Key takeaways

- The Consumer Price Index (CPI) readings in France and Spain came in stronger than expected in February at 7.2% and 6.1%, respectively, pushing the European Central Bank (ECB) to cement the half-point rate move they had planned for March.

- These high inflation rates have caused investors to increase bets on the peak of ECB interest rates to 4%, indicating that officials may hold borrowing costs at a high level for some time once they hit the peak.

- The market's cautious mood seems to be limiting the EUR/USD pair's upside, despite the strong inflation reports.

Inflation reports from France and Spain were released on Tuesday and came in higher than expected, causing investors to boost their bets on the peak of ECB interest rates to 4%, a level they had never reached before.

The ECB had already planned a half-point rate move in March, and these stronger readings are likely to bolster officials who say that more big moves are needed beyond that to get inflation under control.

The French CPI rose to 7.2% on a yearly basis, while the Spanish CPI increased to 6.1%. In Spain, higher energy and food prices led to a 1% increase in February compared to the previous month, raising the year-on-year rate by 0.2%. This increase in inflation has risen for two consecutive months in its year-on-year rate and is at its highest level since last November.

Meanwhile, in France, consumer prices rose by 6.2% in a year, driven by the acceleration in food prices, which rose by 14.5% over one year, and services, which increased by 2.9% over the same period. In one month, consumer prices increased by 0.9%.

The ECB's Chief Economist, Philip Lane, said that officials may hold borrowing costs at a high level for some time once they hit the peak, indicating that any moves higher could prove sticky.

Later in the day, the Conference Board will release the US Consumer Confidence Survey for February. Investors are likely to react to inflation-related findings of the survey, as in January, the one-year consumer inflation rate expectation rose to 6.8% in December.

EUR/USD technical analysis

The strong inflation reports have caused markets to nearly fully price in a 4% ECB terminal rate, compared to 3.75% last week, and hawkish ECB bets are helping the Euro hold its ground.

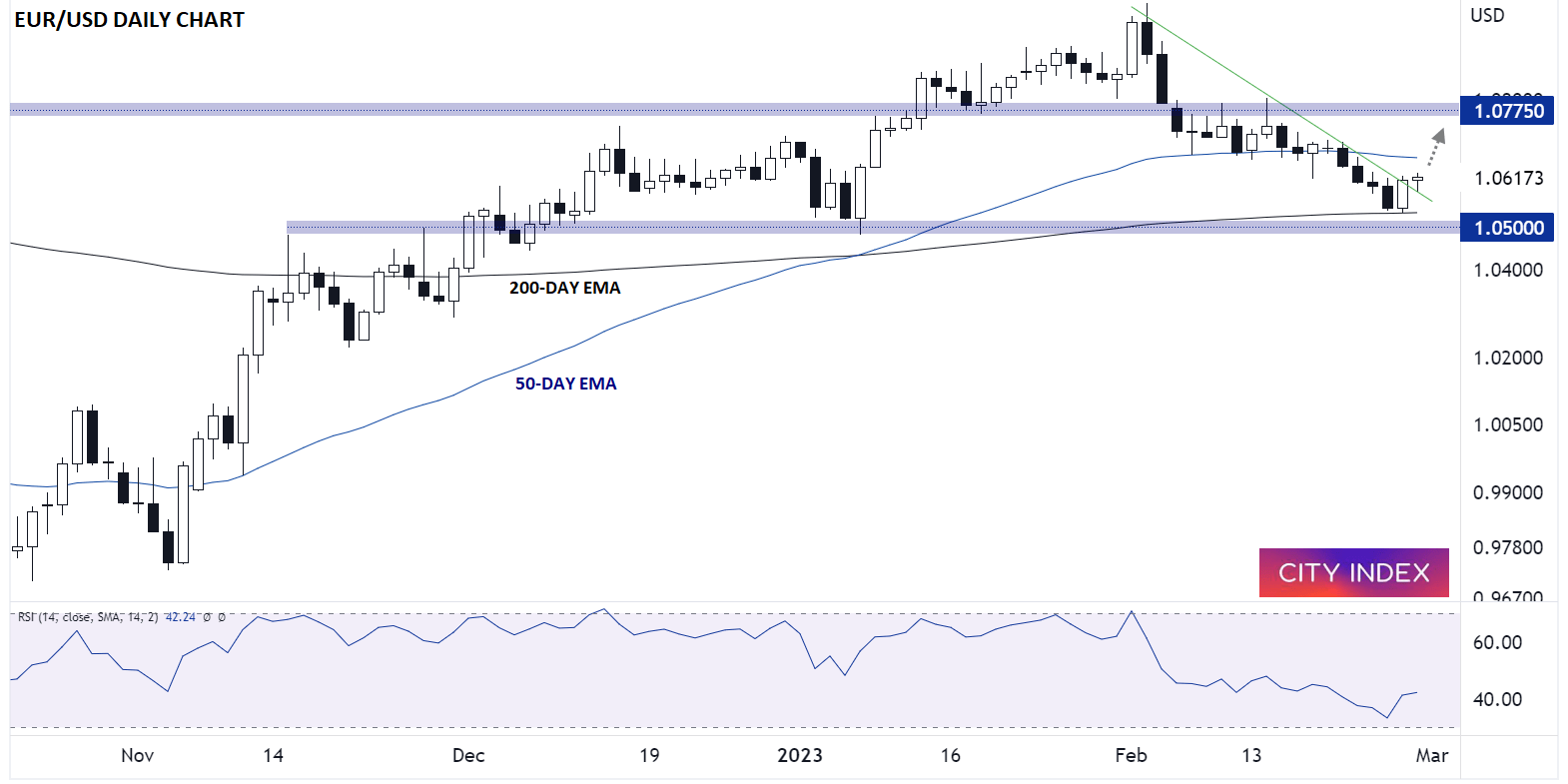

EUR/USD, the world’s most widely traded currency pair, bounced off its 200-day EMA yesterday, forming a piercing candle formation on the daily chart. For the uninitiated, this candle pattern shows a shift from selling to buying pressure and is often seen at near-term bottoms in the market.

If the bounce gathers steam in the coming days, the next resistance levels to watch will be the 50-day EMA near 1.0660 and previous-support-turned-resistance up at 1.0775. Meanwhile, a break below the 200-day EMA and the 1.0500 level would suggest that the early week bounce has petered out and rates may have further to fall from here.

Source: TradingView, StoneX

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter @MWellerFX

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade