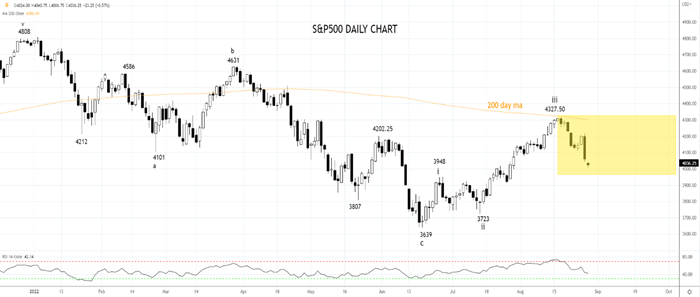

After a stunning run higher from the June lows, U.S stock markets had their worst week since June, closing 4% lower after Fed Chair Powell's highly anticipated speech at Jackson Hole.

The Fed Chair dashed misplaced equity market hopes of an imminent dovish pivot, noting the Fed would continue to raise rates and keep them higher for longer as it digs in to fight inflation.

For the U.S bond market, which steadfastly refused to share the same dovish “hopetimism” as equity markets, it was business as usual. U.S 2-year yields are now trading at their highest level since the end of 2007.

To answer the question of what comes next for the S&P500, the interplay between recession fears and higher rates that flamed tail risks and drove U.S equity markets to the June lows has eased.

The labour market remains strong, and earnings results from the recently completed earnings season were better than expected.

However, on the topside, it’s difficult to see an enduring rally taking place in the coming months.

This is because the Fed is targeting Financial Conditions as it fights inflation. Financial Conditions comprise of bond yields, the Fed funds rate, corporate spreads, the trade-weighted exchange rate and the S&P500.

As witnessed on Friday night, the Fed simply need to sound hawkish to push back on any material easings in financial conditions that come via higher stock prices.

The conclusion is that the S&P500 is likely to trade within a 4300/3950 type range trade for the next two months. And as with any range trading type market, the preference is to fade the market at either of these extremes.

Source Tradingview. The figures stated are as of August 29th ,2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade