Asian Indices:

- Australia's ASX 200 index rose by 40 points (0.54%) and currently trades at 7,409.50

- Japan's Nikkei 225 index has risen by 336.17 points (1.12%) and currently trades at 30,344.36

- Hong Kong's Hang Seng index has risen by 423.24 points (1.65%) and currently trades at 26,139.24

UK and Europe:

- UK's FTSE 100 futures are currently up 8.5 points (0.12%), the cash market is currently estimated to open at 7,032.71

- Euro STOXX 50 futures are currently up 5.5 points (0.13%), the cash market is currently estimated to open at 4,182.61

- Germany's DAX futures are currently up 8 points (0.05%), the cash market is currently estimated to open at 15,631.15

US Futures:

- DJI futures are currently down -151.69 points (-0.43%)

- S&P 500 futures are currently up 24 points (0.15%)

- Nasdaq 100 futures are currently up 8.25 points (0.18%)

Learn how to trade indices

Indices rise to the occasion (but no cake)

Asian equities were higher overnight, helped in part by positive earnings and on reports that Joe Biden had a phone call with Xi Jinping, which suggests US-Sino tensions were abating. Over the 90-minute call, the two powers had a “broad, strategic discussion” including how to avoid competition veering into conflict. Nice. So, we’re not quite at the ‘the most beautiful piece of chocolate cake’ stage of the relationship, but it is a step in the right direction.

The Hang Seng was a top performer, rising around 2% and the China A50 index rose 1.4%. Japan’s share markets extended their rallies to see the TOPIX hit its highest level since 1990 and the Nikkei tough a fresh 6-month high. The ASX 200 recovered from yesterday’s lows yet found resistance just under the resistance zone around 7430-50 highlighted in today’s Asian Open report.

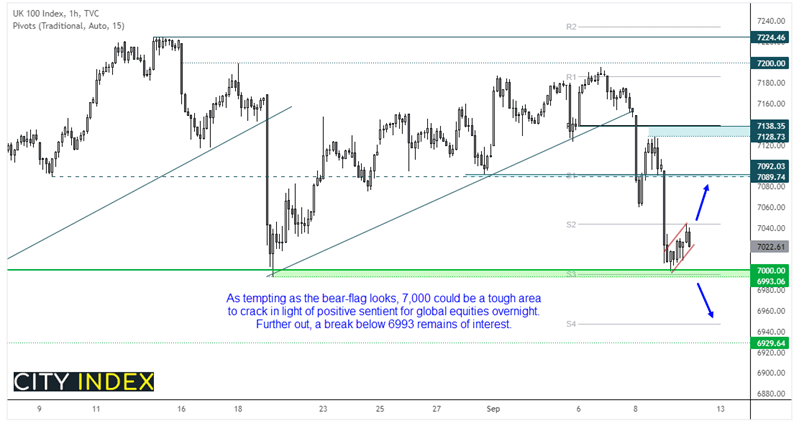

Bears wasted no time in driving the FTSE 100 down to our 7,000 target yesterday, with the first hour of trade accounting for most of the daily range. In isolation, the bearish flag on the hourly chart looks quite appealing for bearish eyes. Yet in context of improved global sentiment for equities, and the fact that 7,000 is a psychological round number near the weekly S3 pivot, it’s plausible to expect a countertrend bounce today. 7060 and 7090 make viable bullish targets. Further out, a break beneath 6993 could mark its next leg lower.

FTSE 350: Market Internals

FTSE 350: 4068.81 (-1.01%) 09 September 2021

- 129 (36.75%) stocks advanced and 211 (60.11%) declined

- 5 stocks rose to a new 52-week high, 10 fell to new lows

- 71.23% of stocks closed above their 200-day average

- 64.67% of stocks closed above their 50-day average

- 17.38% of stocks closed above their 20-day average

Outperformers:

- + 5.58% - IP Group PLC (IPO.L)

- + 3.94% - Grainger PLC (GRI.L)

- + 2.56% - Helios Towers PLC (HTWS.L)

Underperformers:

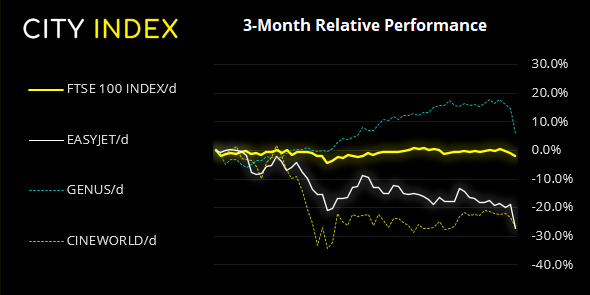

- -10.2% - Easyjet PLC (EZJ.L)

- -7.63% - Genus PLC (GNS.L)

- -4.80% - Cineworld Group PLC (CINE.L)

Forex: UK GDP, CA employment and US PPI on tap

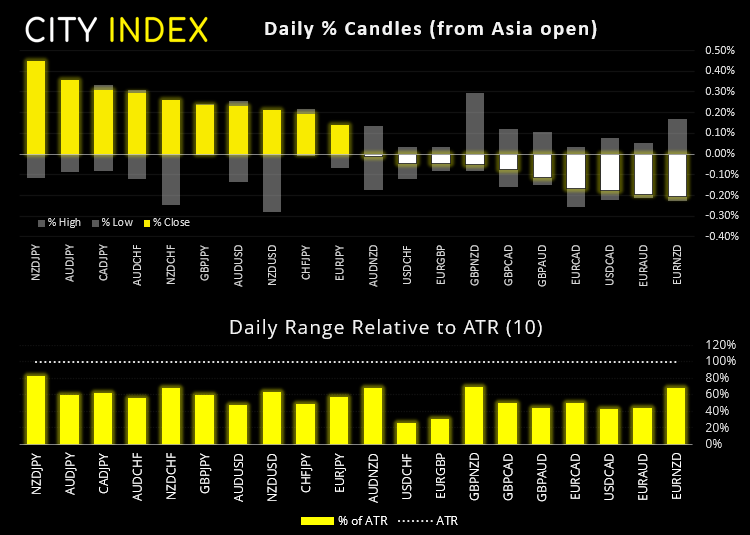

Commodity currencies were the leaders overnight, with AUD rising 0.3%, NZD up 0.23% and CAD 0.16% for the session. The yen and USD were the weakest currencies during the mildly risk-off session.

NZD/JPY is the strongest pair and is showing the potential bull flag on the daily chart. We just need the markets to get ahead of themselves with the Biden-Jinping phone call and nothing else to go wrong.

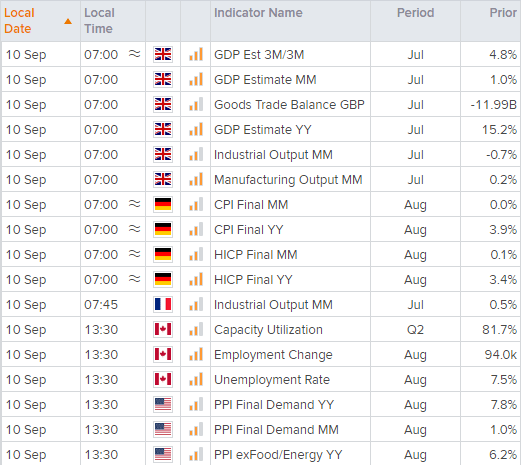

UK GDP is then released at 16:00. Whilst the economy has been picking up it remains behind where is was prior to the pandemic. Yet hawkish comments from BOE Governor Bailey have teased expectations of a rate hike, so a strong print today could serve bullish setups well for GBP pairs.

Later in the US session, Canadian employment is released and, for one, won’t be overshadowed by NFP. As we think BOC may still be close to tapering (despite the setback in Q2 GDP), a strong employment report could have the Canadian dollar regain some strength ahead of the weekend.

At the same time of 13:30 BST, US producer prices are released. And a strong print could be of interest for USD bulls as it can be seen as a proxy for next week’s CPI data.

Learn how to trade forex

Commodities show the potential to perk up:

Copper futures broke above daily trend resistance on news of the Biden-Xi Jinping phone call. The next target remains to be 4.435 as long as prices remain above 4.20 and its possible that an inverted head and shoulders pattern is forming on the daily chart.

The CRB commodity basked is trading just below its 4-year high, with a break above 221.25 confirming trend resumption whilst a break below 216.85 assumes a countertrend move.

Up Next (Times in BST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.