Asian Indices:

- Australia's ASX 200 index fell by -19.1 points (-0.28%) and currently trades at 6,833.10

- Japan's Nikkei 225 index has risen by 21.55 points (0.08%) and currently trades at 27,641.16

- Hong Kong's Hang Seng index has fallen by -29.33 points (-0.15%) and currently trades at 19,196.37

- China's A50 Index has risen by 8.96 points (0.07%) and currently trades at 13,234.29

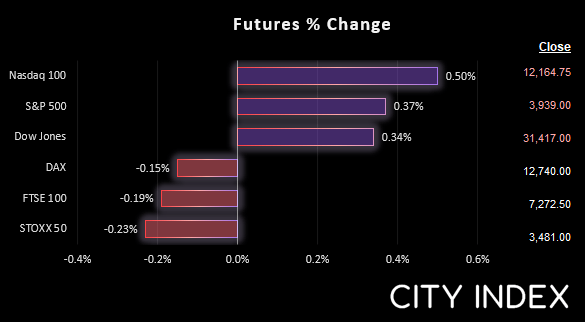

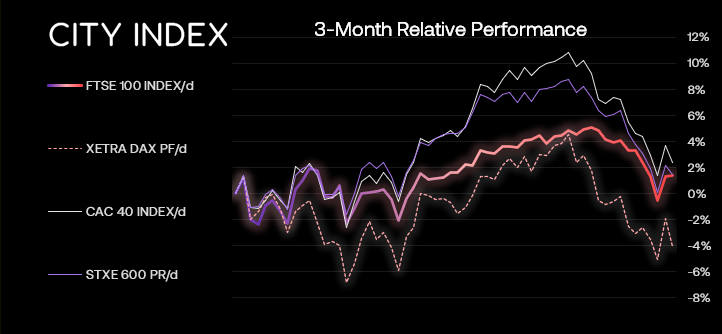

UK and Europe:

- UK's FTSE 100 futures are currently down -13.5 points (-0.19%), the cash market is currently estimated to open at 7,273.93

- Euro STOXX 50 futures are currently down -8 points (-0.23%), the cash market is currently estimated to open at 3,482.01

- Germany's DAX futures are currently down -19 points (-0.15%), the cash market is currently estimated to open at 12,741.78

US Futures:

- DJI futures are currently up 101 points (0.32%)

- S&P 500 futures are currently up 59.5 points (0.49%)

- Nasdaq 100 futures are currently up 14.25 points (0.36%)

Russia are in no hurry to fix a faulty pipeline

European energy prices and the closed Nord Stream 1 pipeline remains a key focus for traders. Russia are yet to reopen the pipeline, and are in no hurry to do so. Gazprom’s Deputy CEO has said Siemans need to repair the faulty pipeline, which is something the company denies that they have neither been commissioned to carry out the repair, the fault could be sealed on site and that there are other turbines available to use to rectify the problem.

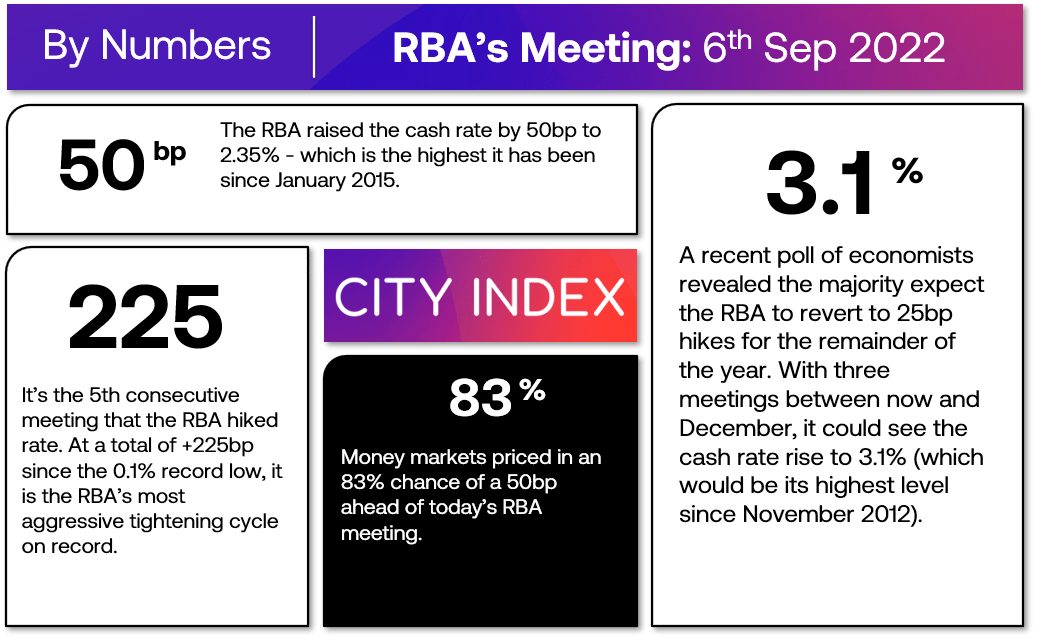

The RBA hikes rates by 50bp:

As today’s 50bp hike was fully expected by economists and priced in by money markets, it provided no element of surprise to drive the markets in a meaningful direction.

It takes the RBA’s cash rate to 2.35% - its highest since 2015 – and extends its most aggressive tightening cycle on record at 225bp over five meetings. And there are likely further hikes to come, although the consensus is for the RBA to revert to 25bp hikes into the year end.

Rates remain below their neutral rate of ‘around’ 2.5%, so I think the RBA will revert to 25bp hikes in October and November and reassess in December when they have more data at hand (such as the new monthly inflation report).

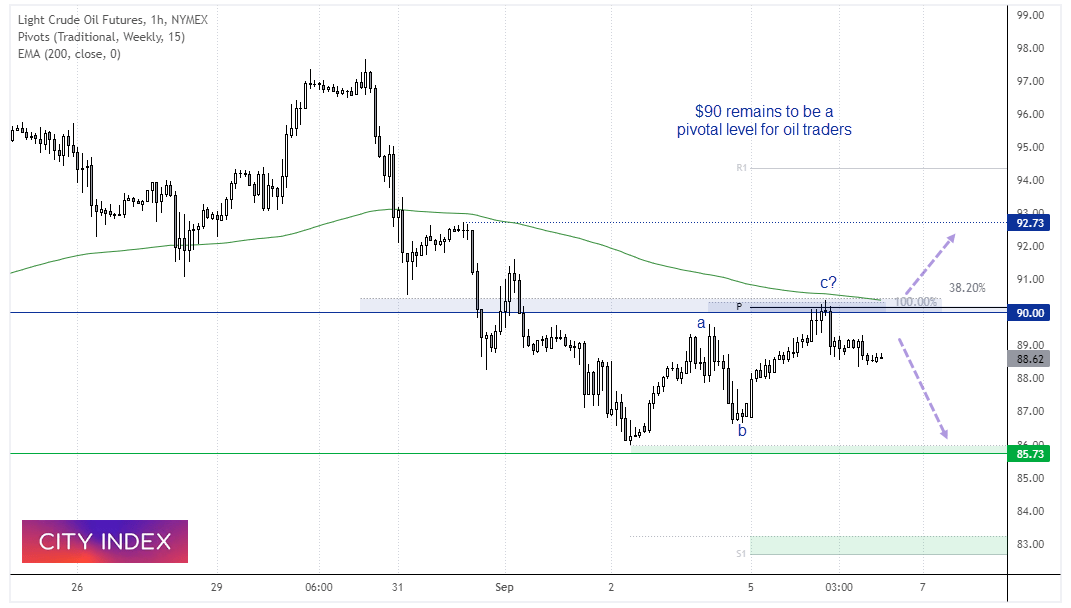

WTI 4-hour chart:

OPEC+ gave a slight production cut at yesterday’s meeting to help support prices, which saw WTI rise to around $90. But OPEC’s decision was seen a ‘symbolic’ as most producers have failed to hit their quotas anyway – hence the pullback in oil prices overnight.

It appears an impulse wave lower began just below 98 and found support just above the August low. Since then we have seen a 3-wave retracement which stalled around $90, near a cluster of resistance levels (which includes the 200-bar eMA, weekly pivot point, 38.2% Fibonacci retracement and 100% projection levels).

So perhaps the corrective high is in place, in which case the bias remains bearish below this week’s highs and for an initial move back towards the lows.

FTSE 350 – Market Internals:

FTSE 350: 4029.14 (0.09%) 05 September 2022

- 81 (23.14%) stocks advanced and 264 (75.43%) declined

- 1 stocks rose to a new 52-week high, 33 fell to new lows

- 20.86% of stocks closed above their 200-day average

- 94.29% of stocks closed above their 50-day average

- 0.29% of stocks closed above their 20-day average

Outperformers:

- + 7.15% - Bridgepoint Group PLC (BPTB.L)

- + 5.17% - Countryside Partnerships PLC (CSPC.L)

- + 4.03% - Glencore PLC (GLEN.L)

Underperformers:

- -15.64% - Aston Martin Lagonda Global Holdings PLC (AML.L)

- -10.58% - Dechra Pharmaceuticals PLC (DPH.L)

- -7.66% - Tyman PLC (TYMN.L)

Economic events up next (Times in BST)

Final PMI data for Europe, UK and the US are released today, but first Germany release industrial orders and manufacturing output data at 16:00. It’s safe to say we’re not expecting any decent data from Germany given flash PMI fell to a post-COVID low and Europe is starring down the barrel of a recession.

ISM services PMI warrants a look at 15:00, following an upside surprise from the manufacturing report last week. Prices paid by manufacturers fell for a fifth month and to 26-month low, so it would be nice to see another sharp drop for prices paid by services companies. Last month ‘prices paid’ fell by -7.8 points which is its fastest monthly drop since 2011 (and long may that trend continue). But the manufacturing report also showed that new orders expanded and the headline PMI figure remained expansive at 52.8.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade