Asian Indices:

- Australia's ASX 200 index rose by 19.5 points (0.3%) and currently trades at 6,488.90

- Japan's Nikkei 225 index has risen by 170.61 points (0.64%) and currently trades at 26,601.85

- Hong Kong's Hang Seng index has fallen by -189.29 points (-1.06%) and currently trades at 17,665.85

- China's A50 Index has risen by 34.59 points (0.27%) and currently trades at 12,939.49

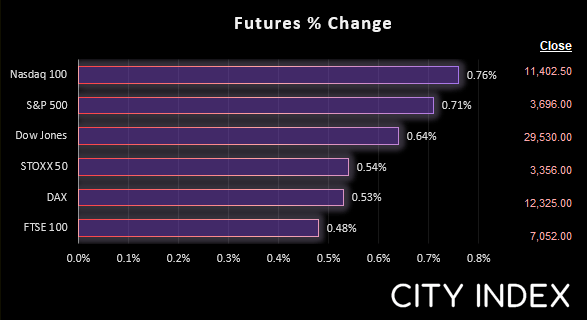

UK and Europe:

- UK's FTSE 100 futures are currently up 35 points (0.5%), the cash market is currently estimated to open at 7,055.95

- Euro STOXX 50 futures are currently up 18 points (0.54%), the cash market is currently estimated to open at 3,360.56

- Germany's DAX futures are currently up 65 points (0.53%), the cash market is currently estimated to open at 12,292.92

US Futures:

- DJI futures are currently up 188 points (0.64%)

- S&P 500 futures are currently up 87 points (0.77%)

- Nasdaq 100 futures are currently up 26.25 points (0.72%)

We have more central bankers at the helm today from the ECB, BOE and Fed. Christine Lagarde speaks at 12:30, although the topic of ‘financial stability amidst digitisation of financial services’ is unlikely to touch on monetary policy. ECB vice president de Guindos then speaks at 14:00.

But given that the BOE have been put on the spot by the flailing pound and its fallout from the UK’s mini budget, all eyes will be on BOE MPC member Pill at 14:35. Traders will seek any clues as to just how aggressive any BOE hike may be to support the pound, keeping in mind that money markets were pricing in as much as 200bp yesterday.

As for Fed members, Jerome Powell hits the wires at 12:30 and Bullard is then up at 14:55. And in all likelihood, comments from BOE and Fed will be more highly anticipated than any economic data.

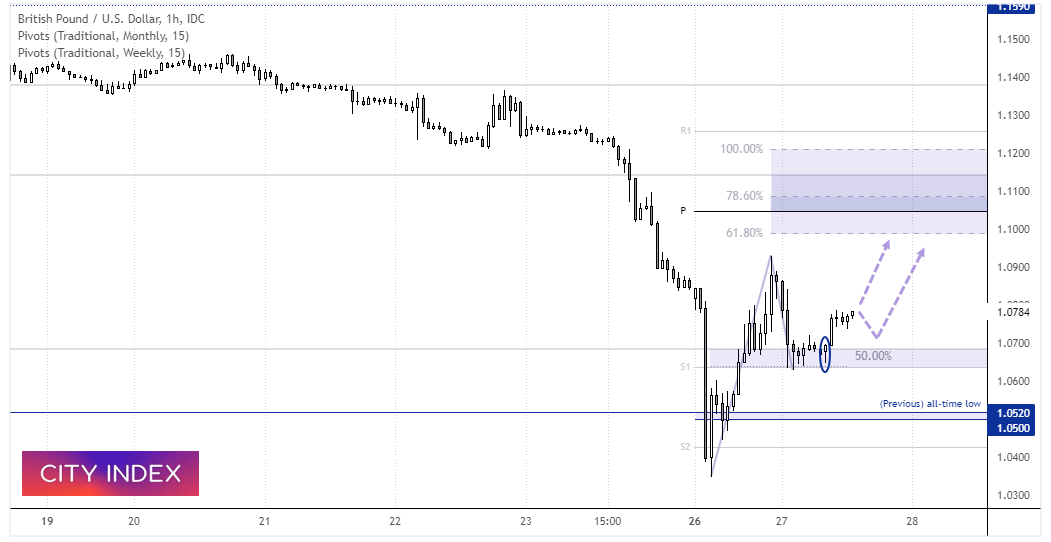

GBP/USD 1-hour chart

The pound’s 5.2% rally from its all-time low may not have recouped all of the day’s losses yesterday but was prominent enough to suggest we are now within a 3-wave correction. Having pulled back from the ~1.09 high, prices found support at the weekly S1 and monthly S3 pivots and 50% retracement level. Lower wicks shows demand around that support zone then a small bullish hammer preceded a turn higher in the Asian session. Prices are now coiling in a small consolidation pattern on the 1-hour chart and shows the potential to continue higher in its ‘C’ section of an ABC correction.

The bias remains bullish above the recent swing lows and for a move towards the 1.1000 area, and any hawkish comment from the BOE could make it get there sooner than later.

FTSE 350 – Market Internals:

FTSE 350: 3874.7 (0.03%) 26 September 2022

- 120 (34.19%) stocks advanced and 223 (63.53%) declined

- 3 stocks rose to a new 52-week high, 104 fell to new lows

- 16.52% of stocks closed above their 200-day average

- 35.04% of stocks closed above their 50-day average

- 1.14% of stocks closed above their 20-day average

Outperformers:

- + 11.34% - Aston Martin Lagonda Global Holdings PLC (AML.L)

- + 7.17% - Playtech PLC (PTEC.L)

- + 6.07% - Darktrace PLC (DARK.L)

Underperformers:

- -8.08% - Bellway PLC (BWY.L)

- -7.83% - Vistry Group PLC (VTYV.L)

- -7.72% - Redrow PLC (RDW.L)

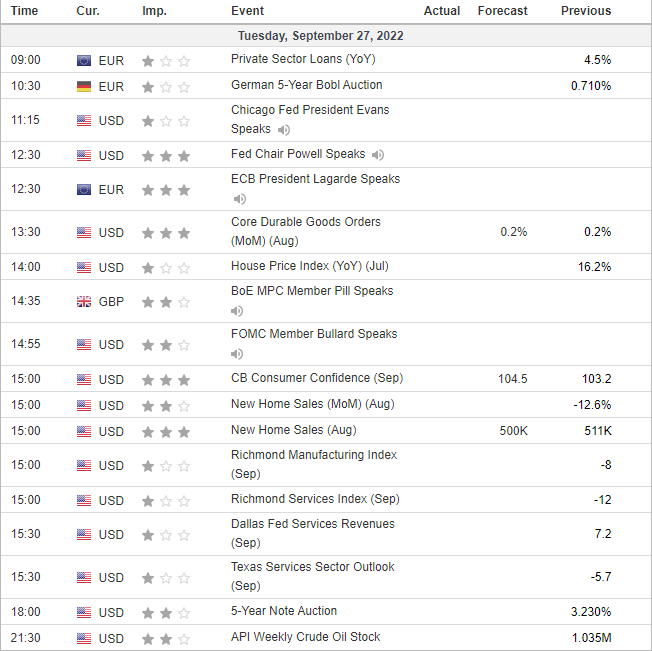

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade