Key takeaways

- Fed Chairman Jerome Powell is set to testify before Congress this week, where he is expected to signal that interest rates may need to be raised higher than previously estimated due to strong economic data.

- Powell's views on the economy and inflation are closely watched by investors, and any hawkish signals he sends could lead to market volatility.

- While some policymakers are calling for more aggressive tightening to combat stubbornly high inflation, Powell will need to balance these concerns with the need to avoid damaging the labor market recovery.

Federal Reserve Chair Jerome Powell is preparing to address Congress this week, where he is expected to provide an update on the state of the US economy and the central bank's plans for monetary policy. According to analysts, Powell is likely to signal that interest rates may need to be raised more than previously anticipated in light of recent economic data, which has exceeded expectations in many areas.

Powell's remarks will be closely watched by investors, as any hawkish signals he sends could lead to market volatility. The Fed has already raised rates repeatedly over the last year in response to higher inflation, and some policymakers are calling for more aggressive tightening to combat this persistent problem. However, Powell will need to balance these concerns with the need to avoid damaging the labor market recovery, which has been a bright spot for the Biden administration.

The central bank has set a target of 2% inflation, but the current pace is at 5.4%, which officials argue needs to be brought down to ensure long-term labor market strength. Powell has previously indicated that more rate hikes may be necessary, given the "extraordinarily strong" labor market. However, he will need to strike a balance between highlighting progress made in slowing inflation without job losses, while acknowledging that more work needs to be done as risks to the inflation outlook remain skewed to the upside.

While the majority of policymakers are signaling that the central bank should continue raising rates in more measured 25 basis-point increments, some officials and Fed watchers have suggested a 50 basis-point move should be on the table if inflation fails to slow. San Francisco Fed President Mary Daly ,for example, has stated that further policy tightening, maintained for a longer time, will likely be necessary to put the current episode of high inflation behind us.

It is likely that Powell's semiannual testimony will be his last public remarks before the Federal Open Market Committee next meets on March 21-22. As such, his remarks this week will be closely scrutinized by investors for any signals about the central bank's plans for monetary policy going forward.

AUD/USD technical analysis

AUD/USD is edging lower so far today, with the Aussie struggling in the wake of a softer-than-expected growth target out of China, Australia’s biggest trading partner, and ahead of tonight’s big RBA meeting.

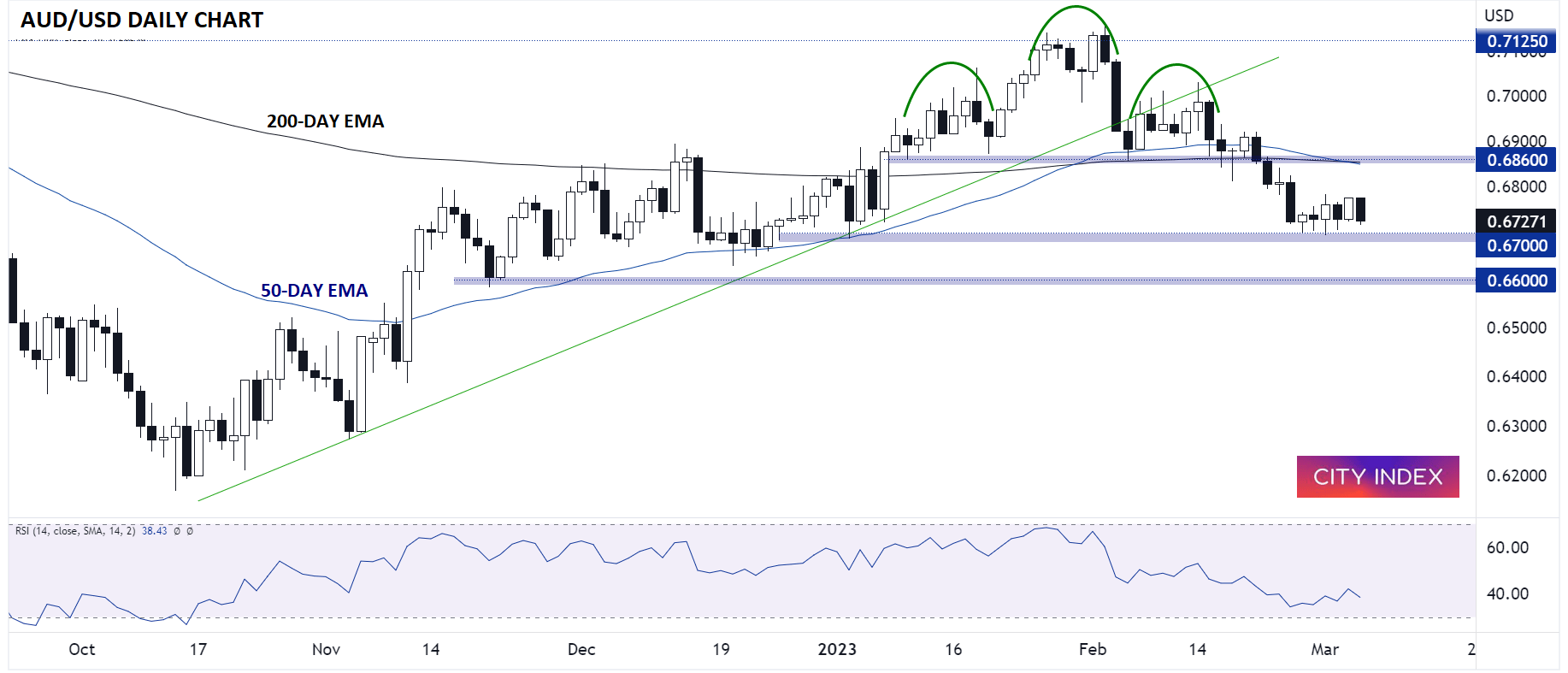

Technically speaking, the pair put in a clear “head-and-shoulders” pattern over the first two months of the year. For the uninitiated, this pattern shows a shift from a bullish trend (higher highs and higher lows) to a bearish trend (lower lows and lower highs), and is often seen at major tops in a market.

If Powell’s comments come off as more hawkish than expected (or the RBA is relatively dovish), AUD/USD could break below its near-term support at 0.6700 and continue toward the measured move objective of the head-and-shoulders pattern near 0.6600. Only a break above previous-support-turned-resistance at 0.6860 would reverse this bearish near-term bias.

Source: StoneX, TradingView

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter @MWellerFX

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade