The ECB hiked interest rates by 50bps to bring the refining operations rate to 3.00%, as expected. This is the highest level since 2008! In addition, the statement pre-committed to an additional 50bps rate hike at the March meeting. After that, decisions will be made on a meeting-to-meeting basis.

However, during the press conference, Christine Lagarde seemed to be talking out of both sides of her mouth. At one point she said that the ECB “intends” to hike rates by 50bps. Therefore, the March rate hike doesn’t seem like it’s a done deal. However, later she said that under all scenarios, significant hikes are needed (referring to the March 50bps hike).

Everything you need to know about the ECB

As with the FOMC meeting yesterday, the ECB statement was “as expected”, while Christine Lagarde’s press conference was less hawkish than expected and even a bit confusing.

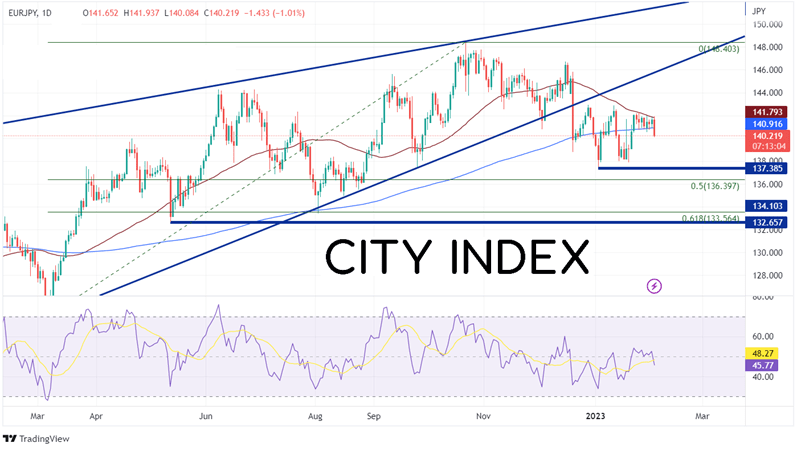

EUR/JPY was one of the biggest movers after the rate hike and subsequent press conference. After trading sideways for the last week and a half between the 50-day and 200-Day Moving Averages (140.92/141.79), EUR/JPY was sold aggressively. The pair broke below the recent range and has plenty of room to run on the downside. First support isn’t until the lows of January 3rd at 137.39. Below there, price can fall to the 50% retracement level and then the 61.8% Fibonacci retracement level from the lows of 2022 to the highs of 2022 at 136.40 and 133.56, respectively. Resistance is close, at the bottom of the recent range and the 200 Day Moving Average. Above the top of the range and the 50 Day Moving Average, price can move to the bottom upward sloping trendline of the ascending wedge (the pair broke below on December 20th, 2022) near 145.65.

Source: Tradingview, Stone X

Trade EUR/JPY now: Login or Open a new account!

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

**A few hours after the press conference, as after the last few press conferences, ECB “Sources” were out to clarify anything that may have been missed or misinterpreted. This time, the sources noted that there may be one or two more rate hikes of 25bps or 50bps, and that they expect a terminal rate around 3.5%.

The ECB hiked rates by 50bps, as expected, and said that it intends to continue it again at the March meeting. However, Christine Lagarde sounded less sanguine about it. EUR/JPY sold off aggressively after the meeting and during the press conference. There is a good deal of resistance above for the pair. But if it breaks back above the recent range, there is plenty of room for it to run!

Learn more about forex trading opportunities.