- EUR/USD analysis: Eurozone CPI cools to lowest in more than a year

- Focus turns to the US data and dollar

- Key levels to watch on EUR/USD

The EUR/USD rose in the first half of Thursday’s session despite Euro-area inflation slowing more than analysts’ estimates. The weaker inflation data failed to shift rate bets in money markets, which continue to point to two more ECB rate increases. Clearly, investors were already expecting the Eurozone CPI to come in weaker, because most of the national figures that were released earlier in the week, including from France, Germany and Spain, had cooled more than expected. Meanwhile, the US dollar’s rally lost some momentum after comments from a top Fed official that hinted of a “skip” in June prompted a quick reversal in rate-hike pricing. Investors’ focus now turns back to US data as speculation over whether the Fed will hike in June continues. Watch out for fresh EUR/USD analysis from the team as the data could shift Fed bets again.

Eurozone CPI cools to lowest in more than a year

Eurozone inflation was expected to cool to 6.3% YoY in May, down from 7% in April. But it moderated more markedly, falling to 6.1% which was its lowest level in more than a year. The weakness was driven mainly by lower energy costs. Core CPI was 5.3%, also weaker than 5.5% expected and down from 5.6% recorded in April.

While inflation was less than expected, this didn’t stop the European Central Bank’s hawkish rhetoric. ECB President Christine Lagarde said there’s “no clear evidence” that inflation has peaked and added: “We have made clear that we still have ground to cover to bring interest rates to sufficiently restrictive levels.”

Focus turns to the US data and dollar

After 3 weeks of gains, the US dollar index has been flat so far in the week. The greenback is was still holding up well against the antipodean and several emerging market currencies amid a slight risk-off tone across financial markets in the first half of this week. The likes of the British pound, Canadian dollar and Japanese yen have all found some support. In the first half of Thursday’s session, the EUR/USD even bounced back despite those weaker inflation figures from the Eurozone.

The dollar’s recent rally has been driven by at least two reasons. Firstly, it was rising speculation for another 25bp rate hike by the Fed in June, which was priced in with a 64% implied probability earlier this week. Secondly, it was weakness in foreign data, including China where the official manufacturing PMI fell deeper in contraction territory, which triggered a risk-off wave across financial markets.

However, the dollar has given back some of those gains over the past day and half or so. On the rate hike speculation front, the probability of a June hike was slashed following dovish comments from Fed Vice Chair Jefferson, who said that the Fed could skip a hike in June. On Chinese concerns, the Caixin PMI released overnight contradicted the official data in that it pointed to expansion in the manufacturing sector at 50.9 vs. 49.5 eyed.

Whether the rate hike probabilities will shift significantly again will now depend on three key data releases between now and the FOMC’s next meting on Jun 14. These include the latest non-farm payrolls report on Friday, the ISM services PMI for May, due on Monday, and last month’s inflation figures due on 13th June.

Sure, we will have some more data in between, including ADP private sector payrolls report, jobless claims and ISM manufacturing PMI today. But these will not be as important as those mentioned.

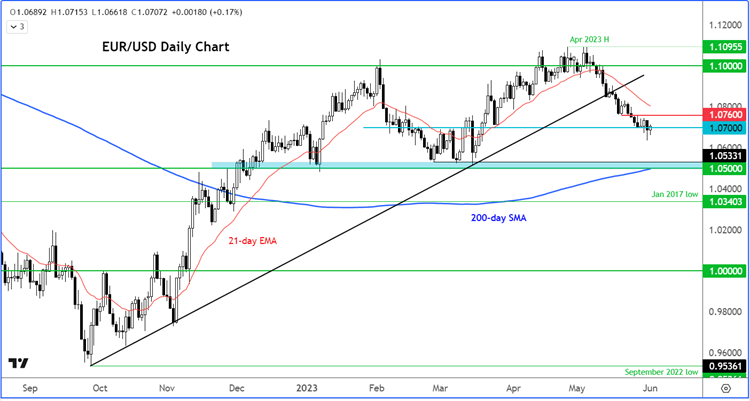

EUR/USD analysis: Key levels to watch

The EUR/USD needs to make a short-term higher high to end its bearish bias, even if temporarily. A break above recent support-turned-resistance level around 1.0760 is precisely what the bulls will be looking for next. If this happens, then we could see the onset of a short-squeeze rally towards 1.0900 area, the backside of the broken bullish trend line.

On the downside, there’s not many obvious support levels to watch except the round figures such as 1.0700 and 1.0600. Key support sits around 1.0500, some 300 pips lower, where we also have the 200-day average converging.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade