected to highlight central bank divergence. The minutes come from the June meeting in which the BoJ reiterated its accommodative stance. Meanwhile, the Fed is considering another possible 75 basis point hike.

EUR/USD has lost traction, handing back most if its earlier gains. The eurozone economic calendar is quiet so attention will be on the USD and Fed Chair Powell’s testimony.

GBP/USD +0.18% at 1.2267

EUR/USD +0.47% at 1.0557

Oil rises after dropping 7%

Oil prices are on the rise on Tuesday after falling 7% across the past two days on fears that slowing global growth would hurt the demand outlook.

Today, the price is rising as improving summer fuel demand and tight supply drive the market higher. Attention has shifted away from recession fears, distracted by improving flight activity and mobility data in the US. Furthermore, with China re-opening and summer travel in the northern hemisphere ramping up, demand could well stay strong. Particularly as supply growth is slow.

Supply concerns are unlikely to subside anytime soon, as the Russian Ukraine war rumbles on. It would take a sharp and sustained rise in supply from ether the US or OPEC+ to calm supply concerns.

WTI crude trades +0.8% at $109.56

Brent trades +0.8% at $113.22

Learn more about trading oil here.

Looking ahead

15:00 US existing home sales