Asian Indices:

- Australia's ASX 200 index rose by 62.2 points (0.9%) and currently trades at 6,990.20

- Japan's Nikkei 225 index has fallen by -72.07 points (-0.24%) and currently trades at 29,658.72

- Hong Kong's Hang Seng index has risen by 238.7 points (0.83%) and currently trades at 28,913.50

UK and Europe:

- UK's FTSE 100 futures are currently up 25 points (0.37%), the cash market is currently estimated to open at 6,910.32

- Euro STOXX 50 futures are currently up 14 points (0.36%), the cash market is currently estimated to open at 3,970.77

- Germany's DAX futures are currently up 55 points (0.36%), the cash market is currently estimated to open at 15,231.36

Wednesday US Close:

- The Dow Jones Industrial rose 16.02 points (0.05%) to close at 33,430.24

- The S&P 500 index rose 6.01 points (0.15%) to close at 4,079.95

- The Nasdaq 100 index rose 38.24 points (0.28%) to close at 13,616.70

Futures point to a firmer open for European indices

The ASX 200 was the strongest performer among major Asian indices. Breaking to a 13-mont high just after the open its upside was limited by the 7,000 level. Although the bias remains bullish, given the clear pickup of momentum over recent sessions, the 7100 level is now in focus for bulls. The Hang Seng and CSI300 also tracked the ASX higher although the Nikkei 225 was -0.5% lower.

Index futures for Europe and US have opened higher, with Nasdaq E-mini futures currently up 0.7%, DAX futures are 0.37% higher and FTSE futures could see the FTSE cash index above 6900 at the open.

FTSE 100: Market Internals

- 87 stocks advanced (86.1%), 14 declined (13.9%).

- 83.2% were above their 200-day and 50-day average,

- 89.1% were above their 20-day average.

- 3 hit a new 52-week high, 0 hit a new 52-week low.

- Outperformers: Just Eat (JETJ) +5.06%, D Smith (SMDS) +2.94%, Informa PLC (INF) +2.8%)

- Underperformers: Flutter Entertainment (FLTRF) -1.3%, London Stock Exchange (LSEG) -1.25%, Renishaw (RSW) -1.23%

The FTSE 100 (0.91%) outperformed the FTSE 350 (0.88%) and FTSE All Share index (0.87%), technology and basic material sectors were the strongest performers, rising 1.83% and 1.7% respectively. Healthcare was the only index in the red at -0.28%.

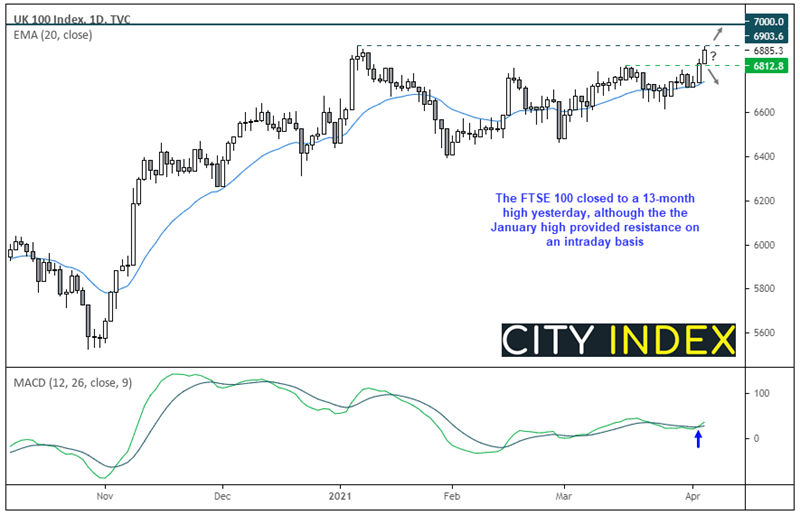

7,000 is tantalisingly close for the FTSE 100

On a closing basis the FTSE 100 now sits at a 13-month high, its rate of change is increasingly bullish and prices now sit above the upper bollinger band (which had squeezed slightly) to suggest a breakout is on the cards. That said, traders should be mindful of the January high at 6903 as it’s an obvious resistance level which capped further gains yesterday, but a break above here brings 7,000 into focus.

- A break above 6904 brings the 7,000 level into focus. And if volatility (and direction) of the past two days is to persist, it could be there by the end of the week.

- If this key resistance level holds, bearish range traders could take an interest at fading into the highs.

- Although a more conservative approach for bears is to perhaps wait for a break below 6812.80 support as it would signal a failed breakout.

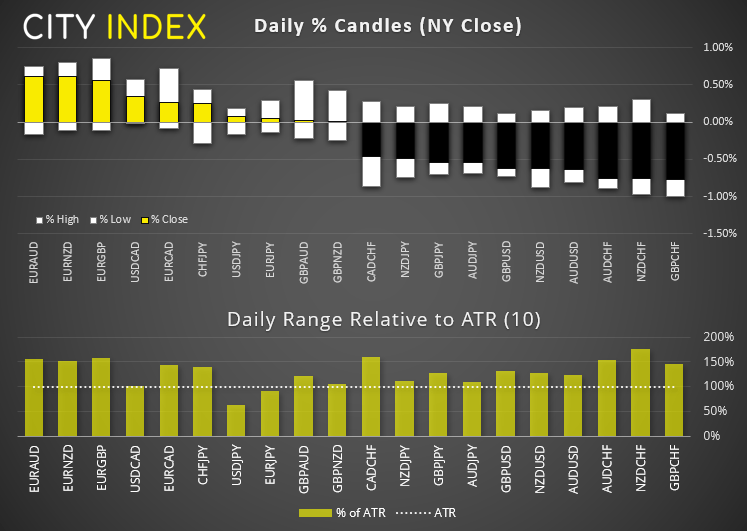

All quiet on the forex front

With the lack of any macroeconomic news, it has been a quiet session for currencies overnight. From what we can see, minor movements have been technical repositioning and corrective from the prior session. This saw NZD, GBP and AUD as the strongest majors and CAD as the weakest.

- The US dollar index (DXY) respected 92.50 resistance overnight after printing a small bullish candle yesterday. We expect this level to remain pivotal over the coming session/s as prices meander around the 20-day eMA.

- GBP/JPY reached our initial target outlined in yesterday’s Asian Open report report and a series of small indecision candles have formed at lows. Given the strength of the bearish move yesterday we continue to favour fading into rallies, although the reward to risk ratio is now less appealing with 150.23 and 150.55 support levels nearby.

- EUR/GBP rose to a five-week high yesterday, yet found resistance at the 50-day eMA. Whilst four bearish bars have drifted lower on the four-hour chart as port of a corrective move, there is little in the way of obvious support levels to try ad pinpoint a potential corrective low. And with the 50-day eMA capping as resistance, we could find price action to be choppy around current levels.

- USD/JPY printed a small doji which closed just beneath the June 2020 high. A break above the doji high also sees it back above 109.85 resistance which paints a bullish bias for the session. And the bias would remain bullish above the 109.58 low.

- AUD/USD found resistance at its 50-day eMA and printed a bearish outside day yesterday. With a revised neckline for its head and shoulders top pattern the target is now around 0.7240.

Metals await volatility:

- Gold has found support at its 20-day eMA after producing a small bearish inside day yesterday. If you drop to the four-hour chart you’ll see prices are coiling, so perhaps a burst of volatility awaits. Whilst it holds above its 20-day eMA the bias is for a retest of 1745 and perhaps the 1750/55 mark but this would depend on the prospects for a weaker US dollar as well.

- Conversely, silver has found resistance at its 20-day eMA, but a break above Tuesday’s high at 25.30 will see it back above the average and provide additional merit to the MACD buy signal which appeared yesterday.

- We remain bullish on platinum above the 1195 – 1200 area, although the four-hour chart is respecting a bullish trendline from the 1149.50 low. At the time of writing, the current four-hour candle is on track to print a small bullish engulfing candle, so we’ll look out for a swing low to be confirmed.

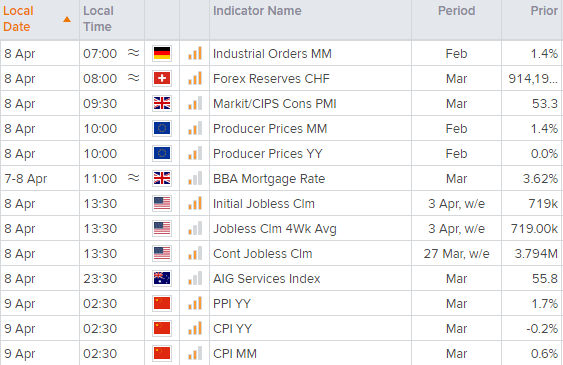

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.