Asian Indices:

- Australia's ASX 200 index fell by -3.1 points (-0.04%) and currently trades at 7,313.10

- Japan's Nikkei 225 index has fallen by -29.37 points (-0.11%) and currently trades at 26,818.53

- Hong Kong's Hang Seng index has fallen by -281.57 points (-1.33%) and currently trades at 20,820.32

- China's A50 Index has risen by 150.75 points (1.13%) and currently trades at 13,516.30

UK and Europe:

- UK's FTSE 100 futures are currently up 8.5 points (0.11%), the cash market is currently estimated to open at 7,569.83

- Euro STOXX 50 futures are currently up 3 points (0.08%), the cash market is currently estimated to open at 3,764.19

- Germany's DAX futures are currently up 7 points (0.05%), the cash market is currently estimated to open at 14,046.47

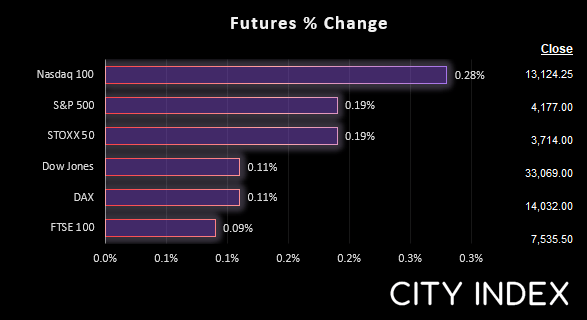

US Futures:

- DJI futures are currently up 38 points (0.12%)

- S&P 500 futures are currently up 36.75 points (0.28%)

- Nasdaq 100 futures are currently up 7.75 points (0.19%)

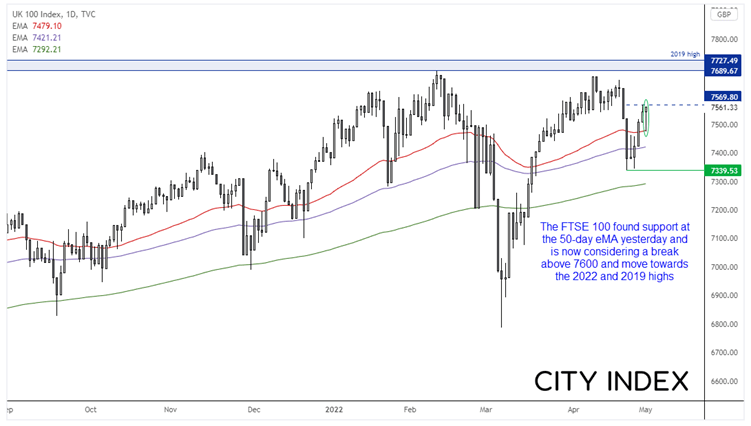

FTSE 100:

The FTSE 100 has risen for five consecutive days, which is its fourth such occurrence since January 2021. A weaker GBP is helping to play its part and it looks like the FTSE wants to break above 7600 today. A break above 7569.8 confirms last week’s bullish pinbar, and we also like how yesterday’s (potentially) bullish hammer found support at the 50-day eMA.

FTSE 350: 4218.6 (0.22%) 03 May 2022

- 111 (31.71%) stocks advanced and 230 (65.71%) declined

- 7 stocks rose to a new 52-week high, 14 fell to new lows

- 29.43% of stocks closed above their 200-day average

- 39.71% of stocks closed above their 50-day average

- 14.86% of stocks closed above their 20-day average

Outperformers:

- + 7.96% - Auction Technology Group PLC (ATG.L)

- + 7.60% - Energean PLC (ENOG.L)

- + 5.80% - BP PLC (BP.L)

Underperformers:

- -10.32% - SEGRO PLC (SGRO.L)

- -9.35% - Jtc PLC (JTC.L)

- -8.61% - Tritax Big Box Reit PLC (BBOXT.L)

A 50-bps hike is baked into the cake

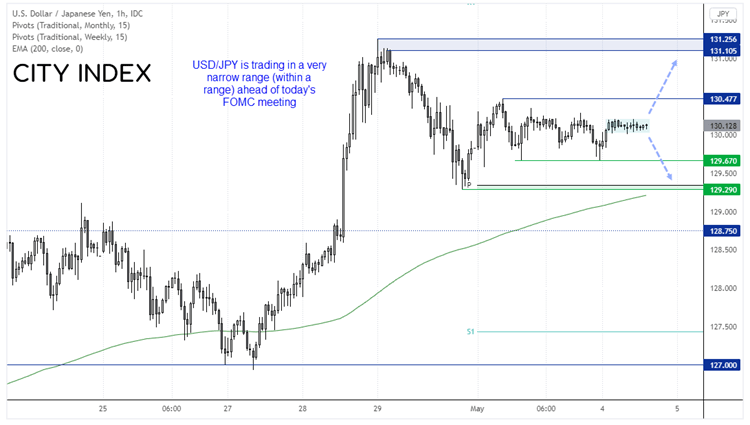

It should go without saying that today’s FOMC meeting is the main event, even if a 50-bps hike is baked into the cake. Money markets have priced in a 99.8% chance of that happening, but the tone of today’s decision could either confirm or bring into doubt the market’s confidence of multiple 50-bps hikes.

As things stand, money markets are pricing in additional 50-bps hike at their June, July and September meetings, before dropping to 25-bps hikes in November and December. So it’s really about confirming whether the markets have the right curvature or not.

For today, traders will be looking for any clues that change the expected trajectory via the statement or press conference, however subtle they may be. With that said, it is more likely the any notable shift in policy would be made apparent in public comments as we head towards their June meeting, or the meeting itself (which also includes the staff forecasts, dot plot and press conference).

As you’d expect, currency markets are trading within tight ranges ahead of today’s FOMC meeting. But tight ranges ahead such events are usually an indication that a flash of volatility is due. So we don’t expect to see USD/JPY trading at 130 this time tomorrow.

USD/JPY is hugging 130 like it’s an old friend it’s about to part ways with, with the question being which way it will break. It’s been confined to a 20-pip range these past 12 hours and sits in the middle of the 129.67 – 130.48 range it has been stuck within since Monday. We all know the trend points higher, but we may need a decisively hawkish hike (via hints of additional 50-bs hikes) for it to break convincingly above 130.50 and target 131.00. If it’s simply a 50-bps hike and ‘see you next month’ then we’d expect some bearish volatility to slap the dollar around as it could bring into question the extremely hawkish trajectory that markets are currently expecting.

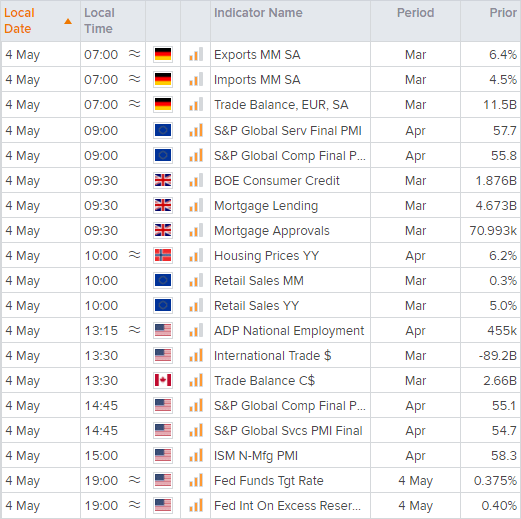

Up next (Time in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade