Despite this, Amazon.com (AMZN US), one of the darlings of the Big Tech sector and integral member of the FAANGS, has underperformed by approximately 13% the Nasdaq’s 28.5% gain in 2021. Last Friday, just a week out from Black Friday and five weeks from Christmas, two of Amazon's busiest times, the share price of Amazon closed lower despite another record high in the Nasdaq.

Behind Amazon's recent underperformance, a weaker than expected third-quarter earnings report that missed on both the top and bottom line. Along with disappointing fourth-quarter guidance - a result of “several billion dollars” of extra costs, coming from labour shortages, supply chain constraints, and increased freight and shipping costs.

As well as a planned strike this Friday (Black Friday) by Amazon employees in 20 different countries as part of the “Make Amazon Pay” - a coalition of 70 organisations including Greenpeace, Oxfam, and Amazon Workers International protesting long hours, low pay, and complex performance review systems for Amazon employees.

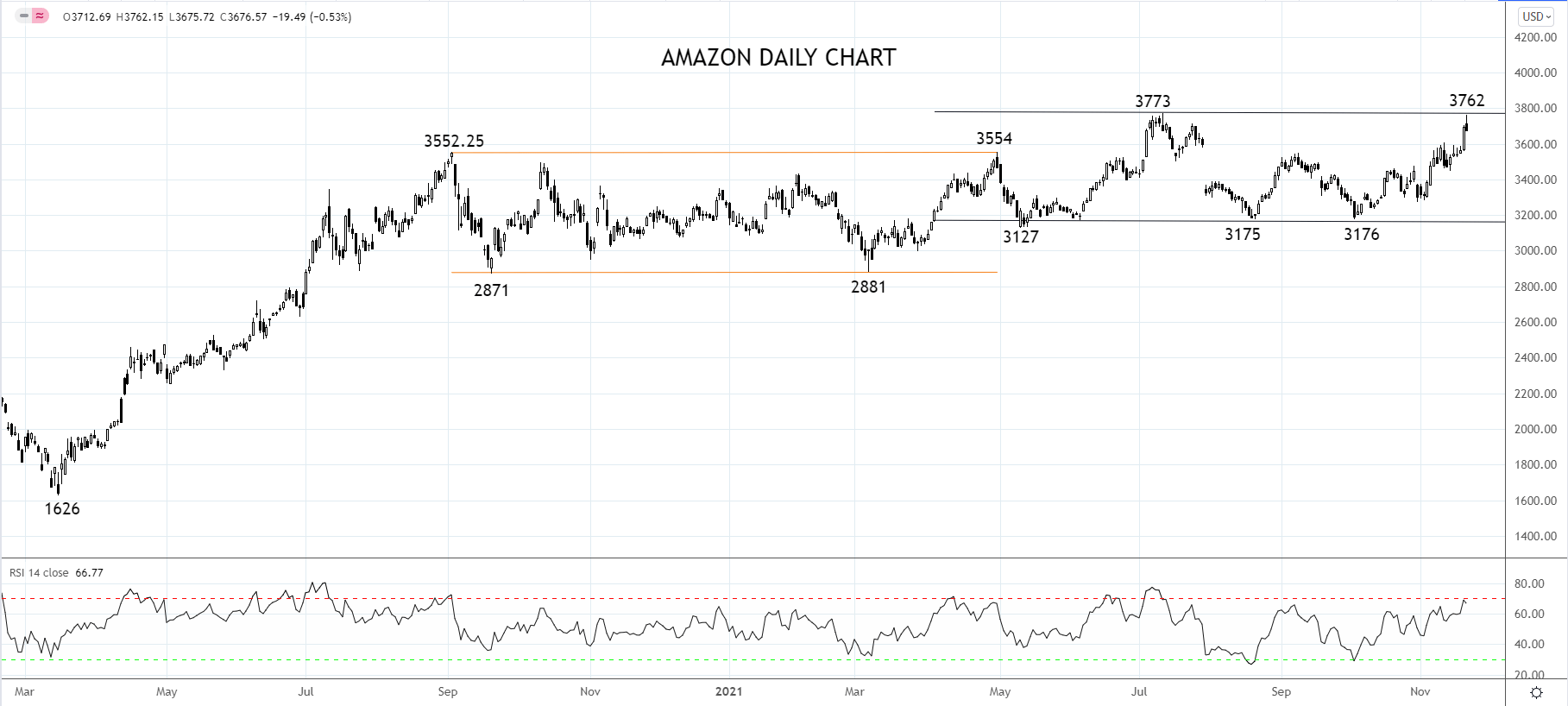

As viewed on the chart below, the share price of Amazon has been encapsulated within a $3125 to $3775 type range for the last eight months after spending the eight months before that trading in a range between $3550 and $2870.

Should the share price of Amazon fall below last Friday's $3675 low without first breaking above range highs at $3775, it would be an indication further range trading is likely.

To take advantage of this, consider going short Amazon on a stop entry at $3665 with a protective stop loss placed at $3782. The first profit target to cover half the position is near $3555 (previous range highs) and the final target is near $3305, providing a trade with a 2:1 risk-reward ratio.

Source Tradingview. The figures stated areas of November 22nd, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade