The selling in Bitcoin, Ethereum and other cryptoassets resumed on Monday as more details about FTX’s collapse emerged and fears of contagion spread over the weekend.

FTX latest: “F* regulators” and hacker dumping

Even for corporate fraud historians, the scope and audacity of FTX’s con defies imagination. As FTX’s interim CEO John J. Ray, who notably was responsible for cleaning up Enron’s bankruptcy two decades ago, stated in the company’s bankruptcy filing late last week, “Never in my career have I seen such a complete failure of corporate controls.” That same filing shows that FTX owes $3.1B to its 50 largest creditors alone, and the lawsuits over the remaining funds have only started.

Meanwhile, in an explosive, ill-advised interview with Vox media, FTX’s former CEO Sam Bankman-Fried seemingly showed no remorse for his fraud. In a series of disjointed messages, SBF declared that his biggest regret was declaring bankruptcy for FTX and that much of his advocacy for ethics in business and Effective Altruism was a front that “woke westerners play where we say all the right shiboleths [sp] so everyone likes us.”

If cozying up to lawmakers and regulators while lying to their faces wasn’t enough, SBF went on to say “F* regulators. They make everything worse [and] don’t protect customers at all.” For traders and investors, every word that comes out of SBF’s mouth at this point increases the likelihood of harsher regulations in the crypto space, both in the US and elsewhere, and token prices are likely to remain under pressure as long as fears over the regulatory hammer falling loom.

In more immediate news, the mysterious hacker who purloined hundreds of millions of dollars of tokens from FTX in the wake of the bankruptcy is exerting a huge impact on the market. He/she sold 50K ETH ($60M) on Sunday morning, driving the price of the second-largest cryptoasset down $75 to the mid-$1100s; the hacker’s account still holds another 150K+ ETH to sell if desired. The timing and manner of the selling, with large “at market” sales during the lowest liquidity period of the week, suggest that the hacker may be trying to launder the funds by shorting ETH on another “clean” account and profiting from the resulting drop in price. Obviously, any additional large sales would mechanically depress the price of Ethereum further, regardless of what else is happening in the space.

Contagion: Are Genesis and DCG in trouble?

Unfortunately for crypto bulls, the fallout from the FTX fiasco may well extend beyond SBF’s empire. The latest firm to come under pressure is Digital Currency Group (DCG) after its crypto lender Genesis was forced to pause withdrawals and is reportedly seeking an emergency $1B loan. A collapse of DCG, and its subsidiary Grayscale Bitcoin Trust (GBTC) which owns over 3% of the total Bitcoin in circulation, could unleash another tsunami of selling pressure onto the market, though for now Grayscale has distanced itself from Genesis, noting that its assets are held at Coinbase and that Genesis “is not a counterparty or service provider for any Grayscale product.” One way or another, traders should have more clarity on the outlook for DCG and the implications for the broader ecosystem later this week.

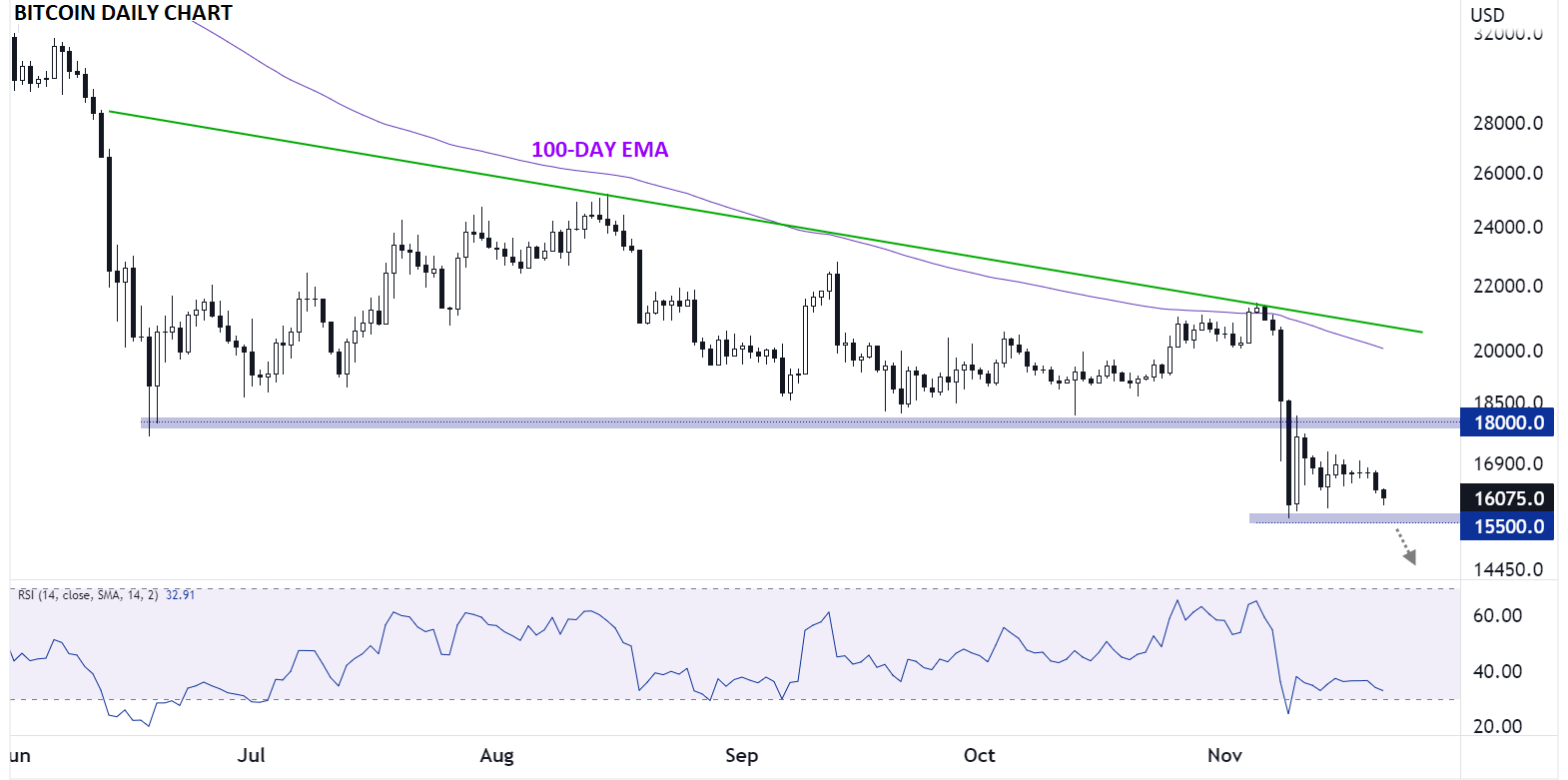

Bitcoin price: Holding above the summer’s lows so far…

If you were just watching the headlines, you’d be shocked to hear that the price of Bitcoin is holding up relatively well for now. Despite all the negative developments, the world’s largest cryptoasset is still holding above this month’s panic lows near $15,500 for now, though a break below this key support level could open the door for a drop toward previous-resistance-turned-support at the June 2019 highs near $14,000 in short order. Meanwhile, crypto bulls would like to see Bitcoin stabilize here and eventually break back above the summer lows in the $18,000 to turn more constructive on the space as a whole.

Source: TradingView, StoneX