When will HSBC release Q3 earnings?

HSBC will release third-quarter earnings before the market opens on Tuesday, October 25. A conference call will be held the same day at 08:30am /3:30 EDT

HSBC Q3 earning consensus

Analysts forecast HSBC will report an 11.4% year-on-year rise in adjusted revenue in Q3 to $13.6 billion, and reported pre-tax profit is forecast to fall 53% to $2.5 billion.

HSBC earnings preview

HSBC share price trades up 0.5% year to date outperforming the wider sector and the broader market. The FTSE trades 7.5% lower so far this year.

HSBC has been the best-performing of the major UK banks after reporting a pre-tax profit of $5 billion in Q2, which was well above forecasts of $3.9 billion. The upbeat earnings were thanks mainly to rising interest rates which boosted net interest income, the return that banks make on loan interest over interest paid on deposits.

Interest rates have continued to rise across the third quarter, which is expected to have a positive effect on NII again this quarter, with a 24% increase forecast to $8.2B. That said, the bank’s non-interest income is expected to drop 25% to $4.06B and non-interest expenses are projected to rise 20% from Q3 last year. In other words, the benefit from rising interest rates is likely to be mostly cancelled out by rising costs and falling revenue in other aspects of the bank’s business.

Rising interest rates are a double-edged sword and carry their own risks for the bank. The moves by the central bank are designed to cool the economy, slowing demand and raining the likelihood of more loan defaults. The bank’s bad loan provisions are expected to rise as concerns over an economic slowdown rise. A key focus will be the bank’s expected credit loss (ECL), or loan loss provisions, which are expected to rise to $814 million compared to a $659 million release the year before. While the year-ago figure will represent the last tough comparison (i.e. Q3 last year saw relatively low provisions for losses), that will be little consolation for traders until next quarter’s earnings. Notably, Jefferies estimated that the UK government’s energy-price cap would reduce defaults on UK consumer loans, potentially limiting the increase in HSBC’s ECL.

Cost cutting is also expected to be a key focus thanks to branch closures, office downsizing and the withdrawal from less profitable foreign operations. HSBC has already sold out of some operations in US, France, Brazil, and Greece and is currently looking to sell out of its Canada business for $9 billion, in an effort to find more cash for fighting off breakup calls from its largest shareholder PingAn. The Chinese insurance firm, which owns 8,4% of HSBC is pursuing the spin of the Asian business.

Relative to more UK-centric rivals like Lloyds and NatWest, the greater international exposure of HSBC (and Barclays, for what it’s worth) should insulate its profits somewhat. In addition, the ongoing across-the-board weakness in the pound should boost HSBC’s international profits in sterling terms.

Q4 guidance will be key. Like most businesses with extensive exposure to the UK credit markets, HSBC faces an uncertain outlook given the volatility in the market. Readers will recall the big spike in long-term gilt yields and the collapse in the value of sterling in late September, which may cast a pall over this quarter’s results and the start of Q4.

Analysts ratings

On the whole, analysts are positive about HSBS. According to the Financial Times of 21 analysts polled, 4 gave outperform ratings, 4 – buy ratings, and 10 gave hold ratings. Meanwhile, 3 rated the share as underperform.

Where next for HSBC stock?

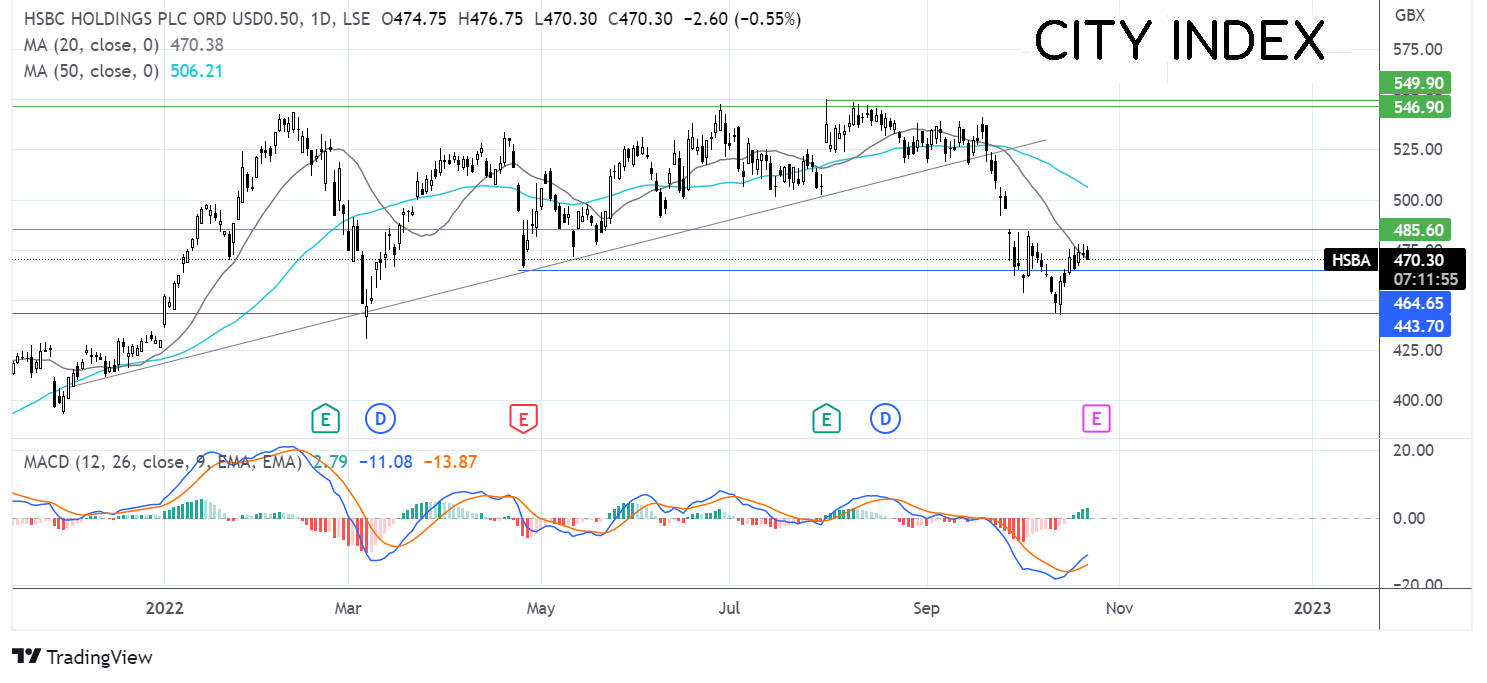

HSBA stocks had been forming a series of higher lows across the year, however, the upside has been capped by 545/550. However, the stock price tumbled in mid-September, falling below the rising trendline, the 20 & 50 sma.

Having found support at 442p, the price is attempting to rebound, testing resistance around the 470p level, the 20 sma. A bullish crossover on the MACD is keeping buyers hopeful of further upside.

Buyers need to retake 485p the October high to extend the bullish rebound toward 500p psychological level.

On the flip side, should the 20 sma fail to hold, sellers will look for a move below 465p on the April low, before brining 442p the October low back into focus.