China is said to be considering a partial easing to the ban on imports of Australian coal, beginning April 1st. The ban was first put in place when Australia, along with other countries, called for an investigation into how the Covid virus started. In addition, China is also setting up measures to help its ailing property market by creating a fund for “too big to fail” developers. Also, Chinese authorities are downplaying the effects of Covid after the abrupt reopening and the impact it may have on the economy. (However, some counties, such as Australia, will require a negative test for inbound Chinese travelers beginning January 5th.) All the positive news from China is helping the Aussie catch a bid on hopes of an upcoming economic expansion in China, which in-turn will help AUD/USD.

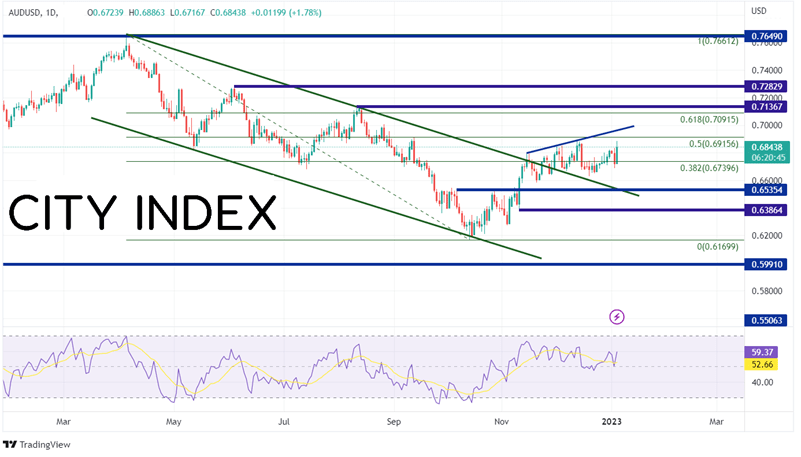

On a relatively calm day in the fx markets, as traders wait for the FOMC minutes, AUD/USD is in a range of nearly 170 pips, with an intra-day high of 0.6886. The pair had been moving in a downward sloping channel from April 5th, 2022, when it made a high of 0.7661 until October 13th, 2022, when it made a low of 0.6170. Since then, AUD/USD moved higher and broke above the top trendline of the channel in mid-November. The pair then proceeded to retrace 50% of the move from the high of 2022 to the low of 2022, closing the year near the 50% retracement level at 0.6815.

Source: Tradingview, Stone X

Trade AUD/USD now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

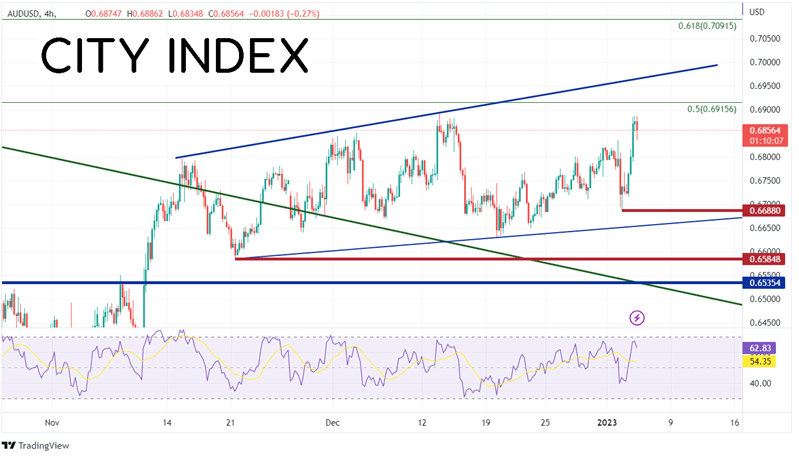

On a 240-minute timeframe, after breaking out of the long-term downward sloping channel (green), AUD/USD continues to grind higher in a new channel as it approaches the 50% retracement for 2022. That level offers first resistance at 0.6915, followed by the top trendline of the new channel at 0.6968. If price continues to move higher above there, the next level of resistance isn’t until the 61.8% Fibonacci retracement at 0.7092. However, if AUD/USD remains in the channel and the resistance holds, first support is at the January 3rd lows of 0.6688. Below there, price can move to the bottom trendline of the new channel near 0.6652 and then the lows of November 22nd at 0.6585.

Source: Tradingview, Stone X

Will the good news from China continue or will Covid continue to ravage the country for longer than expected. Regardless, it seems that the government is willing to help with additional measures. As long as this continues, it should be good news for Australia and AUD/USD.

Learn more about forex trading opportunities.