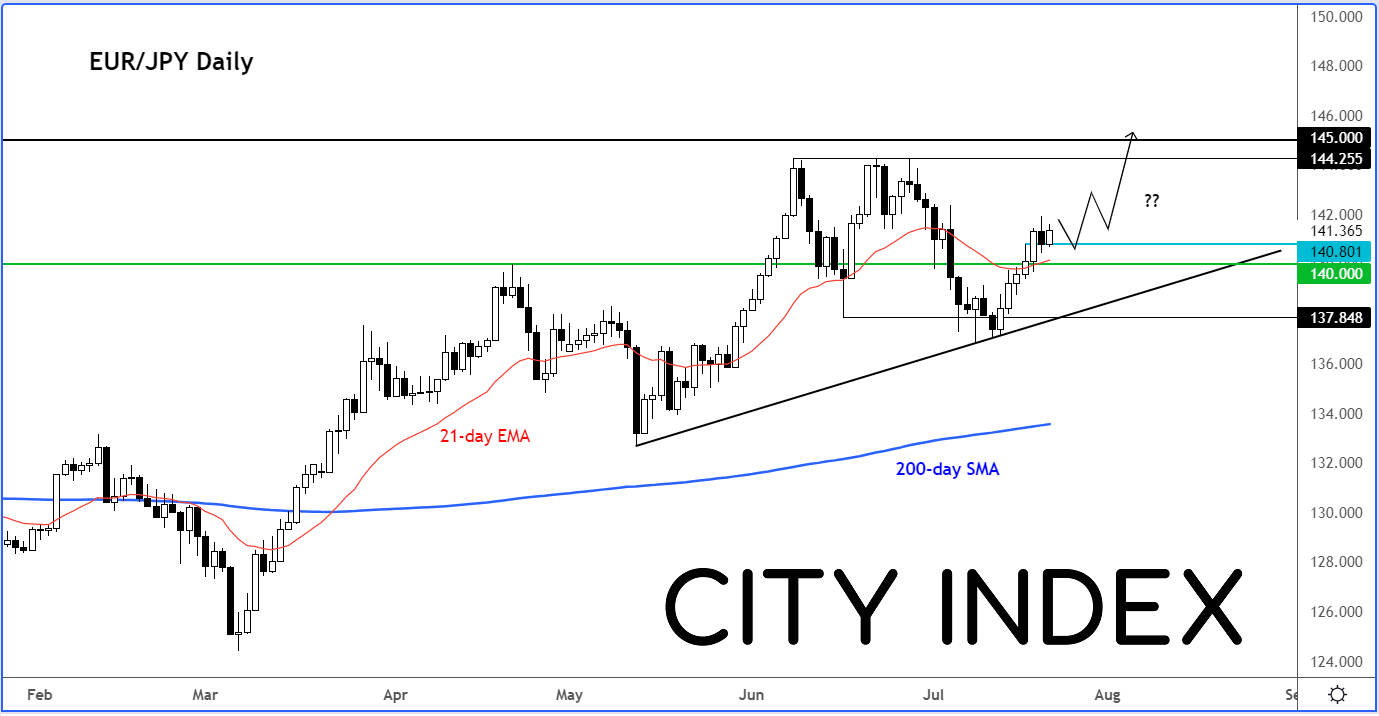

EUR/JPY could target 145.00 if ECB is aggressive

While I think the ECB will raise rates by 50 bps today, I obviously cannot rule out the possibility of a dovish 25bp hike, which leaves the euro vulnerable to some correction. In any case, the EUR/USD may not receive much sustained support even in a 50bp hike scenario, thanks to a weak macro-outlook.

But against the yen, the single currency has the best chance of making some solid ground against.

The EUR/JPY remains our favourite euro pair for potential appreciation, given that the Bank of Japan (BOJ) again refused to deliver any hawkish surprises at its policy announcement overnight. The BOJ reiterated that economic growth is more important than yen weakness, which should keep the pressure on the currency in the weeks and months ahead, especially if sentiment across the financial markets stabilises further.

Thus, if the ECB were to deliver a 50 bp hike today, I would imagine the EUR/JPY would find renewed buying interest as the disparity between Japan and Eurozone monetary policies grow larger.

As a result, we could see the EJ break to a new yearly high above 144.25, possibly hitting 145.00 thereafter.

If, however, the ECB delivers a dovish surprise, then I would focus on looking for short setups emerging on the EUR/USD than EUR/JPY, given the ongoing dollar strength.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade