Asian Indices:

- Australia's ASX 200 index rose by 49.7 points (0.71%) and currently trades at 7,015.20

- Japan's Nikkei 225 index has risen by 344.44 points (1.24%) and currently trades at 28,223.40

- Hong Kong's Hang Seng index has fallen by -179.51 points (-0.9%) and currently trades at 19,843.71

- China's A50 Index has fallen by -84.94 points (-0.63%) and currently trades at 13,386.19

UK and Europe:

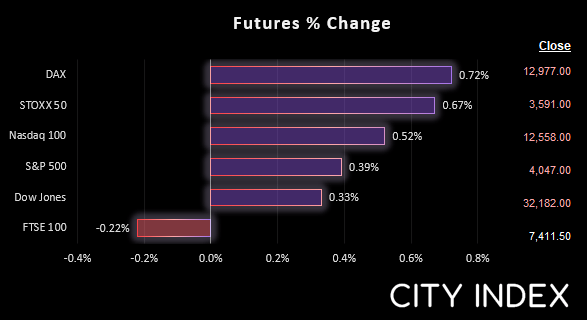

- UK's FTSE 100 futures are currently down -16.5 points (-0.22%), the cash market is currently estimated to open at 7,410.81

- Euro STOXX 50 futures are currently up 23 points (0.64%), the cash market is currently estimated to open at 3,593.51

- Germany's DAX futures are currently up 93 points (0.72%), the cash market is currently estimated to open at 12,985.99

US Futures:

- DJI futures are currently up 105 points (0.33%)

- S&P 500 futures are currently up 65 points (0.52%)

- Nasdaq 100 futures are currently up 15.75 points (0.39%)

It proved to be a turnaround Tuesday for share markets across Asia, although China was the exception. Whilst Wal Street continued lower yesterday, losses were limited which shows selling pressures are receding. And that helped to lift sentiment in the overnight Asian session

This has seen futures for European and US indices rise ahead of the open, although the FTSE is the odd one out and currently trades -0.22% lower. Volatility remained very low for currency pairs and commodities overnight.

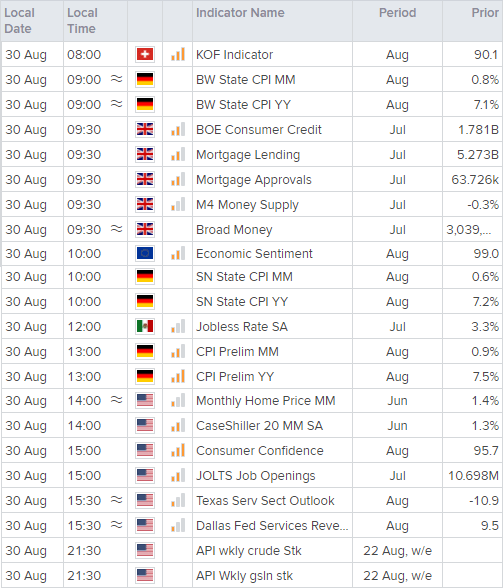

A host of regional inflation reports for Germany are released at 09:00 – and that can potentially provide a lead on where CPI could be headed for Germany as a whole and the Euro area. One has just been released, which saw annual inflation for Nordhein-Westfalen rise to 8.1% although is only rose 0.3% m/m, down from 1.1% previously. German CPI is then released at 13:00 BST

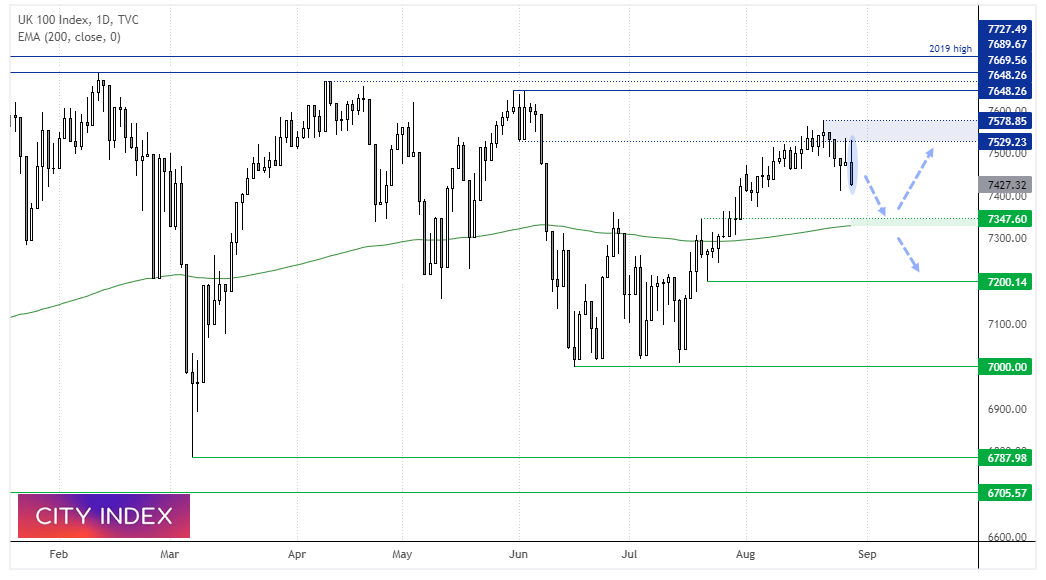

FTSE 100 daily chart:

The FTSE’s latest rally failed to test the 7600 handle, and after a period of consolidation at the highs momentum has now turned lower. This is now its third marginally lower high since the February high, which now has us on guard for at least a dip lower – with the potential for a move down to 7200.

A bearish hammer on Thursday and bearish outside day on Friday show resistance around 7230, and today’s bias remains bearish whilst prices remain beneath it. We’d consider fading into retracements within Friday’s range for an initial move to 7350 – a level which could prove pivotal. Whereas a break below the 200-day eMA assumes bullish continuation towards the 7200 low.

FTSE 100 trading guide

Economic events up next (Times in BST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade