Asian Indices:

- Australia's ASX 200 index fell by -7.6 points (-0.11%) and currently trades at 7,144.20

- Japan's Nikkei 225 index has risen by 14.72 points (0.05%) and currently trades at 27,914.49

- Hong Kong's Hang Seng index has fallen by -376.48 points (-2.09%) and currently trades at 17,616.06

- China's A50 Index has fallen by -197 points (-1.61%) and currently trades at 12,072.57

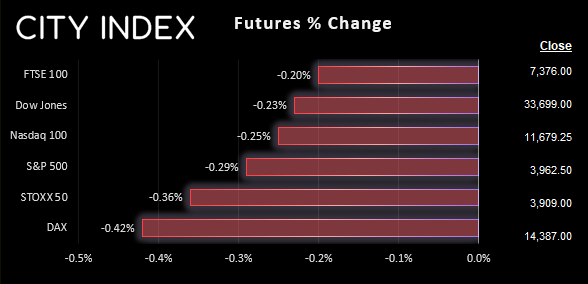

UK and Europe:

- UK's FTSE 100 futures are currently down -16 points (-0.22%), the cash market is currently estimated to open at 7,369.52

- Euro STOXX 50 futures are currently down -13 points (-0.33%), the cash market is currently estimated to open at 3,911.84

- Germany's DAX futures are currently down -55 points (-0.38%), the cash market is currently estimated to open at 14,376.86

US Futures:

- DJI futures are currently down -79 points (-0.23%)

- S&P 500 futures are currently down -28.5 points (-0.24%)

- Nasdaq 100 futures are currently down -11 points (-0.28%)

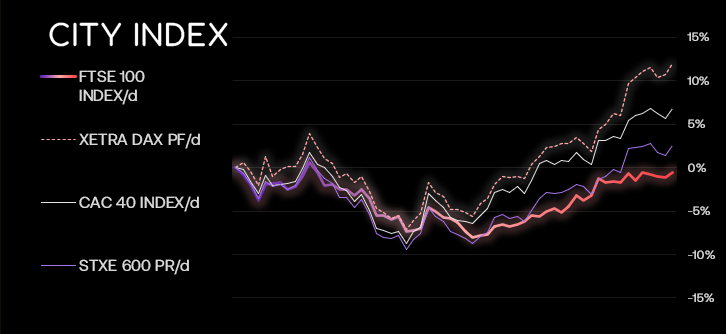

COVID cases in China have continued to rise, several schools across Beijing have been shut down and Shijiazhuang announced mass testing. The Hang Seng fell as much as -3.3% at the open and was the weakest performer overnight. Oil prices were also slightly lower overnight as traders price in slower demand from a locked-down China.

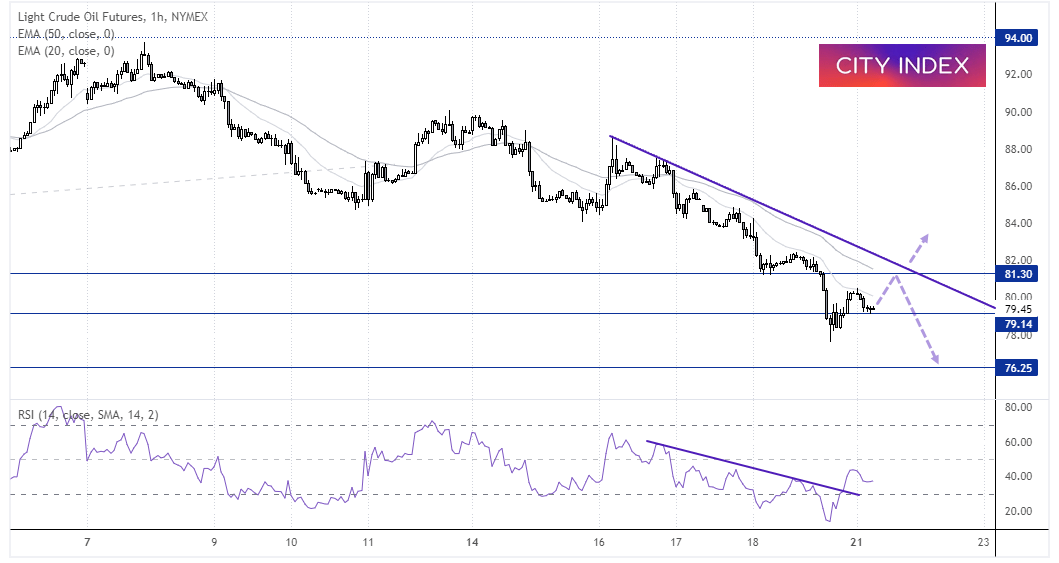

WTI 1-hour chart:

WTI formed a bearish outside week and suffered its worst week in 15 on Friday. It is trading below $80 ahead of the open but looks like it wants to pop higher on the 4-hour chart. The RSI (14) reached a very oversold level of 14 on Friday, but it has since tracked prices higher and broken its own trendline. If prices can remain above $79 then we see the potential for it to bounce a little higher towards $81 before returning to its bearish trend.

FTSE 350 – Market Internals:

FTSE 350: 4096.19 (0.66%) 18 November 2022

- 229 (65.43%) stocks advanced and 112 (32.00%) declined

- 3 stocks rose to a new 52-week high, 2 fell to new lows

- 12.57% of stocks closed above their 200-day average

- 50.57% of stocks closed above their 50-day average

- 5.43% of stocks closed above their 20-day average

Outperformers:

- + 15.33% - WAG Payment Solutions PLC (WPS.L)

- + 7.25% - Aston Martin Lagonda Global Holdings PLC (AML.L)

- + 6.32% - International Distributions Services PLC (IDSI.L)

Underperformers:

- ·-4.90% - Mitie Group PLC (MTO.L)

- ·-2.58% - Morgan Advanced Materials PLC (MGAMM.L)

- ·-2.56% - ASOS PLC (ASOS.L)

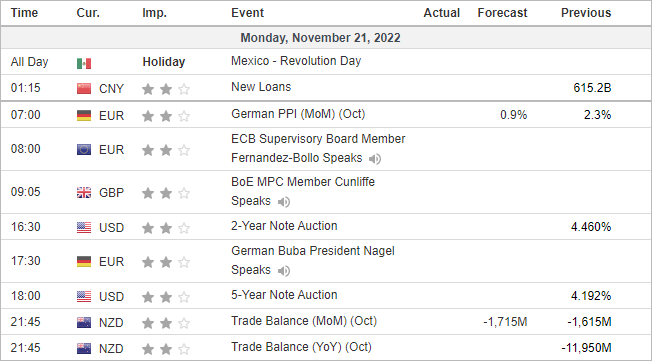

Economic events up next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade