Freeport warns over a delay to restarting operations

Natural gas prices have tumbled over 14% at the time of writing after the operator of the Texas export terminal, Freeport LNG, said that it could take 90 days to partially restart the facility after an explosion last week, and it may take the rest of the year to complete all repairs and return to full operation.

Freeport had initially said that the facility would be closed for a couple of weeks.

The more extended closure of the facility means that the US natural gas market will be oversupplied for a period, as the gas will remain in the US rather than being exported. This will loosen the LNG gas market in the US but tighten it globally, such as in Europe and Asia. The facility exported around 2 billion cubic feet of LNG per day, around 2% of US demand which, has been temporarily halted.

Producers aren’t about to cut back production in light of the Freeport LNG facility update.

Even so, natural gas prices are still up some 90% since the start of the year. While demand has rebounded as economies have reopened after COVID lockdowns, supply has remained tight.

Russia’s invasion of Ukraine tightened the market further. Europe is attempting to transition away from dependency on Russian energy, both gas, and oil. As a result, record quantities of US LNG are being directed toward Europe.

Soaring energy prices are adding to inflationary issues impacting the US and European economies. US CPI unexpectedly rose to 8.6% YoY in May.

Learn more about trading natural gas

Where next for Natural Gas?

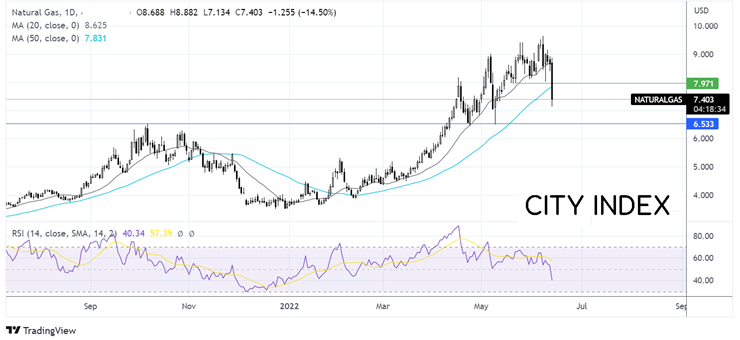

Natural Gas has plunged 14%, falling through the 20 and 50 sma before running into support at 7.134. This is the first time the price has traded below the 50 sma since late January, which, combined with the bearish RSI, could support further downside.

Sellers will need to break below yesterday’s low to extend the bearish move towards 6.500, the May low, and October high. A break below here would negate the near-term uptrend.

On the upside, resistance can be seen at 7.840, the 50 sma ahead of 8.00, the May 23 low and round number.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade