In our thorough Jackson Hole preview report, we outlined the case for more hawkish comments from Fed Chairman Powell in today’s highly-anticipated keynote speech.

In his relatively brief remarks, Mr. Powell clearly hit a hawkish note, emphasizing the importance of leaving policy tight until inflation was thoroughly licked. That said, he left the door open to a slowdown in rate hikes as soon as September, meaning economic data will be critical in tipping the Fed’s hand in the coming weeks.

Highlights from Powell’s speech follow:

- SIZE OF SEPT. RATE HIKE HINGES ON ‘TOTALITY’ OF DATA

- WILL LIKELY REQUIRE RESTRICTIVE POLICY FOR SOME TIME

- HISTORY CAUTIONS AGAINST ‘PREMATURELY’ LOOSENING POLICY

- THE LONGER THE CURRENT BOUT OF HIGH INFLATION CONTINUES, THE GREATER THE CHANCE THAT EXPECTATIONS OF HIGHER INFLATION WILL BECOME ENTRENCHED.

- RESTORING PRICE STABILITY WILL TAKE SOME TIME AND REQUIRES USING TOOLS FORCEFULLY TO BRING DEMAND AND SUPPLY INTO BETTER BALANCE.

- REDUCING INFLATION IS LIKELY TO REQUIRE A SUSTAINED PERIOD OF BELOW-TREND GROWTH. MOREOVER, THERE WILL VERY LIKELY BE SOME SOFTENING OF LABOR MARKET CONDITIONS.

- HIGHER INTEREST RATES WILL BRING SOME PAIN TO HOUSEHOLDS AND BUSINESSES.

- THE LONGER THE CURRENT BOUT OF HIGH INFLATION CONTINUES, THE GREATER THE CHANCE THAT EXPECTATIONS OF HIGHER INFLATION WILL BECOME ENTRENCHED.

Market reaction

On balance, markets are viewing Powell’s comments as more hawkish than anticipated. As we go to press, major US indices are trading down by 1-2%, 2-year Treasury bond yields are above 3.40% (near their highest levels in 15 years!), the US dollar is gaining ground against most of its major rivals, and commodities, including gold and oil, are trading lower on the day.

Traders will now turn their attention to next Friday’s NFP report as the next key economic release that the Fed will rely upon to help tip the scales between a 50bps and 75bps rate hike next month.

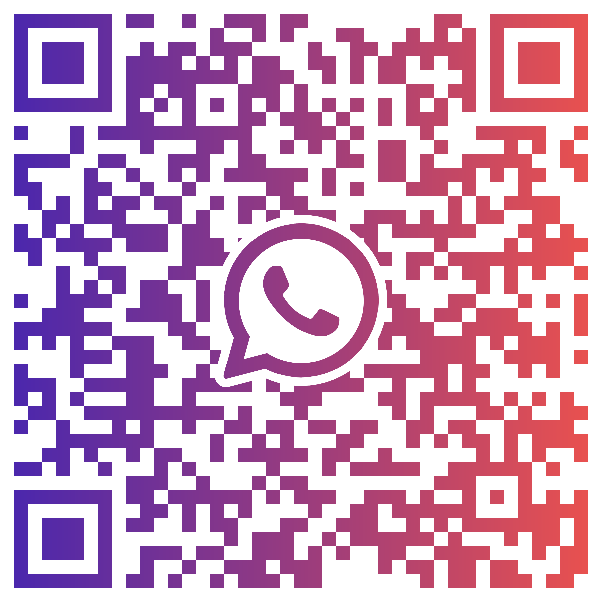

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade