New covid strain shakes the market, is it downhill from here?

The discovery of a new covid variant in South Africa, the B.1.1.529 strain, has rattled the markets, reminding investors that COVID risks still exist.

The new strain is the most heavily mutated strain so far and is according to scientists significantly different from the original virus which emerged in Wuhan. Some of these changes in the virus mean that vaccines, which were designed using the original covid may not be effective.

So not only could some of these mutations mean that B.1.1.529 spreads faster, it could also be resistant to current vaccines.

The British government has been quick to put several southern African countries on the red travel list until more is known about this potentially very concerning variant.

However, it is also worth noting that some variants, which looked bad on paper didn't take off.

How has the market responded and what to watch going forward?

Indices

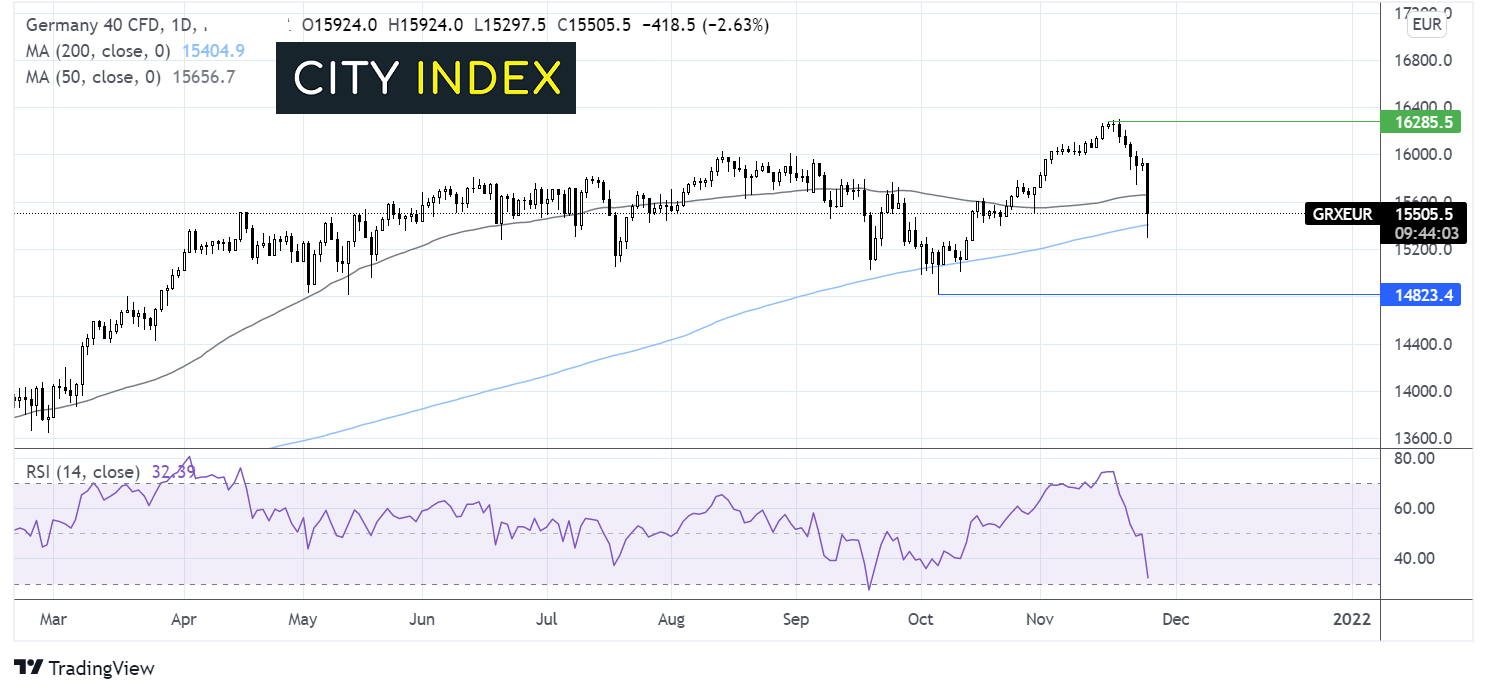

The news has shaken the markets with risker assets being dumped for safe havens. In Europe the FTSE and the DAX are on track to book the worst daily performance this year. US indices are extending the pull back from all-time highs. Given the Thanksgiving break, thin volumes and overstretched valuations perhaps a pullback wasn't so surprising.

Riskier assets such as stocks could struggle to rebound until more is known, the key question being whether it is vaccine resistant? Also let’s not forget this year has been a strong year for stock indices, and this news could be the perfect excuse to book profits for the year. That said investment banks such as Goldman Sachs are telling clients to buy the dips.

Interestingly this selloff came as our clients were starting to adopt a more bullish take on the DAX with the percentage of our clients in long positions rising from just 11% 7 days ago to 51%.

Looking at the DAX chart the sell off broke through the 50 sma negating the near term uptrend and then moved briefly below the 200 sma but buyers have appeared once again before the key 15,000 mark..A close below the 200 sma could open the door to 14,800 the October low beyond which sellers could gain momentum.

Sectors

The COVID trade could be back in play. Travel and tourism stocks are unsurprisingly the biggest fallers as travel restrictions are applied, with British Airways owner AIG tumbling over 12% at one point. Some travel stocks are actually trading lower now across the year. With COVID cases also rising in Europe the travel sector could struggle to find buyers.

Energy and commodity stocks are also on the decline as metals and oil fall lower, Gold miners are bucking the trend, tracing the safe haven higher.

The tech heavy Nasdaq has seen a smaller selloff than its peers as the COVID trades favours those stay at home and WFH tech stocks. Could tech return as the Darlings of Wall Street?

Oil

Oil prices have tumbled, down over 6% as the demand outlook is starting to cloud on the new strain discovery. Concerns over rising covid cases in Europe have also been weighing on oil recently. Supply side fears are adding to the negative tone surrounding oil, amid fears of a supply glut as the US and other oil consuming countries prepare to release emergency reserves.

Gold

The precious metal surged to an all-time high of $2075 mid-pandemic last year and is on the rise again. Not only is Gold supported by safe haven inflows but also by declining probabilities of the Fed hiking rates should this variant start spreading quickly.

Forex

Safe haven currencies such as the Swiss Franc and the Japanese Yen have performed well on the announcement and are the ones to keep an eye on in case of more covid bad news. Interestingly the USD, which is often considered a safe haven is falling as investors reassess the chances of a rate hike by the Fed.

Central banks are likely to be more cautious about hiking rates if covid restrictions could be re-imposed.

Conclusion

The market has seen a big move on the new strain announcement as it served as a reminder that covid flare ups could still knock recovery progress.

covid statistics could be back in the driving seat for the markets. However, it is still early days. This isn’t the first time that covid strain news has prompted a reaction in the market and it remains to be seen to what extent it could threaten the bull run.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.