Tesla added $350 billion to its market capitalisation in a matter of weeks. Nvidia, a company with a market cap of $740 billion (over five times BHPs market cap), rallied 12% on Thursday of last week.

When scanning for opportunities to take advantage of a stock market rally into year-end, it is towards the stock indices that have underperformed and have the potential to play catch up, we turn.

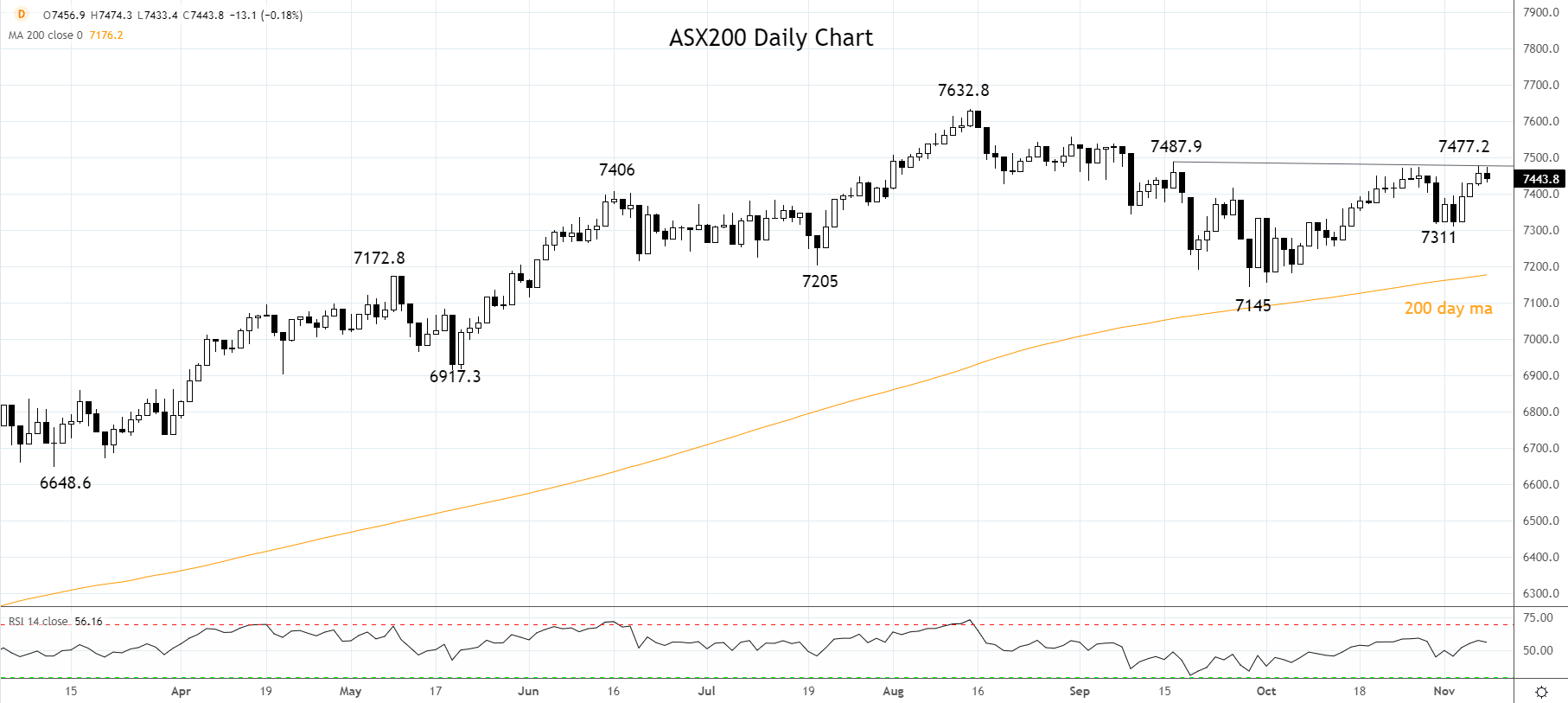

The ASX200 is currently languishing 2% below its all-time highs and up a relatively modest 13% (ex-dividends) year to date. Its underperformance due to a lack of technology stocks, exposure to decelerating Chinese growth, and extended lockdowns in NSW, Victoria, and NSW.

Despite higher than expected inflation and the RBA removing its yield target policy last week, the RBA’s economic forecasts were only modestly changed, and the RBA’s base case for rate hikes remains not until 2024.

To take advantage of a still dovish RBA, the easing of Chinese growth and lockdown headwinds, and evidence of a basing in the ASX200 at last week's 7311 quadruple low, consider the following trade idea.

Should the ASX200 (cash index) break above the band of horizontal resistance coming from recent highs 7477/87, we favour opening longs on a stop entry at 7495 (cash index), looking for a retest of the August 7632 high.

The stop loss would initially be placed at 7422 and trailed higher to 7460 if the ASX200 trades 7550ish.

Source Tradingview. The figures stated areas of November 8th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade