KEY TAKEAWAYS

- Japan’s January CPI expected to be 4.2% YoY

- BoJ Governor nominee Ueda to testify on Friday

- EUR/JPY expected to be volatile

In a few hours, Japan will release it's CPI data for January. Tokyo CPI is said to be a leading indicator for Japan CPI. On January 26th, the headline CPI for Tokyo was 4.4% YoY vs an expectation of 4.2% YoY and a previous reading of 4%. In addition, the Core CPI jumped to 4.3% YoY vs an expectation of 4.2% YoY and a previous reading of 3.9% YoY. This was the highest level since 1981. Japan’s headline CPI is expected to be 4.2% YoY vs a previous reading of 4%. The Core CPI is also expected to be 4.2% YoY vs 4% in December.

The Bank of Japan targets 2% inflation, yet the BoJ has kept rates steady at -0.1% as outgoing BoJ Governor Kuroda said he expects inflation to begin falling later this year. However, the March BoJ meeting will be Kuroda’s last. Kazuo Ueda has been nominated as the next head of the BoJ. He has been in academics since he departed the BoJ as a member. Ueda is thought to be a bit more aggressive than Kuroda. However, recently Ueda said that easy monetary policy must continue. On Friday, he testifies at the Diet. Its doubtful that Ueda would try and stir the pot in his first testimony. Perhaps he may call for a review of current Monetary Policy, however he also could say how government support is still needed.

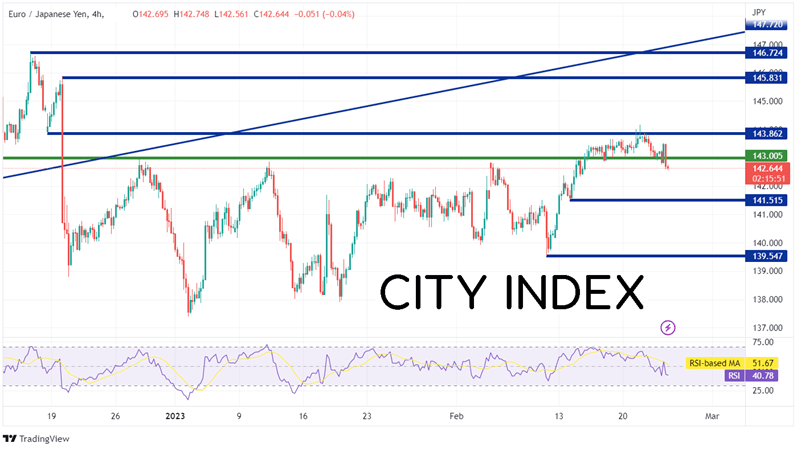

EUR/JPY had been moving higher in an ascending wedge pattern since early March 2022 when the pair bottomed at 124.39. Price broke below the bottom trendline of the pattern on December 20th (the day of the BoJ increased the limits on the 10-Year JGB to 0.50%) as the pair approached the apex of the wedge near 143.00. EUR/JPY pulled back to 137.85 on January 3rd, but had slowly moved higher to 144.16 on February 21st. The pair has since been oscillating around the 50 Day and 200 Day Moving Averages.

Source: Tradingview, Stone X

Trade EUR/JPY now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

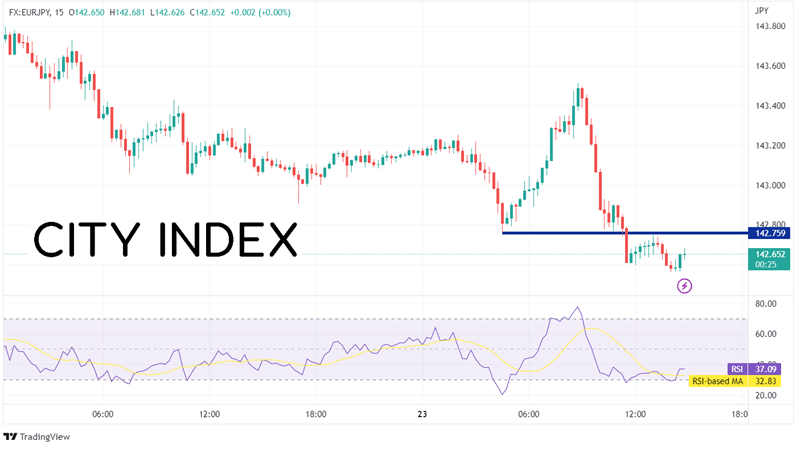

However, it is Thursday’s price action in EUR/JPY that is most interesting. EUR/JPY made a low on Thursday at 142.56. The pair then rallied, making an intraday high at 143.53 soon after the 8:30am US data releases. From there the pair fell aggressively, taking out the previous low and making a daily low at 142.56. Was the Yen buying due to expectations of a higher CPI or that Ueda may provide some “less dovish” comments?

Source: Tradingview, Stone X

On a 240-Minute timeframe, one can see that 143.00 has been an important level, as it has acted as both resistance and support recently. If price does continue lower after Friday’s events, the first support is at the confluence of the 50-Day and 200-Day Moving Averages between 141.31 and 141.38 (see daily). Below there, price can fall to the lows from February 13th at 141.52 and then the lows of February 10th at 139.55. However, if the CPI is weaker or Ueda is “more dovish” than expected, EUR/JPY could move higher. First resistance is the 2023 highs on February 21st at 144.16. Above there, price can move to the highs of December 20th, 2022, at 145.83, then the highs of December 15th, 2022, at 146.72.

Source: Tradingview, Stone X

With Japan’s CPI due out in a few hours and BoJ Governor nominee Ueda set to testify on Friday, EUR/JPY could be volatile. The pair has been trading in a tight range heading into Thursday, when price inexplicitly sold off. Could the market be setting up for Friday’s events in Japan? Manage risk accordingly.

Learn more about forex trading opportunities.

--- Written by Joe Perry, Senior Market Strategist

Follow me on Twitter at @JoeP_FOREXcom