The Bank of England will be under pressure to do even more to calm financial markets, as investors continue to ask questions about their now beefed-up plans aimed at reducing the risk over the UK’s financial stability.

The BoE announced new measures aimed at ensuring an 'orderly end' to its emergency bond buying scheme which ends on Friday. It will increase the amount of bonds it can buy this week, effectively doing whatever is necessary to stop the bond market rout. But with the deadline of the emergency plan approaching, investors are concerned there will be increased levels of volatility again once the scheme ends.

Investors know full well that the BoE’s plans to address the rapidly rising borrowing costs were temporary, and that its main focus remained on withdrawing monetary stimulus and tightening monetary policy, all in order to help fight near double digit inflation.

So, there remains a great deal of uncertainty over how it will achieve an "orderly end" to its emergency bond buying scheme. Traders might wait for the BoE to step aside, and then punish bonds – and pound – once more. I reckon the BoE needed to keep the bond buying programme a bit longer, and without pre-committing to a specific data, for the plan to have worked better. Maybe they will realise they made a mistake and re-assess the situation later on this week.

Also not helping the situation is the simultaneous rate hikes. At the weekend, Deputy Governor Dave Ramsden indicated that the BoE fully intends to charge forward on interest rate hikes.

"However difficult the consequences might be for the economy, the MPC must stay the course and set monetary policy to return inflation to achieve the 2% target sustainably in the medium term, consistent with the remit given to us."

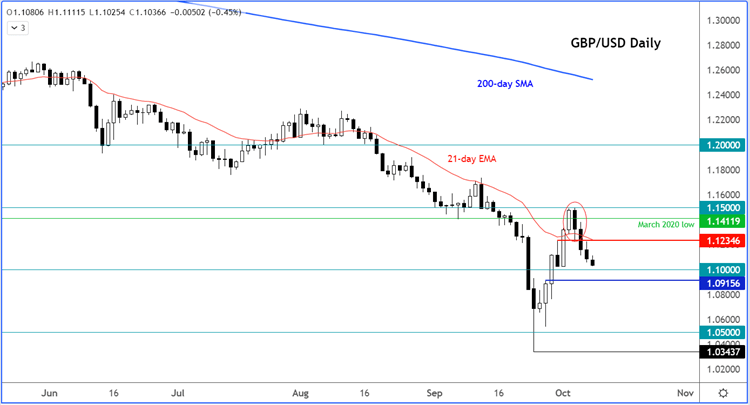

But the big 30+ basis points jump in 30-year yields today means the pressure is growing on the BoE to come up with an even bolder plan, or risk letting the GBP/USD slide towards parity.

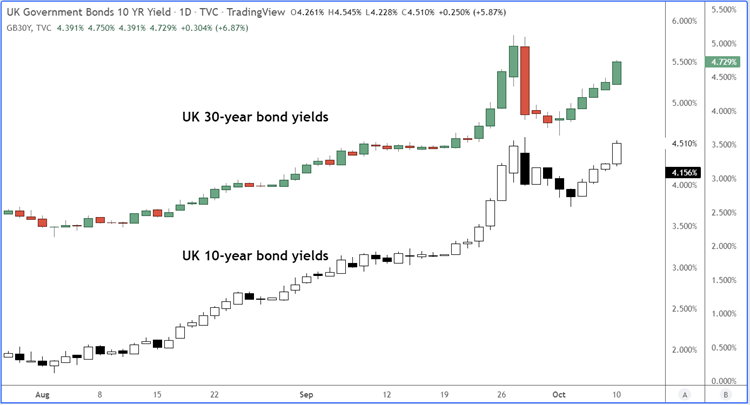

The yield on the 30-year debt has climbed to a high so far of 4.75%, very close to the post-intervention peak of 5.12%. The 10-year yield was also nearing its recent highs:

Yields on bonds with short-term maturities also shot higher. In response, the pound slid to near the $1.10 handle.

With the cable unable to hold the kick-back recovery, and now back below a few key technical levels, the path of least resistance remains to the downside. If it breaks, the next potential support below 1.10 is around 1.0915, which was formerly resistance. Loose that and there will be a risk the GBP/USD might head back down and to 1.05, potentially en route to re-test the late September low at 1.0345.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade