With the SNB surprising most with a 50-bps hike, focus now turns to the today’s BOJ - the last dove in town.

There’s has been a growing expectation that the BOJ could alter, or even abandon, their YCC (yield curve control) target at today’s meeting. The yen began to strengthen after the SNB surprised markets with a 50-bps hike – when few were expecting a hike at all. With central banks fighting inflation in unison it piles pressure on the BOJ to change policy, at least at some point.

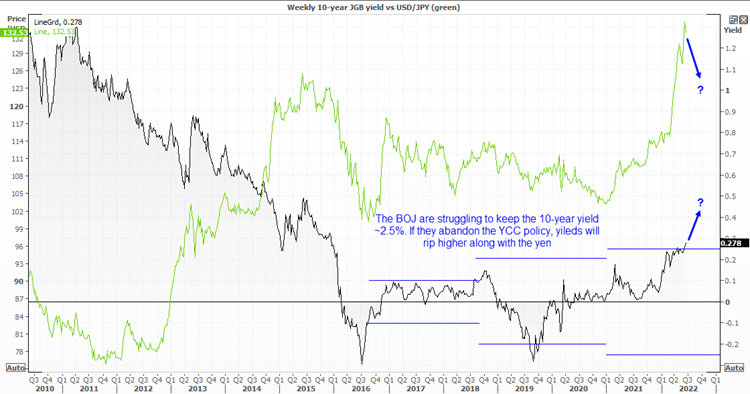

They BOJ have been trying (in vain) to keep their 10yrs bond yield ~0.25, but traders are goading them into abandoning the policy with rates now around 2.8%. Ultimately the BOJ made a choice to support their bond markets over their currency, as they can’t do both. So if they abandon YCC, expect the yen to rip higher in spectacular fashion.

Three potential scenarios to monitor at the BOJ’s policy decision

- The BOJ abandon’s YCC. This is most likely to spur the most volatile reaction and send the yen much higher against other currency pairs. Potentially like opening a Jack in the box.

- They increase the target of their 10-year yield. By how much the increase the target could have a direct impact on levels of volatility and direction; as they last increased the band from +/- 0.2 to +/- 0.25, then +/- 0.3 seems a viable net step (so anything above could be deemed as aggressive), anything less a non-event.

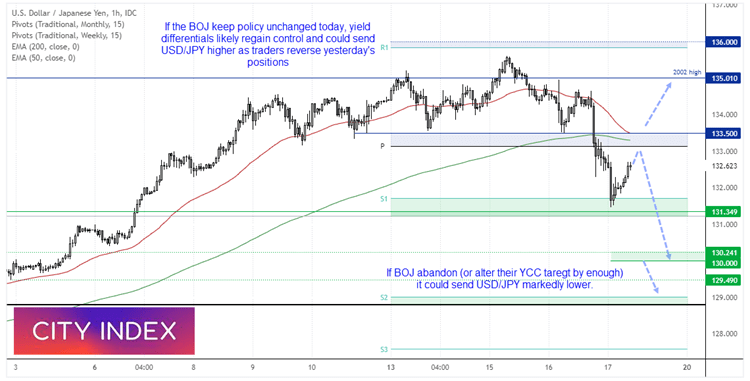

- The BOJ leave policy unchanged. This could send USD/JPY higher from current levels as traders reverse their positions from overnight.

If the BOJ stick to their dovish guns, it likely presents a great buying opportunity for the likes of AUD/JPY and USD/JPY, as pre-emptive traders run for cover and yield differentials come back into play. In fact, we’re already seeing USD/JPY move higher on a report from Reuters that the BOJ are expected to stand pat. Should that turn out to be incorrect, bears are likely to step back in at more favourable levels.

Ultimately, traders remain heavily net-short yen futures so this could be a white-knuckle ride if and when many of those yen bears are caught on the wrong side of the market.

Everything you should know about the Japanese Yen

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade