Asian Indices:

- Australia's ASX 200 index rose by 3.8 points (0.05%) and currently trades at 7,447.20

- Japan's Nikkei 225 index has fallen by -163.16 points (-0.56%) and currently trades at 28,944.65

- Hong Kong's Hang Seng index has fallen by -396.26 points (-1.52%) and currently trades at 25,642.01

- China's A50 Index has fallen by -220.51 points (-1.37%) and currently trades at 15,858.84

UK and Europe:

- UK's FTSE 100 futures are currently down -6 points (-0.08%), the cash market is currently estimated to open at 7,271.62

- Euro STOXX 50 futures are currently down -18.5 points (-0.44%), the cash market is currently estimated to open at 4,205.47

- Germany's DAX futures are currently down -52 points (-0.33%), the cash market is currently estimated to open at 15,705.06

US Futures:

- DJI futures are currently up 15.73 points (0.04%)

- S&P 500 futures are currently down -7.25 points (-0.05%)

- Nasdaq 100 futures are currently up 0.75 points (0.02%)

Another Chinese property developer defaulted on a bond payment, and China’s state planner called on companies of key sectors to reduce their foreign debt holdings. Separately, the South China Morning Post reported that US lawmakers held hearings that fanned speculations that could lead to the delisting of Chinese stocks on US exchanges next year. Chinese equities were the weakest of the session with the Hang Seng falling -1.7% during its worst session in 3 weeks.

Indices:

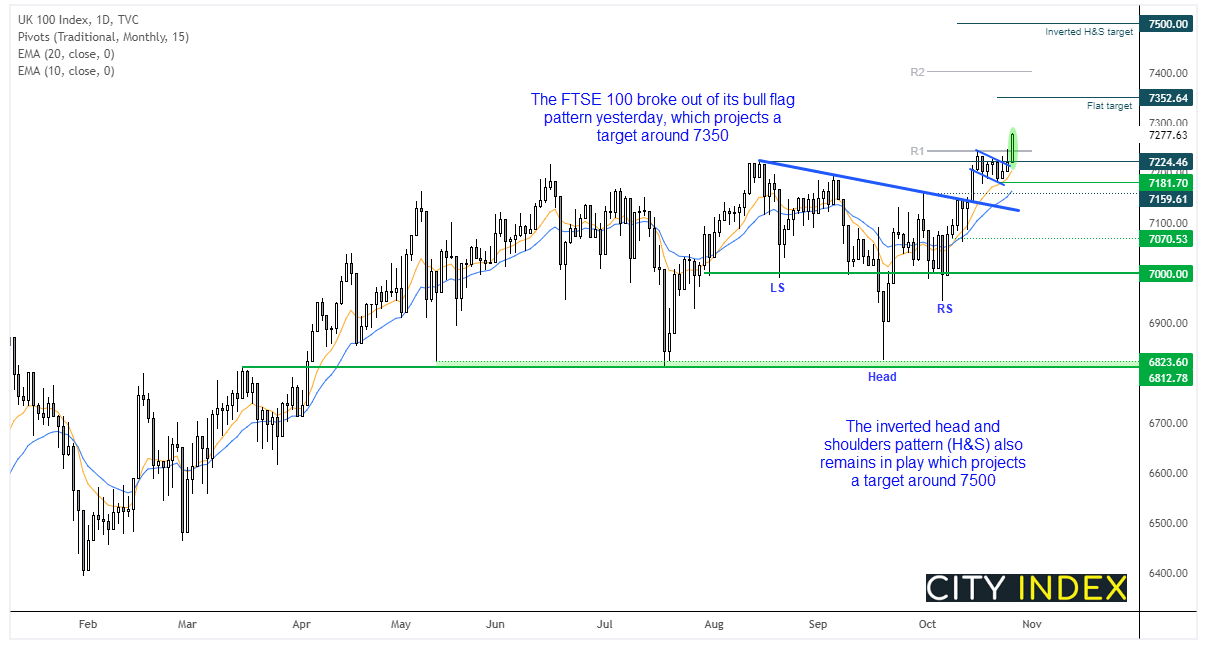

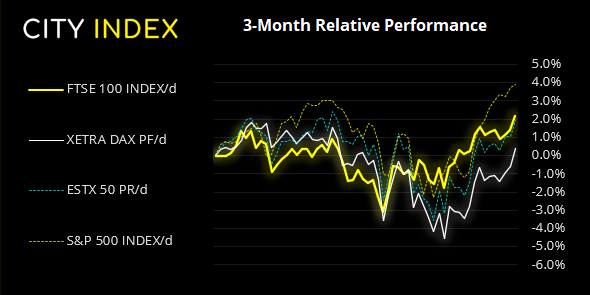

FTSE 100 finally broke out of its bull flag pattern on the daily chart, taking it to its highest level since February 2020 – just as the pandemic’s selloff was gaining traction. Furthermore, yesterday’s close also cleared the monthly R1 pivot. Structurally, the daily trend remains bullish above 7181 and the bull flag target sits around 7350. But if the larger bullish continuation pattern is to play out it could be headed for 7500.

It was also a good day for the STOXX 50 which extended its own bull-flag breakout an 11-week high. Our bias remains bullish above yesterday’s low. The DAX went a step further with an opening gap higher, and our bias remains bullish above 15,500.

FTSE 350: Market Internals

FTSE 350: 4168.17 (0.76%) 26 October 2021

- 277 (78.92%) stocks advanced and 67 (19.09%) declined

- 10 stocks rose to a new 52-week high, 1 fell to new lows

- 61.25% of stocks closed above their 200-day average

- 41.88% of stocks closed above their 50-day average

- 22.22% of stocks closed above their 20-day average

Outperformers:

- + 5.95%-BT Group PLC(BT.L)

- + 5.81%-Reckitt Benckiser Group PLC(RKT.L)

- + 5.71%-Ashmore Group PLC(ASHM.L)

Underperformers:

- ·-6.32%-Entain PLC(ENT.L)

- ·-4.20%-Harbour Energy PLC(HBR.L)

- ·-4.01%-Fresnillo PLC(FRES.L)

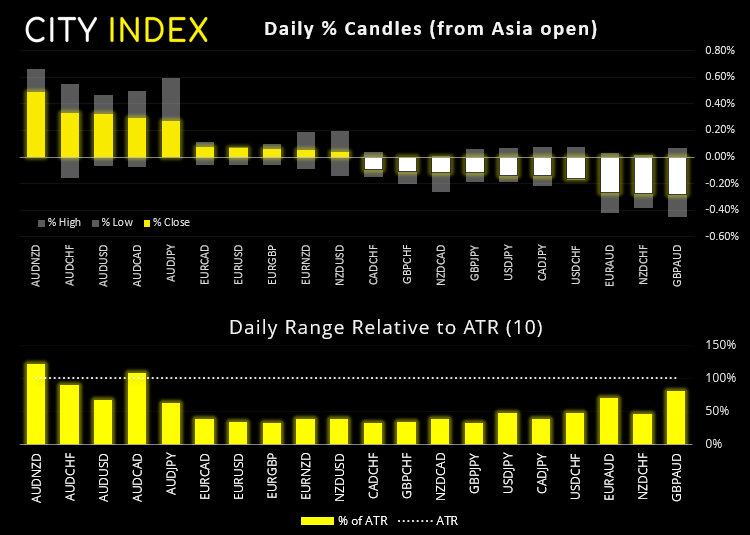

Forex:

The Australian dollar was the strongest major again after CPI data exceeded expectations. Trimmed Mean (the RBA’s preferred gauge) rose to 2.1%, meaning it has re-entered the RBA’s 2-3% target band for the first time since Q4 2015. The short-end of Aussie’s yield curve is higher, led by the 6-moht yield which is up 13.3 bps.

German consumer sentiment kicks off today’s data set at 07:00 and could be of interest following yesterday’s weaker IFO business outlook report. October’s outlook crawled into optimistic territory of 0.3 points, its brightest outlook since April 2020 – although today it is expected to retreat to -0.4.

EUR/USD has retraced from yesterday’s 6-day low, and its high having found resistance at the 20-day eMA. Take note of the triple top around 1.1670 on the daily chart which suggests a swing high has been seen. EUR/AUD trades just off its 18-month low achieved following today’s strong CPI report for Australia. Today’s pivotal level remains around prior support at 1.5425.

In the US session the main event is BOC’s interest rate decision at 15:00 BST. In all likelihood they will taper their bond purchases today and hold interest rates at 0.25%, with a recent poll suggesting they will bring forward their hike to Q3 2022. As for US data, durable goods orders and wholesale inventories are scheduled for 13:30 BST.

Learn how to trade forex

Commodities:

Copper futures have found support at the 20-day eMA yet lack any upside momentum as prices meander around 4.50. We’d probably want to see a daily close above 4.55 at a minimum before assuming a swing low has formed. Until then, a downside break is not out of the question.

WTI printed a bullish engulfing candle yesterday (which measures the open to close range) yet the daily high was beneath Tuesday’s bearish hammer on the daily chart. We remain cautions at these highs on the daily chart, especially if it keeps failing at $85.

Gold found resistance at its 200-day eMA overnight. It trades with a bullish channel on the four-hour chart and a bullish pinbar formed yesterday to leave a potential low around 1780. But if momentum failed to break prices above 1800 then this could easily go lower, with a break below 1780 also invalidating its bullish channel.