Along with US futures, European indices such as the German DAX managed a small bounce during the first half of the European session. At the time of writing, though, they were still holding not very far off Tuesday's lows, along with tech stocks in extended hours trading, after the Nasdaq’s biggest plunge since the pandemic. After such a big decline, dip buyers will likely be very nimble. This means that any bounces that we might see today may not hold for very long. With the market repricing interest rate hikes from the Fed, there will likely be more pain for investors than gains. Look out below.

As far as the situation in Europe is concerned, well there are even less reasons why the bulls would be so enthusiastic about buying the latest dip. Here, the impact of Russia’s war in Ukraine continues to be a major source of worry for investors. The energy crunch and threat of gas rationing, as well as high levels of inflation, means consumers and businesses will be very conservative with their spending.

Meanwhile the latest industrial data from the eurozone has been disappointing, not that this is surprising anyone anymore. Industrial production fell by 2.3% in July, more than reversing the gains made in June. The outlook doesn’t look great with slowing new orders and continued supply-side problems, as the global economy feels the impact of the energy crunch and inflation.

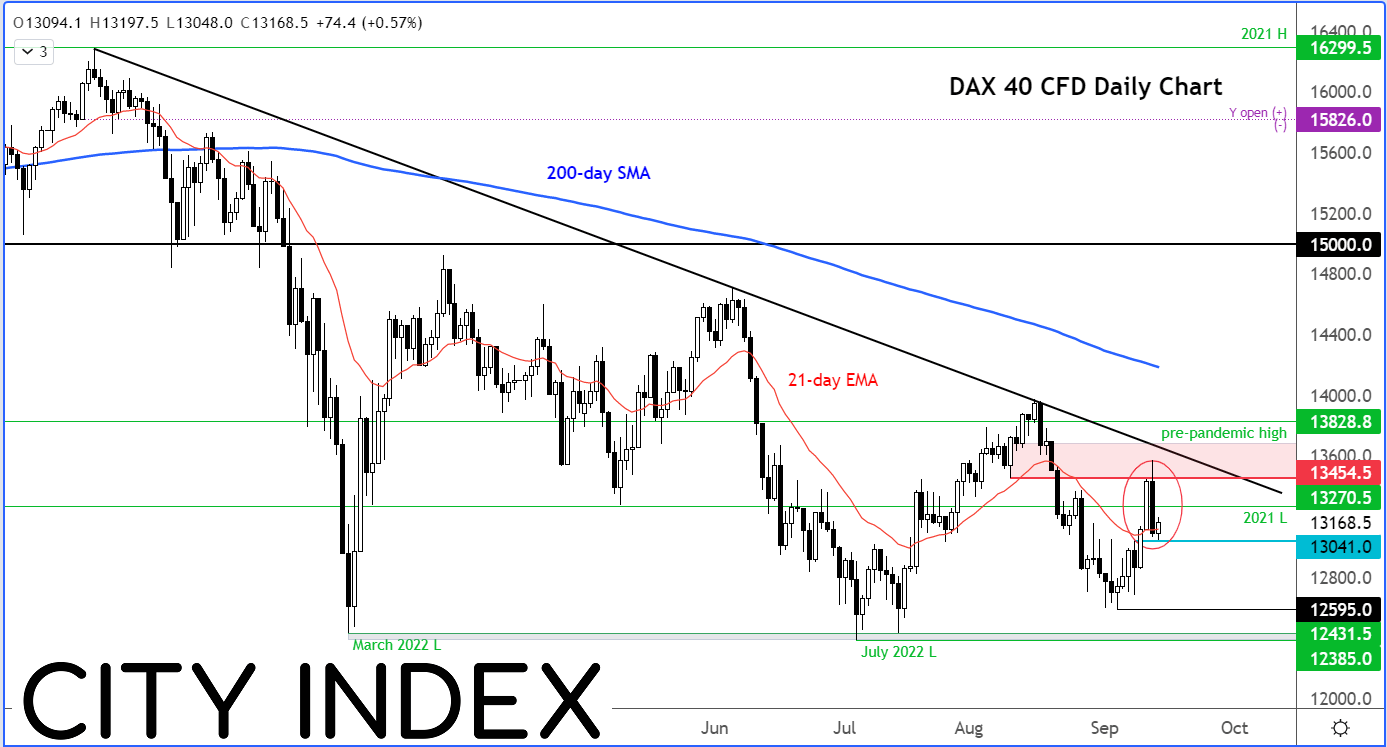

Adding to investors worries is how the indices simply refuse to show any bullish follow-through. They have repeatedly sold off each time an attempt was made to form a low. This repeated bullish failure will discourage the bulls to buy any dips, especially after the big bearish engulfing candles that were printed on the charts of many indices, including the German DAX index:

I would now expect to see some further downside follow through, at least. Many longs are still trapped, and their stops are in danger of getting triggered. At this stage, I wouldn't rule out a return to the summer lows, if we get past and hold below 13040 - the most recent low.

The bulls have a lot of wood to chop. While a short-term bounce from severely oversold levels makes sense, I would now wait to see a clear reversal pattern before looking for bullish setups. It is clear that the biggest moves have been to the downside all year. This is because we are in a bear trend. As always, it is better to trade in the direction of the trend. That being said, if the DAX manages to rally from here and break the long-term bearish trend line then that’s the sort of signals I would be looking for from a bullish point of view.

But my base case scenario is lower levels for the DAX and indeed other major European and global indices.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade