The November preliminary reading of the Michigan Consumer Sentiment Index was 54.7 vs an expectation of 59.5 and an October reading of 59.9. The current conditions component was much worse than expected at 57.8 vs an expectation of 64 and a prior reading of 65.6. The consumer expectations component was 52.7 vs an expectation of 56 and a prior reading of 56.5. Yes, the headline number was ugly.

But after Thursday’s US CPI reading of 7.7% YoY vs an 8.0% YoY expectation, markets aren’t focused on the headline print. It’s the inflation data that matters. For the most part, the inflation data was in-line with expectations. The 1-year preliminary inflation expectation was 5.1% vs a 5.1% expectation and a 5% reading in October. The 5-year preliminary inflation expectation was 3% vs an expectation of 2.9% and a prior reading of 2.9%. With 1-year inflation readings in-line, markets will turn their collective attention back to Thursday’s US CPI print, which caused the NASDAQ 100 to rally over 7% and USD/JPY to sell off 550 pips!

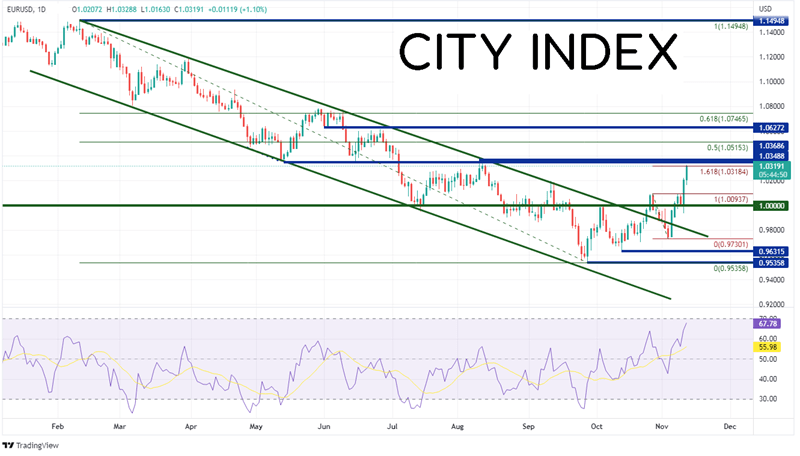

With the US bond market closed on Friday and the lack of new inflation data in the Michigan Consumer Sentiment Index, there was little follow through in the US Dollar after the release. However, the US Dollar did continue its move lower into the US session as dollar bears continue to ride the wave. EUR/USD had moved lower in an orderly channel from mid-February to September 28th, when the pair reached a low of 0.9536. Since then, the pair has been moving higher, breaking above the top trendline of the channel and continuing to the 161.8% Fibonacci extension from the highs of October 27th to the lows of November 3rd near 1.0318.

Source: Tradingview, Stone X

Trade EUR/USD now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

Where to next for EUR/USD? There is strong resistance just above at the May 13th lows and the August 10th highs between 1.0349 and 1.0369. Above there, price can move to the 50% retracement level from the highs of February 10th to the lows of September 28th near 1.0515. The next level of horizontal resistance crosses at 1.0627. However, if EUR/USD pulls back, the first support level isn’t until the October 27th highs at 1.0098! Below there, price can move to the lows of November 10th at 0.9936, then the top trendline of the previous channel near 0.9790.

Will inflation readings continue in the US continue to fall, or was this just a “one-off”? Markets are expecting inflation to be at 5.1% in 1-year and 3% in 5-years. If the November reading of CPI is weaker than the 7.7% YoY print for October, the US Dollar may continue lower and therefore, EUR/USD may continue higher!

Learn more about forex trading opportunities.