Asian Indices:

- Australia's ASX 200 index fell by -108.1 points (-1.51%) and currently trades at 7,074.60

- Japan's Nikkei 225 index has fallen by -509.78 points (-1.89%) and currently trades at 26,401.67

- Hong Kong's Hang Seng index has fallen by -464.98 points (-2.25%) and currently trades at 20,179.30

- China's A50 Index has fallen by -79.35 points (-0.6%) and currently trades at 13,167.04

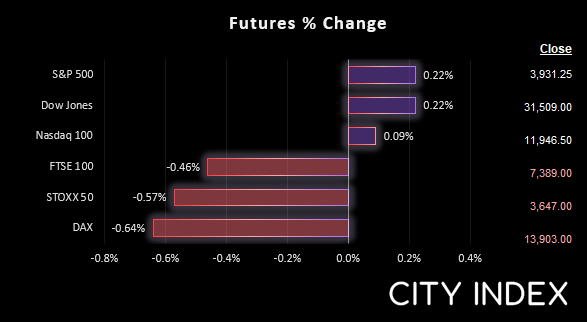

UK and Europe:

- UK's FTSE 100 futures are currently down -34.5 points (-0.46%), the cash market is currently estimated to open at 7,403.59

- Euro STOXX 50 futures are currently down -22 points (-0.6%), the cash market is currently estimated to open at 3,668.74

- Germany's DAX futures are currently down -90 points (-0.64%), the cash market is currently estimated to open at 13,917.76

US Futures:

- DJI futures are currently up 70 points (0.22%)

- S&P 500 futures are currently up 9.5 points (0.08%)

- Nasdaq 100 futures are currently up 8.75 points (0.22%)

Asian indices were all in the red as they tracked Wall Street lower, in light of renewed concerns of stagflation fuelled by weak housing data and profit warnings from Target Corp.

Japan’s trade deficit widened in April as surging commodity prices weighed on import costs. And that’s not ideal for Q2 growth, so soon after we hear that Q1 GDP contracted earlier this week. The Japanese yen was the weakest major overnight which allowed risk pairs such as AUD/JPY and NZD/JPY to rise despite the risk-off tone apparent across Asian equity markets.

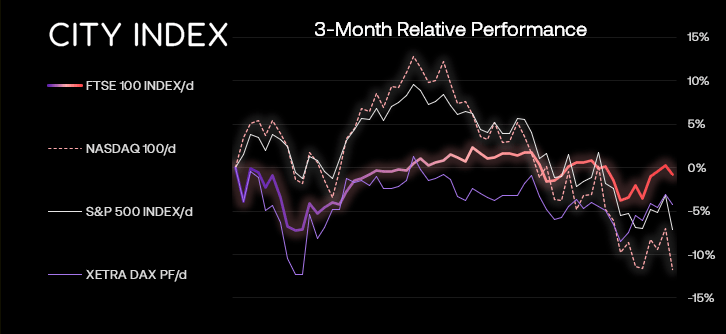

DAX falters at key resistance

We outlined a bullish scenario for the DAX earlier this week. Yet an obstacle which remains unconquered is the bearish trendline form its record high. Until that breaks the risks are to the downside over the near-term.

A bearish engulfing (and outside) candle formed yesterday and also marked a false break of trend resistance. Tuesday’s opening gap has been fully closed, so we now bearish bias whilst prices remain beneath yesterday’s high.

We can see on the four-hour chart that the high respected the weekly R1 pivot point, and we suspect prices will now make their way bac to the 13,815 area near the pivot point itself. Should prices then find support and form a swing low then we’ll revisit the potential for a bullish breakout, as outlined in Tuesday’s report. Yet a break beneath 13,800 assumes further downside.

DAX 30 trading guide

FTSE: Market Internals

FTSE 350: 4142.34 (-1.07%) 18 May 2022

- 108 (30.86%) stocks advanced and 229 (65.43%) declined

- 7 stocks rose to a new 52-week high, 9 fell to new lows

- 26% of stocks closed above their 200-day average

- 100% of stocks closed above their 50-day average

- 18.57% of stocks closed above their 20-day average

Outperformers:

- + 10.13% - Premier Foods PLC (PFD.L)

- + 9.02% - Coats Group PLC (COA.L)

- + 6.71% - Vesuvius PLC (VSVS.L)

Underperformers:

- -15.17% - Darktrace PLC (DARK.L)

- -12.93% - TUI AG (TUIGn.DE)

- -9.05% - Ocado Group PLC (OCDO.L)

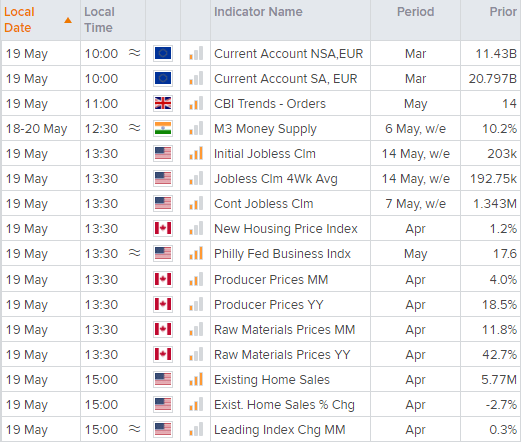

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade