Following the Bank of England’s intervention, UK assets remain firmly in focus. It looks like traders are using price action on the FTSE, pound and – more to the point – gilts as a guide when speculating on the wider financial markets. While the bigger macro risks – especially stagflation – are yet to dissipate, there’s a strong possibility of further central bank intervention in the short-term outlook. Consequently, bearish speculators have eased off the gas a little, and this is providing some relief for beaten-down asset prices.

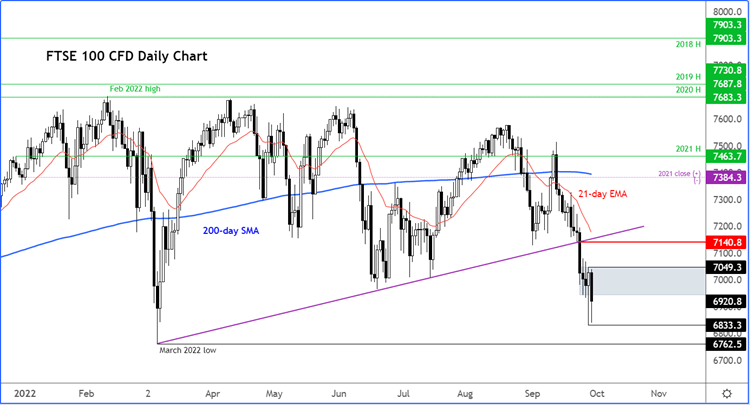

That said, it is not all rosy in the markets. A day after the BoE took emergency action to calm turmoil in financial markets, this morning saw the FTSE nearly gave back all the gains made on Wednesday, with falls in excess of 1.5 percent. Other European indices were faring even worse, with the DAX for example down over 2%, underscoring investor worries about the health of the European economy.

However, at the time of writing in mid-morning London session, the UK index had come off its worst levels. It needs to break and hold above 7050 – the high from Wednesday – to encourage would-be bulls to step in. Otherwise, a drop to the low hit in March at 6762 could be the outcome.

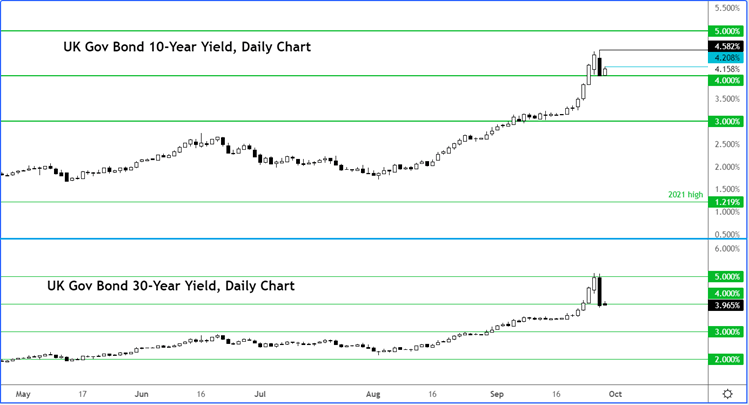

But as mentioned, the focus remains firmly fixated on the bond markets, with investors keeping a close eye on long-dated UK yields. For UK assets to stabilise, the BoE needs to bring yields further lower by buying bonds at an “urgent pace,” and on “whatever scale” as it has promised. For traders, it is important to watch gilts closely, even if they don’t trade these markets.

The BoE saw the pound collapse as government borrowing costs surged, before taking action. This was all triggered by Kwasi Kwarteng’s mini-budget last Friday. There’s no room for complacency. It must carry out its operations aggressively to convince the market. I fear that there might be more pain for investors, as the BoE’s efforts might not be enough to outweigh the ongoing macro risks facing investors. But at least, there’s some hope now.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade