NFP insight

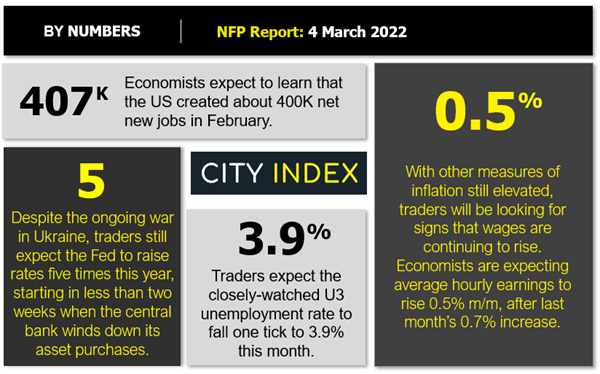

After a much stronger-than-anticipated jobs report last month, traders are primed for another solid reading on the US labor market as the Omicron COVID variant peters out and companies continue to hire aggressively. Indeed, economists are expecting to learn that the US economy created 407K net new jobs in February and that average hourly earnings, a key indicator of price pressures, rose 0.5% month-over-month:

Source: StoneX

When it comes to the Federal Reserve, the immediate interest rate decision appears to be made already: It looks highly likely that the US central bank will raise interest rates by 25bps (0.25%) as it concludes its asset purchase program in its meeting in two weeks’ time, essentially regardless of what this month’s NFP report shows.

Are these expectations justified? We dive into the key leading indicators for Friday’s critical jobs report below!

NFP forecast

As regular readers know, we focus on four historically reliable leading indicators to help handicap each month’s NFP report:

- The ISM Manufacturing PMI Employment component printed at 52.9, down about a point and half from last month’s 54.5 reading.

- The ISM Non-manufacturing PMI Employment component printed at 48.5, down from last month’s 52.3 level and slipping into contractionary territory for the first time in 7 months..

- The ADP Employment report showed 475K net new jobs, which was technically a slight decline from the massive upward revision to the previous month’s +509K reading.

- Finally, the 4-week moving average of initial unemployment claims fell to 230.5K, down from last month’s 255K reading.

As a reminder, the state of the US labor market remains more uncertain and volatile than usual as it emerges from the unprecedented disruption of the COVID pandemic. That said, weighing the data and our internal models, the leading indicators point to roughly in-line reading in this month’s NFP report, with headline job growth potentially coming in somewhere in the 325-425K range, albeit with a bigger band of uncertainty than ever given the current global backdrop.

Regardless, the month-to-month fluctuations in this report are notoriously difficult to predict, so we wouldn’t put too much stock into any forecasts (including ours). As always, the other aspects of the release, prominently including the closely-watched average hourly earnings figure which rose 0.7% m/m in January, will likely be just as important as the headline figure itself.

Potential NFP market reaction

| Wages < 0.3% m/m | Wages 0.4-0.6% m/m | Wages > 0.7% m/m | |

| < 300K new jobs | Strongly Bearish USD | Bearish USD | Neutral USD |

| 300-500K new jobs | Bearish USD | Slightly Bearish USD | Slightly Bullish USD |

| > 500K new jobs | Slightly Bearish USD | Neutral USD | Bullish USD |

The US dollar index fell sharply in the first couple days of February before spending the last three weeks of the month gradually recovering to finish roughly flat. Looking at the 14-day RSI indicator on the index, prices are not quite overbought at these levels, though they are somewhat stretched as the DXY tests previous resistance from June 2020 in the 97.75 area, pointing to some potential for profit-taking on a softer-than-anticipated reading.

As for potential trade setups, readers may want to consider EUR/USD sell opportunities if the jobs report is strong. As we go to press, the pair has broken down to a 21-month low under 1.1125 and has little in the way of support until closer to 1.1000.

On the other hand, a soft jobs report could present a sell opportunity in USD/CAD, which is peaking below its February range between 1.2650 and 1.2800 as we go to press. If the breakdown holds, there is little in the way of support until below 1.2500 for the North American pair.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade