EURUSD falls ahead of German business climate data

EUR/USD is falling, extending losses from last week, although remains above 1.0950.

The German business sentiment will be in focus and is expected tick higher to 94, up from 93.3 in March. The business expectations sub-index could also attract some attention and is also expected to rise to 91.5 from 91.2.

The data comes after the German PMI data on Friday showed that the manufacturing activity fell to a 35-month low at 44, while service sector activity rose to 55.7, a 12-month high.

ECB policymakers have doubled down on their hawkish chatter in recent weeks, with ECB President Christine Lagarde saying that the central bank still had more work to do. Today ECB Executive Board member Fabio Panetta is due to speak, and any comments regarding inflation or ECB policy could influence the EUR.

Meanwhile, the USD has kicked off the week on the front foot supported by expectations that the Federal Reserve will hike interest rates by 25 basis points at the meeting next week. Recent data showed that US economy is proving to be relatively resistant after PMI data on Friday showed that business activity improved. Service sector activity grew at a faster pace, and manufacturing returned to growth.

Fed speakers have now entered the blackout period ahead of next week’s meeting. On the data front, regional manufacturing figures from Dallas and Chicago are due.

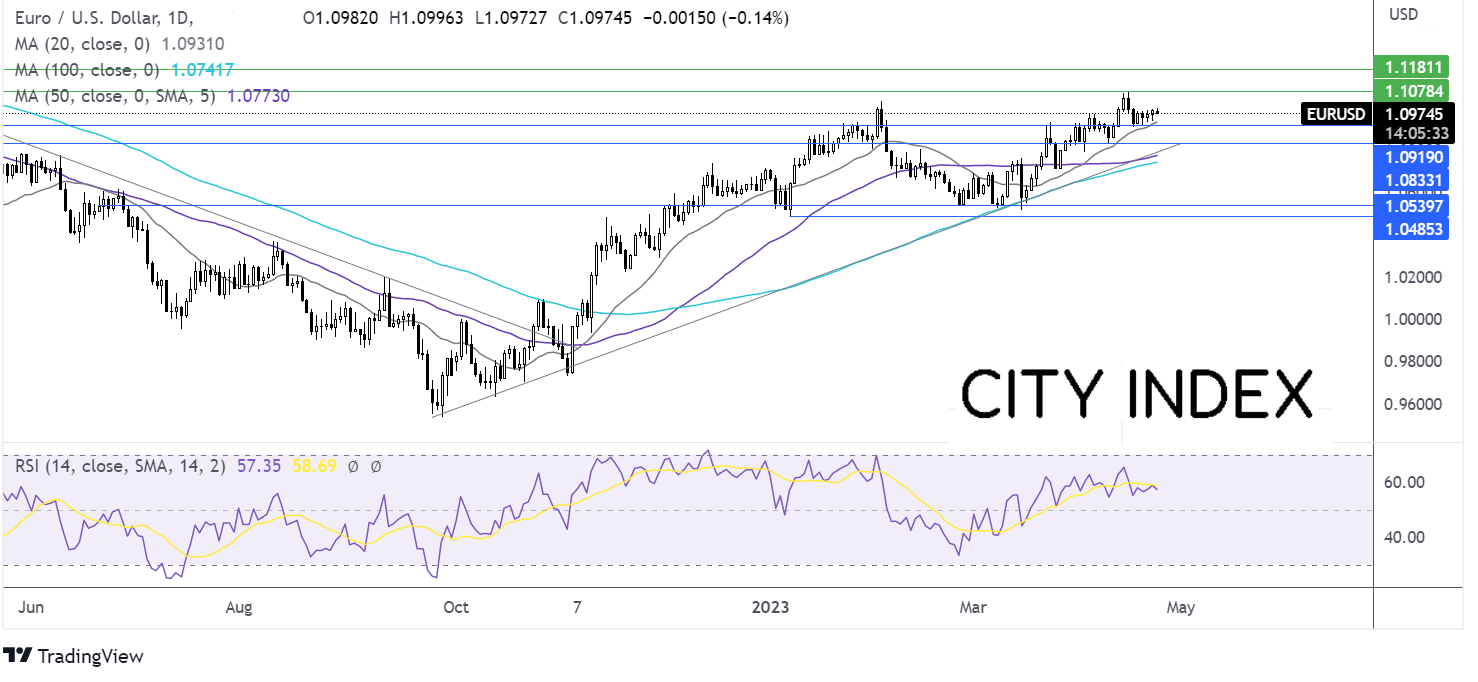

Where next for EUR/USD?

EURUSD is consolidating between 1.09 and 1.10. The long lower wicks on the candles last week suggest that there was little demand at the lower prices, which combined with the RSI above 50 keeps buyers hopeful of further upside.

Buyers could look for a rise 1.10, last Monday’s high, which would be a bullish signal, opening the door to 1.1050 round number and 1.1075, the 2023 high.

Sellers could look for a fall below 1.0930 the 20 sma ahead of 1.09 last week’s low. A break below here creates a lower low and brings 1.0835 the April 10 low into focus.

USD/CAD rises as oil slips & CAD retail sales drop

USD/CAD is rising, extending gains from the previous week as the USD found support from hawkish Fedspeak and stronger-than-expected PMI data.

Meanwhile, the CAD is under pressure after falling Canadian retail sales highlight the impact that the BoC’s rate hikes have had on the consumer, denting demand and as oil prices fall.

Canadian retail sales fell -0.2% MoM in February and are expected to fall -1.4% in March, which would mark the largest fall in 8 months.

This comes as the BoC raised interest rates at a record pace over the past year to cool inflation, and then became the first central bank to pause monetary policy tightening.

Oil, Canada’s main export, fell over 5% last week and trades at a 3-week low amid fears that rising interest rates will slow global growth and hurt the oil demand outlook.

Today Canadian new home price data could influence the price, along with US regional manufacturing data.

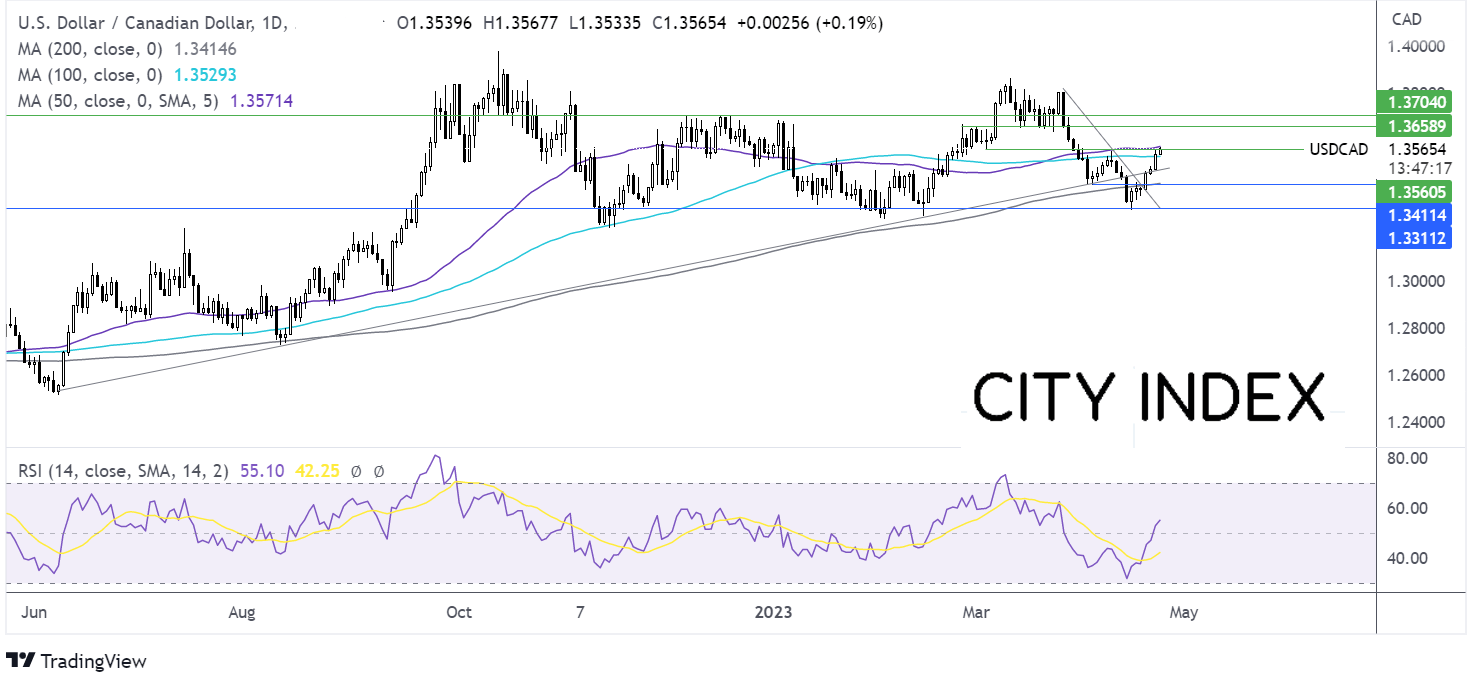

Where next for USD/CAD?

USD/CAD has risen above the 200 and 100 smas and is testing the 50 sms resistance at 1.3570. The RSI keeps buyers hopeful of further upside.

Buyers will look for a rise above 1.36 round number ahead of 1,.3660, the February high, and 1.37.

Failure to rise above the 50 sma could see the price slip back below the 100 sma at 1.3530 and the rising trendline support at 1.3485.