Asian Indices:

- Australia's ASX 200 index rose by 7.6 points (0.12%) and currently trades at 6,608.60

- Japan's Nikkei 225 index has risen by 299.42 points (1.14%) and currently trades at 26,625.58

- Hong Kong's Hang Seng index has fallen by -85 points (-0.4%) and currently trades at 21,223.21

- China's A50 Index has risen by 14.33 points (0.1%) and currently trades at 14,172.97

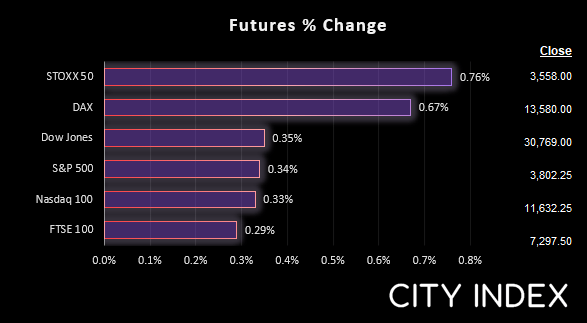

UK and Europe:

- UK's FTSE 100 futures are currently up 21 points (0.29%), the cash market is currently estimated to open at 7,294.41

- Euro STOXX 50 futures are currently up 26 points (0.74%), the cash market is currently estimated to open at 3,558.32

- Germany's DAX futures are currently up 80 points (0.59%), the cash market is currently estimated to open at 13,565.29

US Futures:

- DJI futures are currently up 103 points (0.34%)

- S&P 500 futures are currently up 35.75 points (0.31%)

- Nasdaq 100 futures are currently up 12.25 points (0.32%)

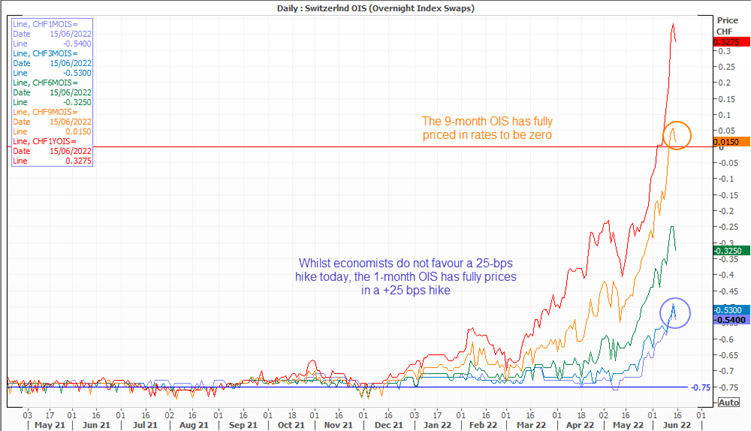

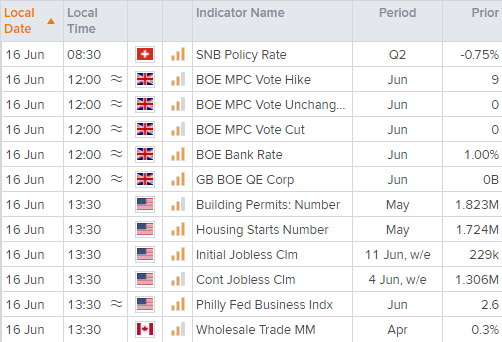

We have three central bank meetings over the next 24-hours, and next up is the SNB (Swiss National Bank) at 08:30 BST. In May we outlined a potential case for a rate hike for SNB, based on the premise deflation is no long a concern and that they are less compelled to intervene to fight a strong currency due to higher interest and inflation rates elsewhere. They even said as much in April, and effectively outlined a case for a strong Swiss franc and rate hike should inflation continue to overshoot (which is has).

Economists and markets are not seeing eye to eye, with economists polled by Reuters mostly backing rates to remain at -0.75% today – whilst the 1-month OIS (overnight index swap) has fully priced in a 25-bps hike. The grater risk here is that few are paying attention to the possibility of a hike. And as traders remain heavily net-short CHF futures, a hike today could prompt a short-covering rally for the Swiss franc.

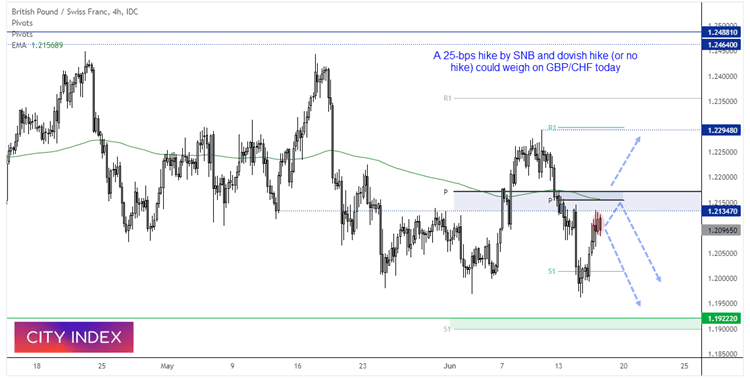

Meanwhile, a 25-bps hike is fully expected from the BOE (Bank of England) today. And this comes on the back of two-months of negative GDP amidst concerns the UK economy will go into a recession. Therefore this is not a happy hike, fully expected by money markets and economist – which leaves little rom for surprise. But what if BOE surprise by not hiking rates, or lowering expectations for future hikes? We’d expect the British pound to suffer, and that could make short GBP/CHF a very interesting setup – especially if the SNB hike today.

Meanwhile, a 25-bps hike is fully expected from the BOE (Bank of England) today. And this comes on the back of two-months of negative GDP amidst concerns the UK economy will go into a recession. Therefore this is not a happy hike, fully expected by money markets and economist – which leaves little rom for surprise. But what if BOE surprise by not hiking rates, or lowering expectations for future hikes? We’d expect the British pound to suffer, and that could make short GBP/CHF a very interesting setup – especially if the SNB hike today.

GBP/CHF rallied from the 1.2000 area yesterday, although it paused below a zone of resistance comprising of the monthly and weekly pivot and 200-bar eMA. A bearish Doji formed on the 4-hour chart and the current candle is on track to close with a bearish engulfing candle, so it is already showing the early signs of a potential top. Should the SNB hike rates today we’d expect quite a strong reaction from CHF pairs – as we suspect few are prepared for it. And this would be amplified if the BOE surprise markets by holding (low probability, but likely a bigger reaction), or delivering a dovish hike.

Economic events up next (Times in BST)

This content will only appear on City Index websites!

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

- Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade