Asian Indices:

- Australia's ASX 200 index fell by -76.3 points (-1.03%) and currently trades at 7,332.50

- Japan's Nikkei 225 index has fallen by -790.02 points (-0.28%) and currently trades at 27,467.23

- Hong Kong's Hang Seng index has fallen by -93.26 points (-0.39%) and currently trades at 24,019.52

- China's A50 Index has fallen by -113.61 points (-0.74%) and currently trades at 15,183.66

UK and Europe:

- UK's FTSE 100 futures are currently down -33 points (-0.44%), the cash market is currently estimated to open at 7,530.55

- Euro STOXX 50 futures are currently down -24.5 points (-0.58%), the cash market is currently estimated to open at 4,233.32

- Germany's DAX futures are currently down -77 points (-0.49%), the cash market is currently estimated to open at 15,695.56

US Futures:

- DJI futures are currently down -156 points (-0.44%)

- S&P 500 futures are currently down -103.5 points (-0.68%)

- Nasdaq 100 futures are currently down -24.5 points (-0.54%)

Asian equities were lower overnight as upside pressure on global bond yields persisted. The Australian 2-year bond rose 16 basis points to a two-year high, whilst the 5-year rose 23 bps. The Nikkei bared the brunt of selling as it fell -3%, taking a leaf from Nasdaq’s bearish book which fell -2.7% yesterday. China’s CSI300 and Australia’s ASX 200 were down around -1%.

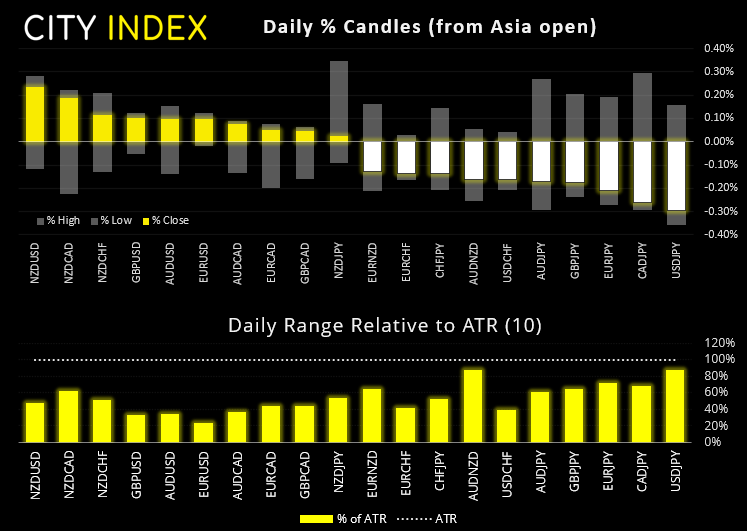

The yen caught a late-session bid

Currency markets were mostly quiet despite weak sentient for equities, yet in the past hour we’ve seen the Japanese yet move broadly higher against its forex major peers. USD/JPY has broken beneath yesterday’s lows and EUR/JPY broke key support.

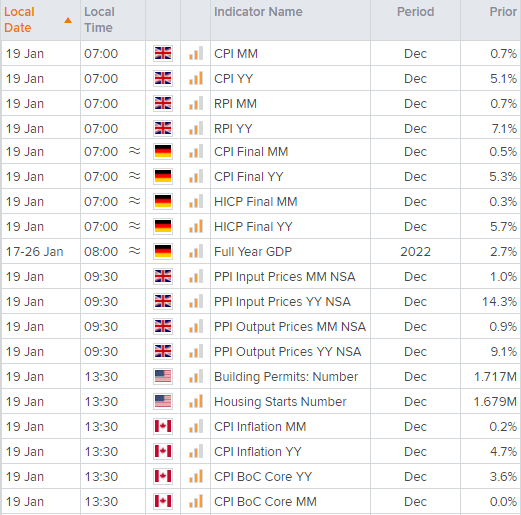

UK inflation data is at 07:00 GMT

UK inflation rose to 5% according to December’s report which piled even more pressure on the BOE to raise rates. At the time, it was still unclear whether Omicron would derail the economy and the potential for the BOE to hike rates, yet the market have since decided all is fine and driven the British pound to a five-week high, as of last week during a short-covering rally. Unless we see some notably weak inflation numbers today (which we very much doubt) then the BOE are likely to be forced to hike rates in the coming weeks. Yet what is driving the pound lower this week is the markets renewed appetite for the dollar thanks to a hawkish Fed and bond-market sell-off.

EUR/GBP probes cycle low

A large bearish engulfing candle formed on the daily chart of EUR/GBP yesterday. Yield differentials between the two regions points to a downside break and trader have tried to push hit lower overnight. Yet we are urging caution at these lows given potential support levels nearby which diminish the potential reward/risk. The weekly S1 pivot sits at 0.8320, the monthly S1 at 0.8312 and historical support at 0.8304 (not to mention 0.8300 being a round number).

Of course, another potential catalyst is the ousting of Boris Johnson. But he was to be “out by Christmas” yet still clings on to power. And should he last the week it may even give the pound another boost.

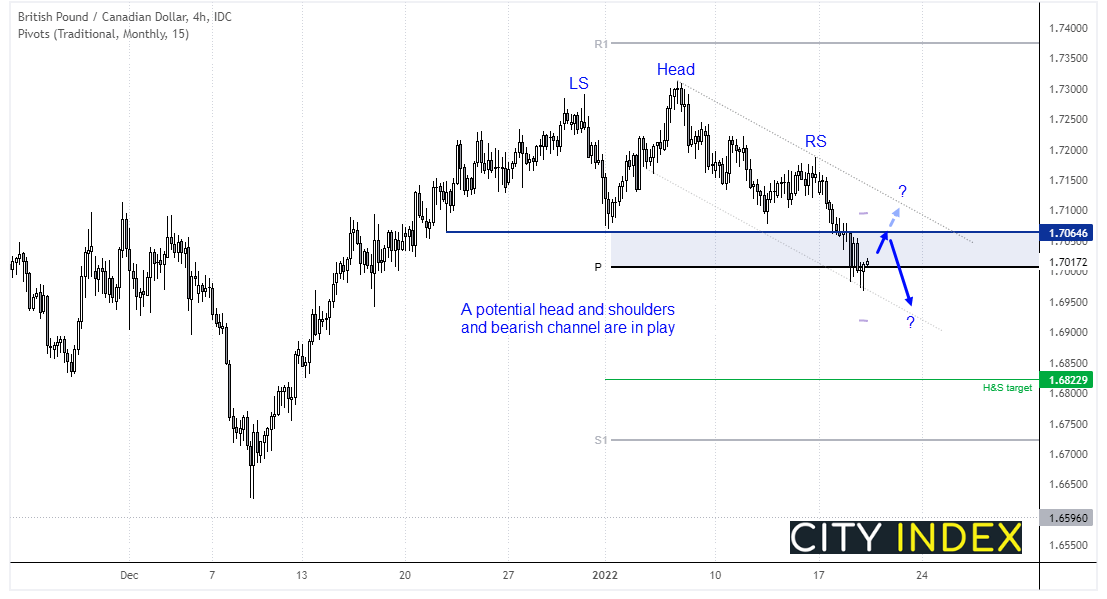

GBP/CAD in focus for Canadian inflation

Just after lunch at 13:30 Canada will release their inflation report. Given the UK release theirs earlier in the day and GBP/CAD sits below a key resistance level, GBP/CAD is of interest. The daily chart has produced a head and shoulders top pattern which projects a target around 1.6823 and remains in play, so long as prices stay below the 1.7065 neckline.

However, and alternative scenario is a countertrend rally within a bearish channel. A Doji and bullish hammer have formed on this timeframe so if we see momentum turn higher then a swing low has formed. Yet a minor rally from current levels (and respect of 1.0765 resistance) suggests the H&S top is in play.

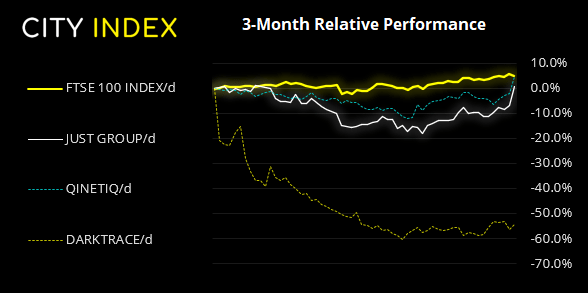

FTSE 350: Market Internals

FTSE 350: 4287.22 (-0.68%), 19 January 2022

- 14 stocks rose to a new 52-week high, 20 fell to new lows

- 89 (25.36%) stocks advanced, 250 (71.23%) stocks declined

Outperformers:

- +8.237% - Just Group PLC (JUSTJ.L)

- +6.869% - Qinetiq Group PLC (QQ.L)

- +4.985% - Darktrace PLC (DARK.L)

Underperformers:

- ·-11.5% - Petropavlovsk PLC (POG.L)

- ·-8.07% - Trustpilot Group PLC (TRST.L)

- ·-7.583% - Chrysalis Investments Ltd (CHRY.L)

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade