The initial reaction in the FX market was as expected yesterday after Fed Chair Powell’s hawkish remarks at Jackson Hole.

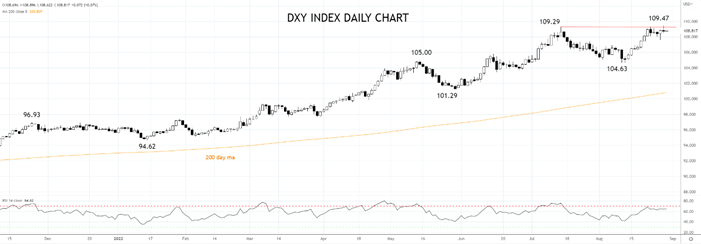

A rise in 2y US yields by as much as 10bp, to 3.48%, reflecting the increased probability for a 75bp hike in September, helped the U.S dollar index, the DXY, to print at 109.47, its highest level since September 2002.

As a reminder, the U.S dollar index, the DXY, has rallied by over 14.5% since the start of the year. The Euro, which accounts for a 57% weighting in the DXY index, has fallen by about 13% during the same period.

However, as the European time zone got underway, hawkish comments from ECB policy markers over the weekend saw European yields rise across the curve. OIS markets are now 60% priced for a 75bp ECB hike in September, and the cumulative amount of ECB hikes by February 2023 is now approaching 200bp.

Providing further support for the EURUSD, a slide in European gas prices following comments from European Commission President Ursula von der Leyen, who suggested the bloc is preparing “an emergency intervention and structural reform of the electricity market.”

Short-dated Dutch gas futures declined sharply, falling by about 20% from a high of ~EUR340/MWh to around EUR272/MWh, reversing a good chunk of last week’s 40% rise. The fall was exacerbated by news that Germany’s gas storage facilities are set to be 85% full by September.

The factors outlined above provided support for the previously friendless Euro and caused the DXY to give up its intraday gains, leaving a loss of momentum daily candle and signs of bearish divergence via the RSI indicator.

Should the DXY now see downside follow through below support 108.50/40, it would likely be the trigger for a deeper pullback in the DXY index, initially to 107.60/40, before 107.00/106.80.

Source Tradingview. The figures stated are as of August 30th ,2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade