Since the last meeting in November, developments in the labour market and inflation have surprised to the upside. Inflation at 5.9% is almost twice the top of the RBNZ’s 1-3% target band and is yet to peak with high oil prices and a soft currency translating into $3/litre petrol prices in some parts of the country.

There is a non-negligible chance of a 50bp hike; however, with the housing market softening and the Omicron surge just getting started, the RBNZ is expected to opt for 25bp. Russia’s decision today to send “peacekeeping” troops into two separatist republics in eastern Ukraine this morning is roiling markets and likely to cast the die in favour of a more conservative 25bp hike.

The MPS will also include the RBNZ’s revised OCR track, which is expected to steepen, reflecting the need for consistent interest rate hikes, taking the end rate closer to 3%.

In addition, the market will also be alert to commentary on the outlook for the RBNZ’s LSAP bond portfolio and guidance on balance sheet runoff, particularly around how it intends to run down its $50billion portfolio of bond holdings.

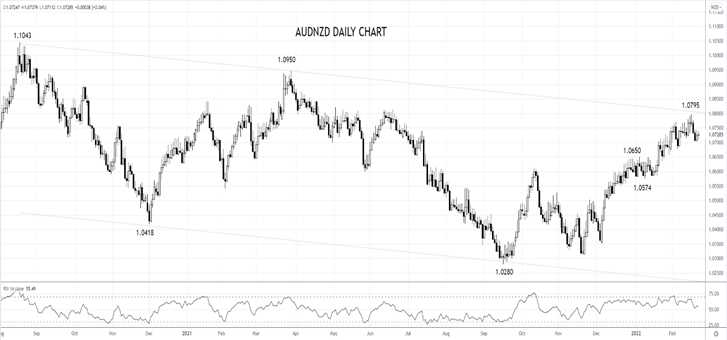

Turning to the FX market, the preferred way to play the rate hike is via short AUDNZD. As the chart below shows, the cross rate recently reached the top of a well-established trend channel near 1.0800, the target for a bullish AUDNZD trade idea most recently updated here.

To take advantage of the possibility of the cross rotating lower towards the middle of the trend channel 1.0600/1.0550 area, we would consider selling AUDNZD on a bounce to 1.0740 and place a stop on close at 1.0825. The profit target would be 1.0600/1.0550 region.

Source Tradingview. The figures stated areas of February 22nd, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade