Asian Indices:

- Australia's ASX 200 index fell by -35.9 points (-0.5%) and currently trades at 7,119.30

- Japan's Nikkei 225 index has fallen by -38.59 points (-0.14%) and currently trades at 26,639.21

- Hong Kong's Hang Seng index has fallen by -96.04 points (-0.48%) and currently trades at 20,075.23

- China's A50 Index has risen by 33.61 points (0.25%) and currently trades at 13,230.50

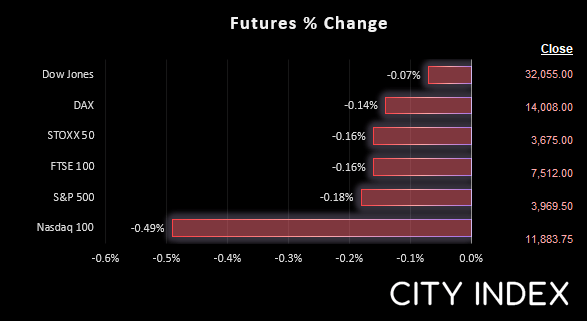

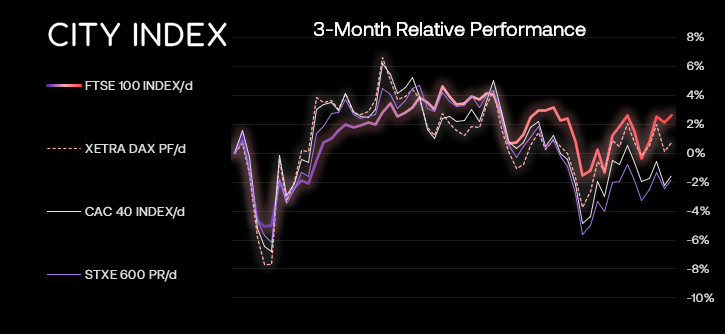

UK and Europe:

- UK's FTSE 100 futures are currently down -15.5 points (-0.21%), the cash market is currently estimated to open at 7,507.25

- Euro STOXX 50 futures are currently down -5 points (-0.14%), the cash market is currently estimated to open at 3,672.10

- Germany's DAX futures are currently down -14 points (-0.1%), the cash market is currently estimated to open at 13,993.93

US Futures:

- DJI futures are currently down -37 points (-0.12%)

- S&P 500 futures are currently down -68 points (-0.57%)

- Nasdaq 100 futures are currently down -9.5 points (-0.24%)

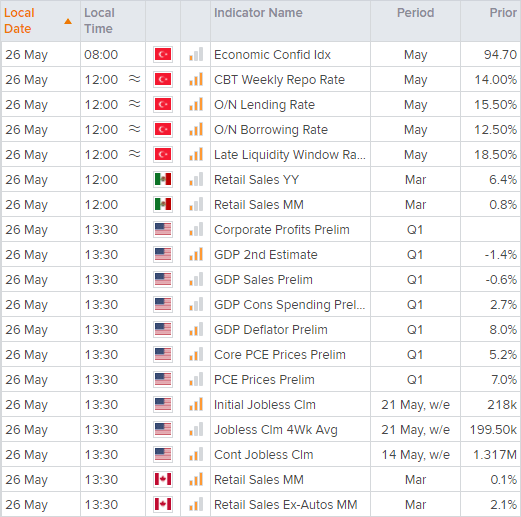

Revised US GDP is in focus today to see if it can be upgraded from the -1.4% contraction seen in the initial release. A print of -1.4% or worse could well send equity markets lower again as it exacerbates worries of stagflation and a potential US recession. Core PCE is also a key data point to monitor to see if inflation is lower than feared – even if that seems an unlikely scenario. Pending homes sales also warrant a look to see if it continues to track other housing market indicators lower. Currently they have contracted for 5 consecutive months and down around -8.3% y/y and, given high mortgage rates and inflation expectations, doubt we’ll see a recovery here soon either.

But first, the central bank of Turkey announce their report rate decision. They last cut rates in November and have since focussed on ‘Liraization’ as part of their policy review. The lira has since fallen around -20% against the US dollar since then, although we’d be surprised if the central bank raised rates to defend it, given the unorthodox policies President Erdogan has forced upon his hand-picked central bankers.

USD/TRY currently trades at 16.36 and at a year-to-date high and, with a hawkish Fed paired with a dovish ‘bank of Erdogan’, it is difficult to see this trend turning lower. The US dollar and EUR were the strongest majors overnight, although trading ranges were tight. Asian equity markets were mixed as they absorbed the latest release of the FOMC minutes, whilst US and European equity index futures are a touch lower.

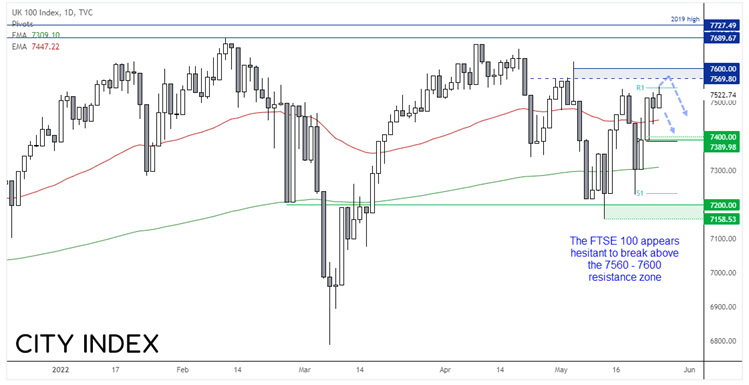

FTSE 100:

These are not the easiest of market to navigate. US indices have grind their way higher in an unconvincing manner, seemingly ready to roll over at the drop of a bad data point. The FTSE has held up relatively well, but we can all agree these are not the ideal trending conditions. But perhaps that can be used to our advantage. Yesterday’s small bullish candle seems hesitant to test 7600 and met resistance at the weekly R1. Should prices break above the high today we would prefer to look for any signs of weakness up to 7600 to fade into. Alternatively, wait for a break of yesterday’s low for more confirmation a near-term top has formed and target either Wednesday’s low or the 7400 support zone.

FTSE: Market Internals

FTSE 350: 4181.75 (0.51%) 25 May 2022

- 215 (61.43%) stocks advanced and 121 (34.57%) declined

- 8 stocks rose to a new 52-week high, 13 fell to new lows

- 28.29% of stocks closed above their 200-day average

- 91.14% of stocks closed above their 50-day average

- 17.71% of stocks closed above their 20-day average

Outperformers:

- + 13.25% - Pets at Home Group PLC (PETSP.L)

- + 6.89% - Volution Group PLC (FAN.L)

- + 5.75% - SSE PLC (SSE.L)

Underperformers:

- ·-6.12% - JD Sports Fashion PLC (JD.L)

- ·-5.32% - Spectris PLC (SXS.L)

- ·-4.47% - Cranswick PLC (CWK.L)

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade