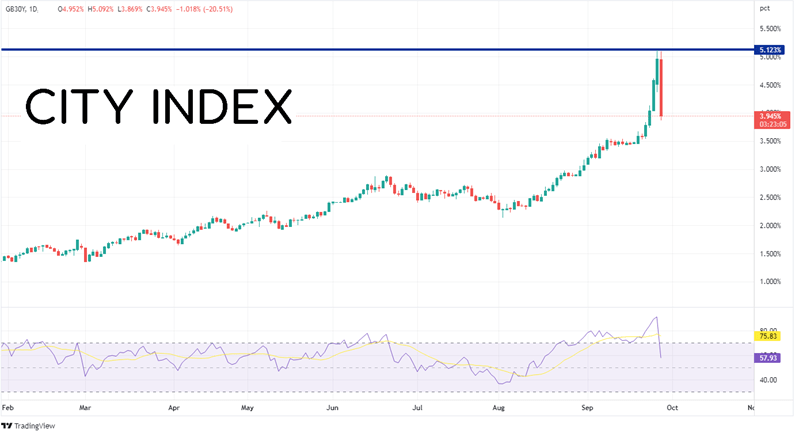

The Bank of England intervened in the Bond market on Wednesday. According to a Reuters “source”, the intervention was a response to issues with liability-driven investments and links to pension funds. The BOE has said that it would buy Gilts with maturities over 20 years, beginning today and lasting until October 14th. As a result, the yield on the 30-year Gilt has moved from a high on the day of 5.092% down to a low of 3.869%. Recall that it was just Thursday that the Bank of England announced a rate hike of 50bps to bring the overnight rate to 2.25% and that it would begin selling its holdings of Gilts at a rate of 80 billion Pounds per year. This sale has been pushed back and will now begin on October 31st. The opening level on the 30-year Gilt on Thursday was 3.535%. However, note the volatility in 30-year Gilt yield since then, which has been more directly related to the fear of new PM Truss’s fiscal policies than fear of the BOE’s monetary policy. 30-year Gilt yields moved up 134bps since Friday’s open and has retraced almost all of that back today!

Source: Tradingview, Stone X

GBP/USD made an intra-day high at 1.1738 on September 13th, just over 2 weeks ago. The pair has been moving aggressively lower since. On Friday morning, GBP/USD opened at 1.1252 and by Monday, the pair had traded to an all-time low of 1.0357. GBP/USD bounced to just above resistance at the 38.2% Fibonacci retracement level from the highs of September 13th to the lows of Monday, near 1.0931. GBP/USD oscillated between 1.0650 and 1.0800 until today. When the BOE made its announcement, GBP/USD rallied 200 pips to 1.0848, before falling to 1.0539 as traders digested the new information. At the end of the day on Wednesday, GBP/USD was trading near its daily highs at 1.0915.

Source: Tradingview, Stone X

Trade GBP/USD now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

As my colleague Fawad Razaqzada points out, the intervention may not be good for the Pound in the long-term. However, as we have seen today, the BOE may have “saved the Pound” in the short-term. If the pair continues to move higher, the first horizontal resistance is near 1.1020. Above there, the pair can move to the 50% Fibonacci retracement level from the above-mentioned timeframe near 1.1047, then a downward sloping trendline from the September 13th highs near 1.1135. First support is at the spike high after the BOE announcement at 1.0838. Below there, GBP/USD can fall to today’s low of 1.0539, then the all-time low at 1.0357.

Did the Bank of England succeed in saving the Gilt market and thus, saving the Pound? It may have worked in the short-term as the yield on the 30-year Gilt fell over 100bps today and GBP/USD closed up over 150 pips on the day. However, in the long-term, the intervention may not be sustainable, and GBP/USD could end up moving to parity or below!

Learn more about forex trading opportunities.