The pound and the UK stock markets have shown no major reaction to the fiscal statement after Jeremy Hunt unveiled an austerity budget with £55 billion in tax hikes and spending cuts. If anything, both have fallen, along with other risk assets today. Tax hikes are going to chock any chances of economic growth that there might be, with the UK economy set to plunge into a recession amid soaring prices. As household incomes continue to get squeezed, spending falls, company revenue and profit are going to get a hit. Against this backdrop, it is very difficult to be optimistic on the UK stock markets or the pound.

The FTSE’s struggles to add to its gains from the previous week suggests investors are more worried about a deteriorating domestic, Eurozone and global economies, than are hopeful about the US and other central banks easing rate hikes.

It looks like worries over China is the main focus right now, where Covid cases are on the rise again and investors fear more lockdowns are likely.

In the UK, recent data shows that quarterly GDP fell by a less-than-forecast 0.2%, while construction output and industrial production both topped expectations, even if they hardly grew. But the monthly GDP disappointed with a bigger fall of 0.6% on month. But the outlook looks grim and that’s where the market is focusing, not on the past.

UK’s soaring inflation means the BoE is expected to keep hiking interest rates, which should intensify the squeeze on the consumer. Lack of growth in the Eurozone and elsewhere are also not good news for UK’s multi-national corporations.

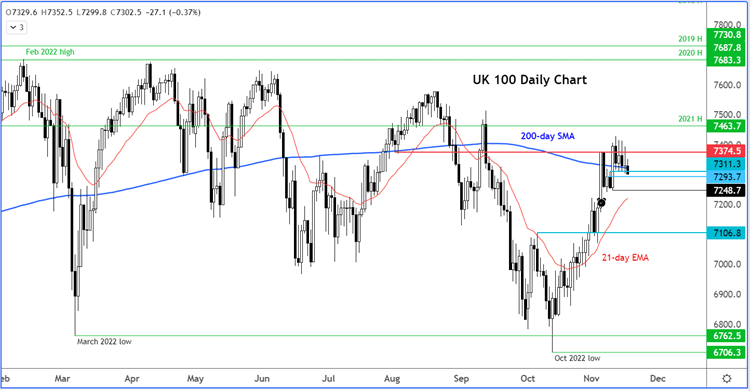

FTSE needs to stay below 200 MA for bears to pounce

The FTSE having turned lower on the week is now broken back below the broken 200-day average and was testing support around 7290-7310 at the time of writing. A daily close below these levels would make things look bearish again. For extra confirmation, the bears might be looking for move below recent lows at 7248. If we break that level, then things will look bearish again and the technical outlook will then match a darkening economic outlook.

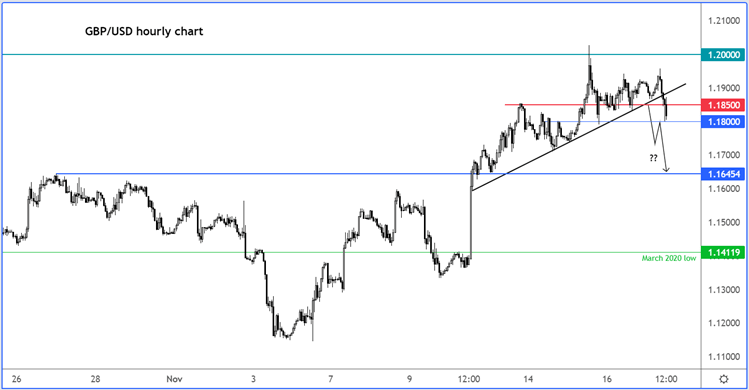

GBP/USD breaks trend line after hitting a ceiling at 1.20

With the short-term trend line broken on the hourly chart, it looks like the path of least resistance is now back to the downside for the cable. So, watch out below!

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade