Asian Indices:

- Australia's ASX 200 index fell by -36.7 points (-0.52%) and currently trades at 6,962.60

- Japan's Nikkei 225 index has fallen by -280.04 points (-1.02%) and currently trades at 27,433.77

- Hong Kong's Hang Seng index has fallen by -304.81 points (-1.86%) and currently trades at 16,053.71

- China's A50 Index has fallen by -108.48 points (-0.91%) and currently trades at 11,804.37

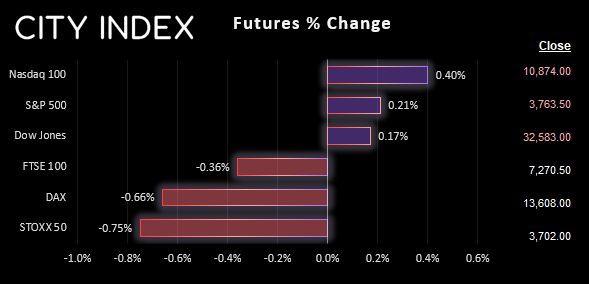

UK and Europe:

- UK's FTSE 100 futures are currently down -27.5 points (-0.38%), the cash market is currently estimated to open at 7,268.75

- Euro STOXX 50 futures are currently down -27 points (-0.72%), the cash market is currently estimated to open at 3,701.03

- Germany's DAX futures are currently down -88 points (-0.64%), the cash market is currently estimated to open at 13,578.32

US Futures:

- DJI futures are currently up 54 points (0.17%)

- S&P 500 futures are currently up 42.25 points (0.39%)

- Nasdaq 100 futures are currently up 7.75 points (0.21%)

RBA hint at a pause

Answering questions to parliament, RBA’s Deputy Governor Michelle Bullock gave a strong hint that the central bank is approaching pause in regards to their tightening cycle. Noting that rates have already been raised “substantially”, she said that they could be nearing a level where there “might be an opportunity to sit and wait”. Rates are currently at 2.85% after seven consecutive hikes, and we’re now left wondering if the RBA will deliver a Christmas present to the people by not hiking interest rates until February.

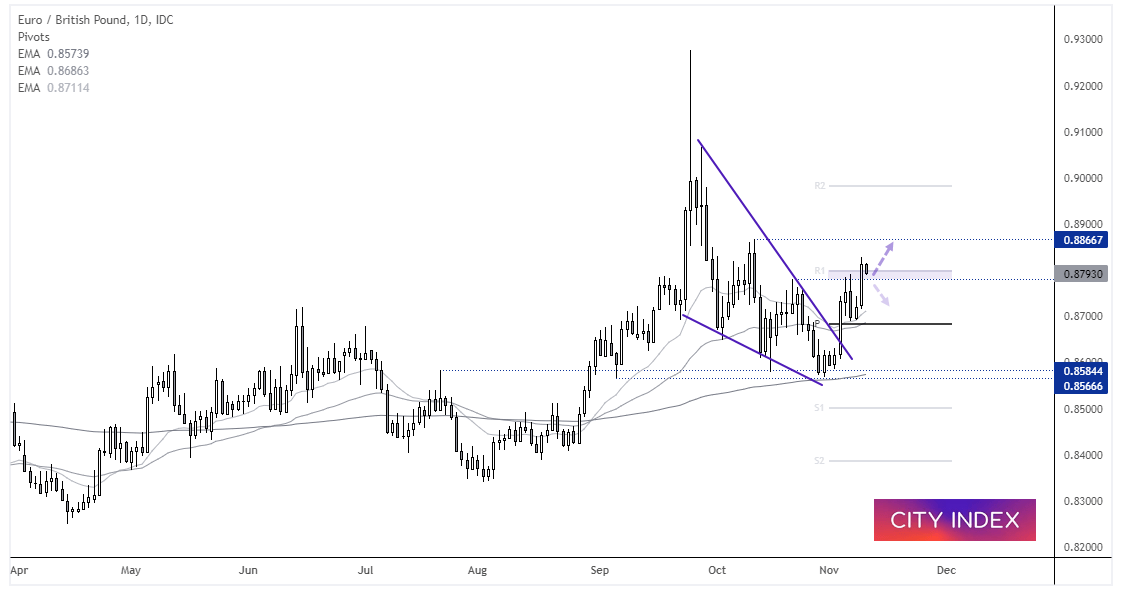

EUR/GBP hits a 4-week high

We noted EUR/GBP’s breakout last week and, after pulling back to the monthly pivot, has turned higher once more. A bullish wedge is in play which projects a target near the patterns base around 0.9060. For today, we’d like to see prices hold above 0.8780 high and break back above the monthly R2- but if we see a low volatility pullback beneath this level then we’d still consider bullish setups on lower timeframes for a potential bullish swing trade. The 0.8866 high is now likely in focus for bulls.

The EUR/AUD analysis from Monday is playing out nicely, with the daily chart making a clear breakout to confirm the bullish channel and now within 1-2 day’s ATR away from the 1.5706 high. The daily chart may not offer the adequate reward to risk ratio around current levels, but if it can pullback then perhaps it could become of interest for bullish intraday traders.

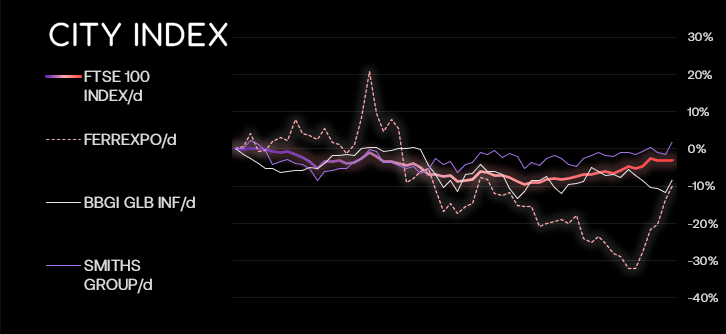

FTSE 350 – Market Internals:

FTSE 350: 4033.95 (0.66%) 09 November 2022

- 229 (65.43%) stocks advanced and 112 (32.00%) declined

- 3 stocks rose to a new 52-week high, 1 fell to new lows

- 12.57% of stocks closed above their 200-day average

- 50.57% of stocks closed above their 50-day average

- 5.43% of stocks closed above their 20-day average

Outperformers:

- + 4.35% - Ferrexpo PLC (FXPO.L)

- + 4.10% - BBGI Global Infrastructure SA (BBGIB.L)

- + 3.55% - Smiths Group PLC (SMIN.L)

Underperformers:

- -9.92% - FirstGroup PLC (FGP.L)

- -6.31% - J D Wetherspoon PLC (JDW.L)

- -5.76% - Petrofac Ltd (PFC.L)

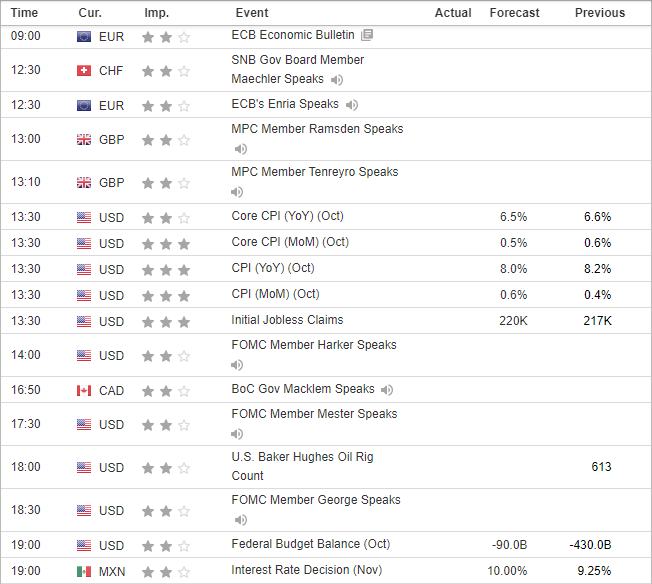

Economic events up next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade