A big relief rally in Chinese and Hong Kong equity markets saw gold and other metal prices rise after starting the week on the backfoot on Monday. But the precious metal is by no means out of the woods. A potential recovery in the dollar and still-rising interest rates around the world means investors might shy away from low- and zero-yielding assets like gold.

There has been some speculation that the unrest in major Chinese cities over Covid restrictions may force the government to loosen its strict Zero Covid policy faster. China has already announced measures aimed at easing some restrictions, although many communities have imposed “targeted lockdowns” amid the latest upsurge in Covid cases. But the government’s pledge to step up its vaccination efforts, among other measures, may be a step towards reducing excessive restrictions in the future. At least that’s how some investors must have interpreted the situation, given the near-5% rally in Chinese equities overnight.

Investors will now turn their attention to the US dollar, as the debate over whether the greenback has already peaked continues. Recent dovish commentary from Fed officials amid signs of slowing inflation has fuelled bets of a slower pace of interest rate increases. Yet, the very fact that the Fed is still hiking means the job is not done yet. Investors are wary of shorting the dollar too far in these uncertain times.

With central banks like the ECB, BoE and many others also continuing to lift their respective interest rates to tackle double- or near-double-digits inflation, there is a real opportunity cost for holding gold. It is the fixed interest you would forgo by investing in non-yielding gold and not holding onto government debt that carry yields at levels not seen in many years.

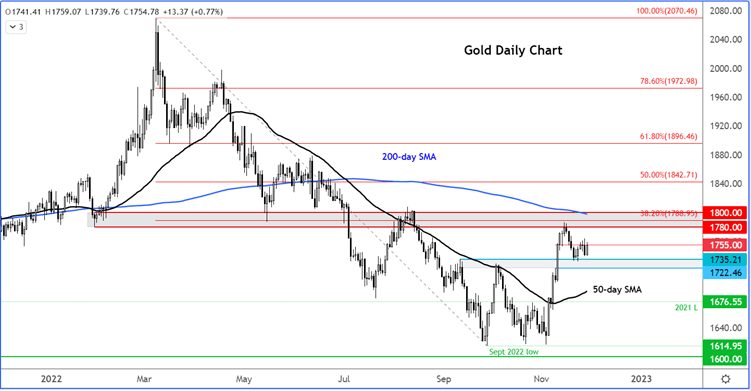

This dilemma is also reflected in gold prices, stuck between two major zones. The upside has been capped in recent days by strong resistance starting around $1780 to $1800. Here, previous support meets the 200-day average (now sloping downwards) and 38.2% Fibonacci level against this year’s highs. The downside has been supported – for now – by previous resistance around $1722-$1735 area.

Once one of these ranges break, then we might see a more pronounced move in gold prices. Could the trigger be provided by Fed Chair Jerome Powell’s speech on Wednesday? For what it is worth, I am leaning towards the bearish argument for gold, due to the reasons stated above.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade