Asian Indices:

- Australia's ASX 200 index fell by -81.3 points (-1.14%) and currently trades at 7,039.40

- Japan's Nikkei 225 index has risen by -144.41 points (0.54%) and currently trades at 26,178.01

- Hong Kong's Hang Seng index has fallen by -442.52 points (-2.21%) and currently trades at 19,559.44

- China's A50 Index has risen by 76.32 points (0.59%) and currently trades at 13,018.85

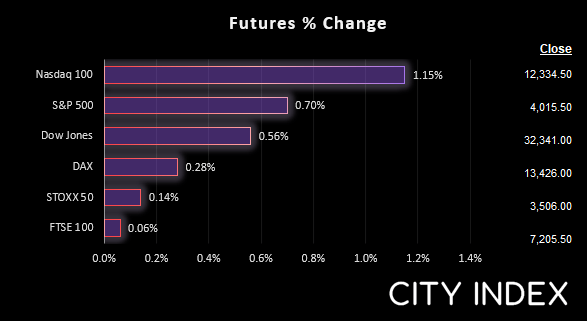

UK and Europe:

- UK's FTSE 100 futures are currently up 1 points (0.01%), the cash market is currently estimated to open at 7,217.58

- Euro STOXX 50 futures are currently up 7 points (0.2%), the cash market is currently estimated to open at 3,533.86

- Germany's DAX futures are currently up 41 points (0.31%), the cash market is currently estimated to open at 13,421.67

US Futures:

- DJI futures are currently up 167 points (0.52%)

- S&P 500 futures are currently up 138.5 points (1.14%)

- Nasdaq 100 futures are currently up 26.5 points (0.66%)

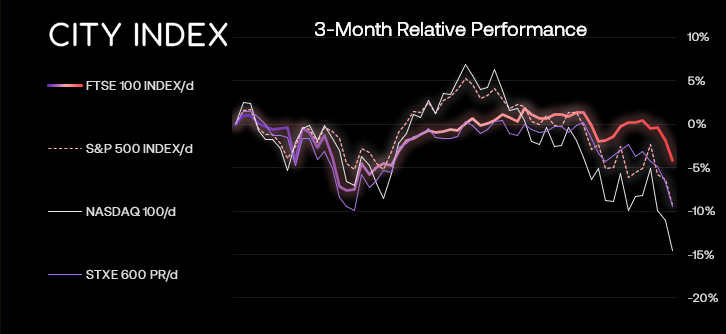

Asian markets continued lower for a second consecutive day following a turbulent session on Wall Street. The Hang Seng and HSCE index led the way lower, after they played catch-up following a 3-day weekend. The ASX 200 fell over -1% for a third consecutive day, a sequence not seen since June 2020.

Yet futures markets for Europe and the US are pointing to a higher open. We also saw gold, AUD/JPY and NZD/JPY bounce from their lows as markets retraced against yesterday’s moved. So whilst there are the early signs of a ‘turnaround Tuesday’ we really need to see how cash markets behave after the open to better gauge the appetite for risk in today’s session.

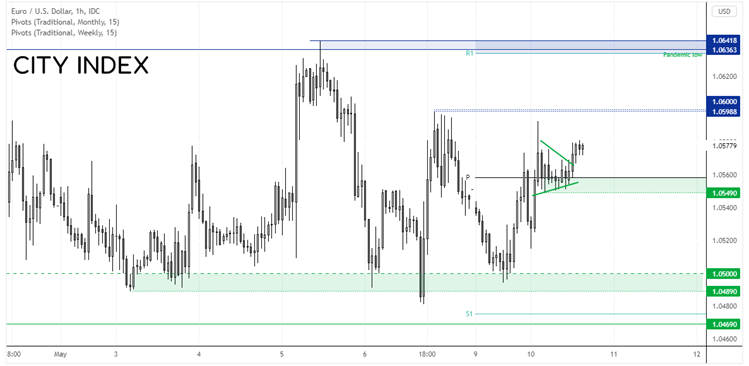

Euro in focus ahead of ZEW data

The euro has been gaining bullish interest against several majors following hawkish comments from ECB members over the past week. Whether that will be enough to see a hike in July remains to be seen (as Lagarde is seemingly unconvinced). But it has helped the euro build a base above 1.0500 and move to the midway point of its 1.0500 - 1.0640 range. ZEW economic data is scheduled for 10:00 and given recent hawkish comments from ECB members, perhaps it could help with another leg higher for the euro should it beat dismal expectations. Prices are above the weekly pivot point and broken out of a small triangle, which brings the 1.0600 highs into focus for bulls.

Euro explained – a guide to the euro

FTSE: Market Internals

FTSE 350: 4017.43 (-2.32%) 09 May 2022

- 28 (8.00%) stocks advanced and 316 (90.29%) declined

- 5 stocks rose to a new 52-week high, 88 fell to new lows

- 20.29% of stocks closed above their 200-day average

- 100% of stocks closed above their 50-day average

- 6% of stocks closed above their 20-day average

Outperformers:

- + 4.76% - QinetiQ Group PLC (QQ.L)

- + 3.68% - NCC Group PLC (NCCG.L)

- + 2.70% - Beazley PLC (BEZG.L)

Underperformers:

- -12.02% - Chrysalis Investments Ltd (CHRY.L)

- -11.62% - Tullow Oil PLC (TLW.L)

- -10.18% - Ferrexpo PLC (FXPO.L)

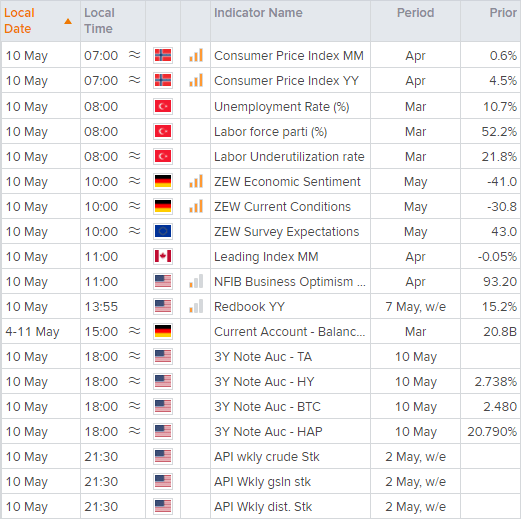

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade