The situation in China continues to dominate market sentiment. We saw oil prices fall more than 3% and stocks in Europe struggled to find buyers during the European morning session. US futures remained near their overnight lows. The dollar gave up its earlier gains, though, as the EUR/USD climbed to a fresh 5 month high to just below the 1.05 handle, before easing back down a tad.

In China, Covid cases continue to rise. More strict mobility curbs were implemented over the weekend as a result. This is going to keep economic activity subdued in the country, and beyond. The civil unrest is adding another layer of uncertainty over the economic situation there. It is certainly hurting investor sentiment across the financial markets.

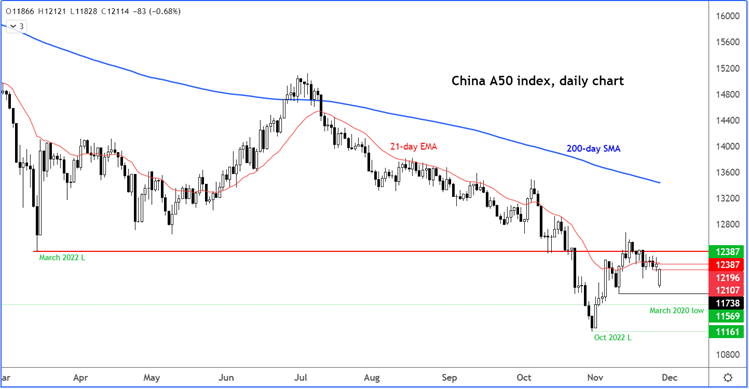

The worry is that the world’s second largest economy may have to tighten its Covid curbs even further. Cases have risen to levels last seen in April, when Shanghai was put in a stringent lockdown. Although China relaxed some restrictions, its zero covid policy means the threat of more growth-choking lockdowns are there. This is going to hold back the yuan and Chinese stocks, and potentially risk assets outside of China – not least crude oil, as we have seen.

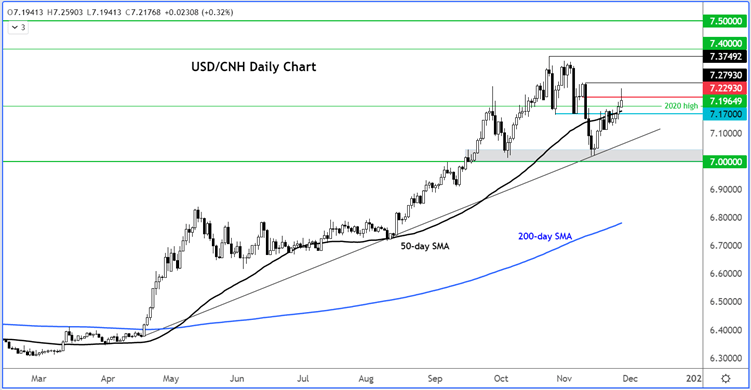

So, the risks remain tilted to the downside until something changes fundamentally in the country. Thus far, we have seen the PBOC inject liquidity into the market and last week cut banks' reserve requirement ratio by 25 bps. That did little to lift the mood in the local stock and currency markets. If anything, it hurt an already-weak yuan, causing the USD/CNH pair to break out above 7.1000 – 7.1800 resistance area.

China’s stock markets have clearly underperformed during the global market recovery that begun in early October. Our China A50 index has been falling again since mid-November. Although it has bounced off the lows to close the overnight gap, the series of lower lows and lower highs suggest the sellers remain in control.

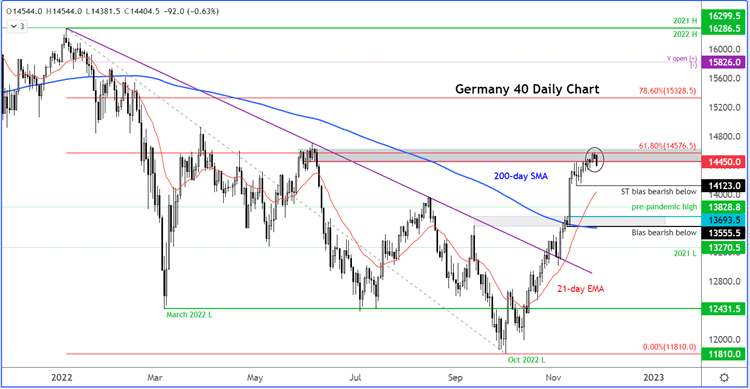

Will we now see the likes of the DAX go down? The German index has dropped after testing resistance around 14450 to 134576 area, where we also have the 61.8% Fibonacci retracement level converging. So far, we haven’t got any short-term lower lows to confirm a near-term top is in. But it could only be a matter of time. A potential break below the 14123 support level would be a bearish development in my view, for that then pave the way for more technical selling and thus a larger pull back.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade