Asian Indices:

- Australia's ASX 200 index fell by -67.2 points (-0.94%) and currently trades at 7,063.60

- Japan's Nikkei 225 index has fallen by -601.6 points (-2.34%) and currently trades at 25,088.80

- Hong Kong's Hang Seng index has fallen by -744.37 points (-3.56%) and currently trades at 20,145.89

- China's A50 Index has fallen by -337.73 points (-2.44%) and currently trades at 13,492.23

UK and Europe:

- UK's FTSE 100 futures are currently down -16 points (-0.23%), the cash market is currently estimated to open at 7,083.09

- Euro STOXX 50 futures are currently down -32.5 points (-0.89%), the cash market is currently estimated to open at 3,618.89

- Germany's DAX futures are currently down -130 points (-0.97%), the cash market is currently estimated to open at 13,312.10

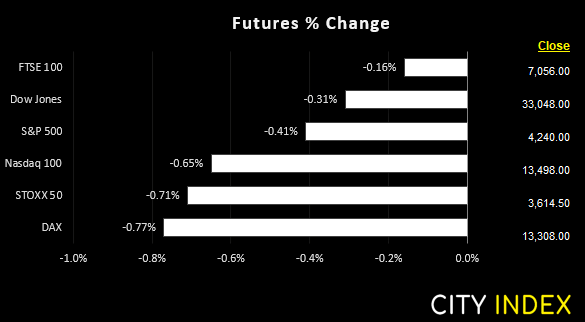

US Futures:

- DJI futures are currently down -120 points (-0.36%)

- S&P 500 futures are currently down -98.5 points (-0.73%)

- Nasdaq 100 futures are currently down -20.25 points (-0.48%)

Alongside hot inflation, fruitless ceasefire talks between Ukraine and Russia also weighed on sentiment. China’s equity markets were the worst hit as US-listed Chinese stocks fell on Wall Street after being named as being potentially de-listed form US exchanges. European index futures trade around -0.3% lower, Nasdaq is down -0.6% and the S&P is -0.3% lower.

It's a bit disappointing to see the ASX trade lower today after putting up a good fight the two days prior. But then success really depends on how it is measured. Taking into consideration the negative news flow these past two weeks, then the ASX has actually done really well to rise around 1% from its close on the 25th of February, and be back above 7,000.

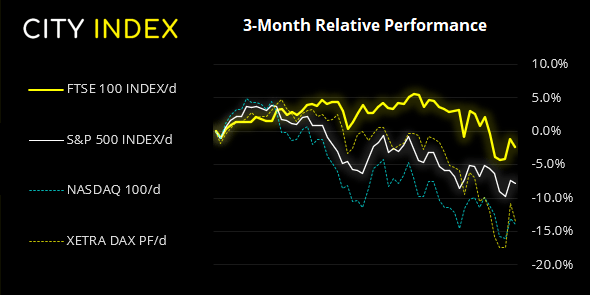

FTSE’s rally foiled at 7200

Despite its outperformance throughout January and most of February, the FTSE 100 was not able to withstand the selling pressures of global equities. Yet like its European and US counterparts, it was able to print a decent rally on Wednesday, yet resistance has been found at cluster of resistance levels around 7200 (10 and 200-day eMA, broken channel, weekly pivot point).

Futures markets are point towards a lower open, but our attention will remain on how prices react around 7200 today if tested. A decent break or daily close above 7218 invalidates our near-term short bias, until which we are looking for a break of yesterday’s low to bring 7000 and 6965 into focus. Bears could also fade into failed rallies to break above 7200 in anticipation of a swing high and break of yesterday’s low.

FTSE 350: Market Internals

FTSE 350: 3982.48 (-1.27%) 10 March 2022

- 118 (33.62%) stocks advanced and 221 (62.96%) declined

- 5 stocks rose to a new 52-week high, 3 fell to new lows

- 20.23% of stocks closed above their 200-day average

- 16.81% of stocks closed above their 50-day average

- 17.38% of stocks closed above their 20-day average

Outperformers:

- +12.1% - Baltic Classifieds Group PLC (BCG.L)

- +9.1% - Hill & Smith Holdings PLC (HILS.L)

- +8.7% - Spirent Communications plc (SPT.L)

Underperformers:

- -14.1% - Petropavlovsk PLC (POG.L)

- -11.9% - Volution Group PLC (FAN.L)

- -10.7% - EVRAZ plc (EVRE.L)

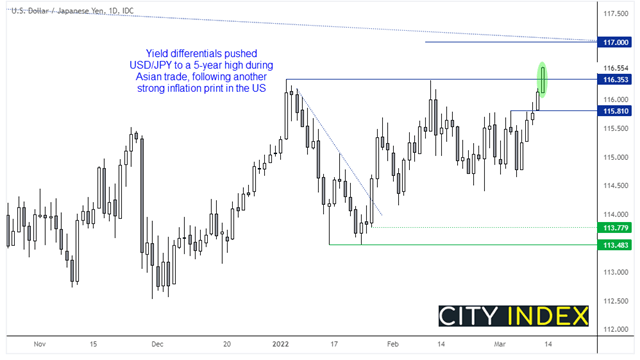

USD/JPY hits a 5-year high

Rising yield differential between the US and Japan helped to drive USD/JPY to a 5-year high today. US inflation reached a 40-year high and effectively confirms that the Fed will hike next week and has reignited expectations that multiple hikes will come this year despite the geopolitical landscape surrounding Ukraine. The January high (116.35) is a key level for bulls to defend today, as a close back beneath it warns of a bull-trap. But that appears to be an unlikely scenario and USD/JPY appears set to record a five-day winning streak, with its next stop at 117.

Everything you should know about the Japanese yenA volatile week for oil could end in disappointment

Crude oil is on track for its worst week this year at around -8.2%, despite hitting a 14-year high on Monday. Trading volumes remain very thin though, and with the big economic events of the weekend behind us it needs a new catalyst to wake it up ahead of the weekend. Support resides around $104, just above Wednesday’s low – which was its most volatile daily selloff since November.

Gold on track for a weekly reversal candle

If gold closes around current levels it will leave a weekly reversal pattern for gold bugs to fret over during the weekend. And that its rally stopped just $5 from its record high rubs salt into the wound. But like oil – which it basically moves in tandem with these days – gold may prove to be an uneventful market without a new catalyst. But perhaps that’s not a bad thing given the high levels of volatility markets have endured these past two weeks.

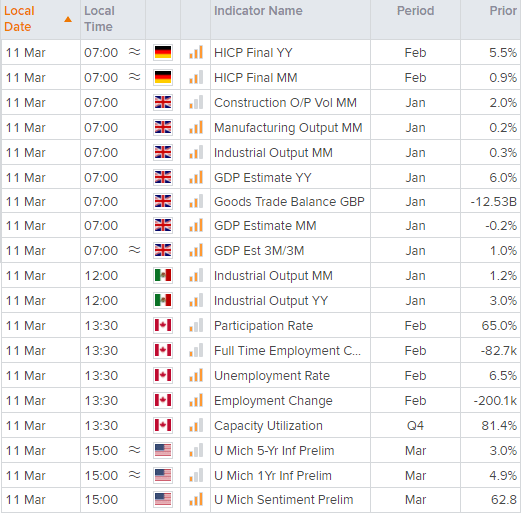

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade