Asian Indices:

- Australia's ASX 200 index rose by 81.7 points (1.17%) and currently trades at 7,087.70

- Japan's Nikkei 225 index has risen by 455.12 points (1.68%) and currently trades at 27,533.60

- Hong Kong's Hang Seng index has risen by 252.18 points (1.07%) and currently trades at 23,802.26

- China's A50 Index has fallen by -254.78 points (-1.7%) and currently trades at 14,769.78

UK and Europe:

- UK's FTSE 100 futures are currently up 55 points (0.74%), the cash market is currently estimated to open at 7,590.78

- Euro STOXX 50 futures are currently up 32 points (0.76%), the cash market is currently estimated to open at 4,256.45

- Germany's DAX futures are currently up 122 points (0.78%), the cash market is currently estimated to open at 15,741.39

US Futures:

- DJI futures are currently up 32 points (0.09%)

- S&P 500 futures are currently up 182.25 points (1.22%)

- Nasdaq 100 futures are currently up 28.75 points (0.63%)

Trading volumes remained lower overnight due to the Week-long celebration of Chinese New Year. Asian equities tracked Wall Street higher for a second day with Japan’s share markets taking the clear lead. Futures markets for Europe have opened higher.

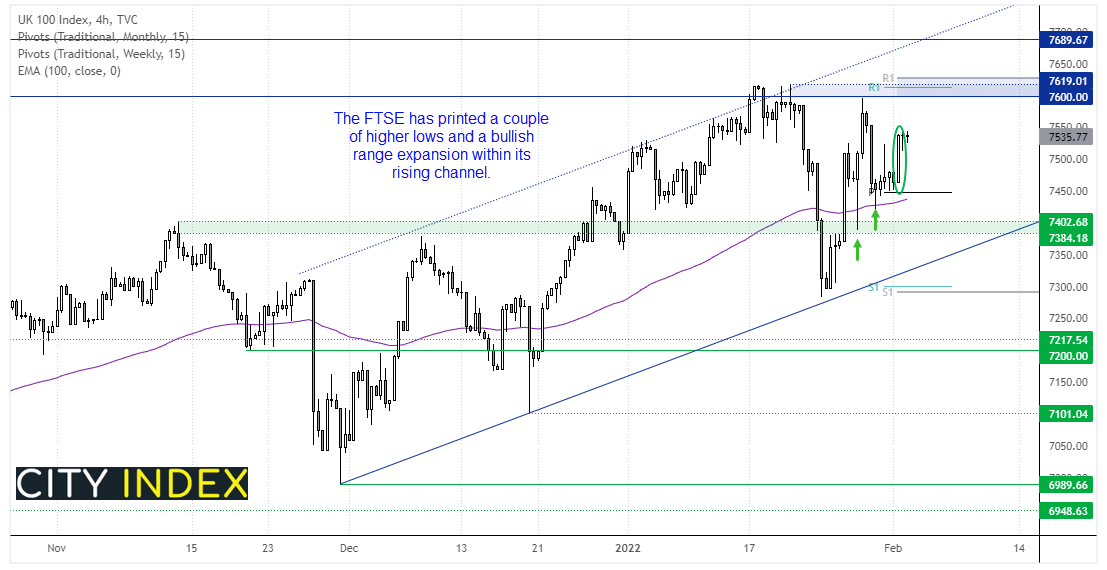

The FTSE 100 looks ready to have another crack at 7600

Around the middle of January, the FTSE 100 struggled to conquer the 7600 level before rolling over during a broad-based sell-off. Yet it confirmed it found support just above the lower trendline before making an admirable attempt to reclaim its recent losses. Since then, sell-offs have been bought and the 100-day eMA has provided support. Two higher lows formed ahead of Monday’s bullish range expansion candle and prices are now coiling around its highs. From here we would welcome low volatility dips within Mondays range, especially if 7500 holds as support, ahead of its next leg higher towards the resistance cluster around 7600.

FTSE 100 trading guide>

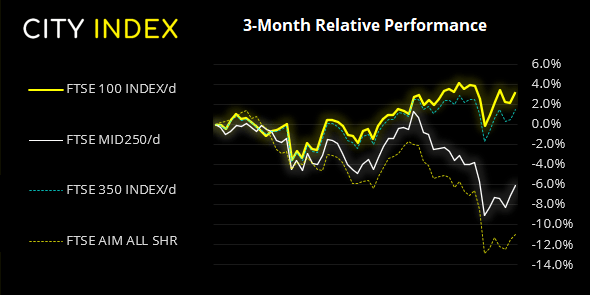

FTSE 350: Market Internals

This image will only appear on cityindex websites!

FTSE 350: 4259.03 (0.96%) 01 February 2022

- 262 (74.86%) stocks advanced and 78 (22.29%) declined

- 4 stocks rose to a new 52-week high, 2 fell to new lows

- 38.57% of stocks closed above their 200-day average

- 63.14% of stocks closed above their 50-day average

- 10.57% of stocks closed above their 20-day average

Outperformers:

- + 11.18% - Baltic Classifieds Group PLC (BCG.L)

- + 6.53% - Carnival PLC (CCL.L)

- + 6.42% - Herald Investment Trust PLC (HRI.L)

Underperformers:

- -4.85% - Ocado Group PLC (OCDO.L)

- -4.51% - Darktrace PLC (DARK.L)

- -4.33% - Currys PLC (CURY.L)

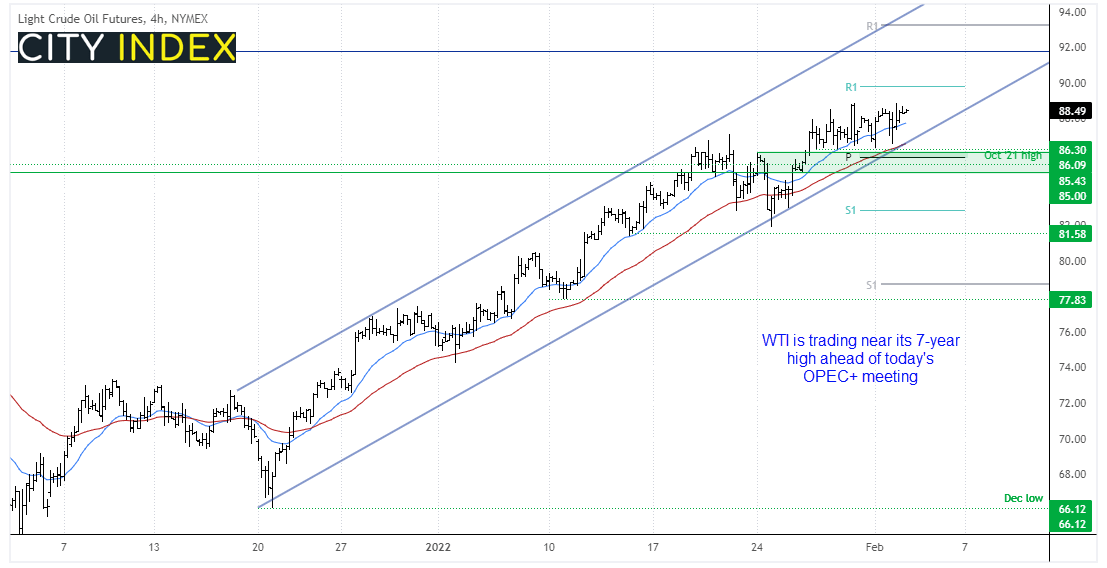

OPEC+ meeting in focus for oil traders today

Some forecasts have pencilled an increase of 400k barrels per day (bpd) at today’s OPEC+ meeting. Although the rise in oil prices may spur OPEC to increase their oil production more than expected at today’s meeting, even if some other reports suggest that they may struggle to deliver the production rise already planned. A recent report from EIA (Environmental Investigation Energy) forecasts OPEC to increase production overall in 2022 by 3.7 million bpd, despite the outages in Libya.

WTI crude is hovering just below its 7-year high ahead of today’s OPEC meeting. It remains in a bullish channel and the 50 and 20-day eMA’s have provided dynamic support. The monthly R1 is its next bullish target, just below $90 – and an OPEC+ surprise where production is not raised by 400k (or not at all) would help its bullish case. Also note that the weekly EIA report is scheduled for 15:30 and rising stockpiles could provide bulls a reason to profits and / or countertrend trades to short at the highs.

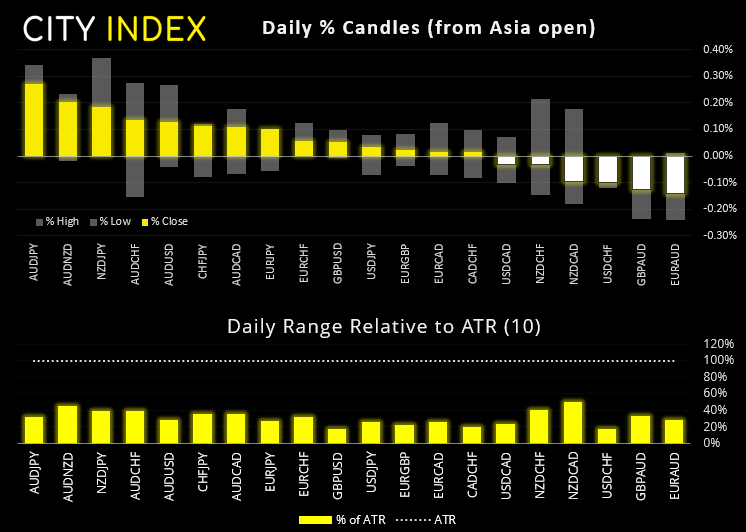

CHF/JPY continues to look promising for bulls

The Swiss franc against the yen has breached yesterday’s highs as it tries to move higher for a third day. It tends to track appetite for risk so we’d likely need to see equity markets extend their current rallies to expect this to also move higher. As mentioned in yesterday’s report, when it moves it tend to do so with few pullbacks.

Elsewhere in currencies volatility has remained low. EUR/USD remains anchored to yesterday’s high in a tight range, USD/CAD trades around yesterday’s mid-point after finding support at its 50-day eMA. USD/JPY is back below 115 after its third bearish day and has found support at its 20-day eMA.

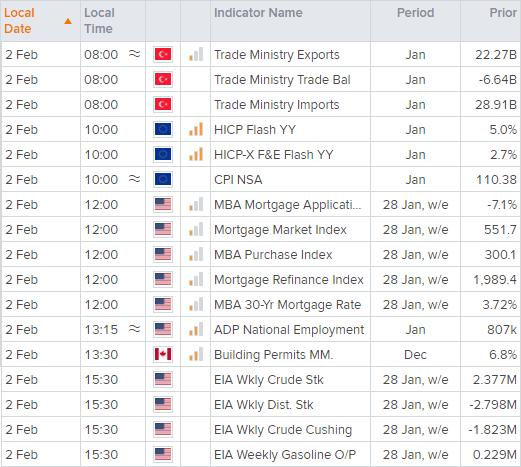

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade