- Commodities slump, tracking sell-off in yuan

- Chinese demand concerns on the rise amid Covid outbreak

- Dollar rebounds as terminal rate back at 5% for May through July 2023 amid hawkish Fed commentary

It has been a bad for commodities. WTI (-4.0%), silver (-2.5%) and copper (-2.0%) have all sold off, tracking the yuan lower. On Wall Street, the major indices were sharply off their earlier lows, despite the commodities sell-off and a mixed performance in Europe. It looks like sentiment has been hurt a little by a broad dollar recovery amid hawkish FedSpeak, and concerns over China’s economic health.

Hawkish Fed talk

A couple of Federal Reserve officials have again re-iterated their fight against inflation and warned of more pain to come. St. Louis Fed President James Bullard said interest rates need to rise further to a 5%-7% range. A day earlier, San Francisco Fed President Mary Daly said a pause in rate hikes was “off the table.” As a result, the market’s pricing of terminal interest rates has gone back to 5% for May through July 2023.

China worries dominate

It also looks like worries over China is one of the main focus areas right now, where Covid cases are on the rise again and investors fear more lockdowns are likely.

China reported rising daily COVID-19 infections yet again, and this seems to have hit sentiment with the yuan and Chinese stock markets falling. According to Reuters, Chinese refiners have also asked to reduce Saudi crude volume in December and also slowing Russian crude purchases. These are signs of weakness in demand from the world’s second largest economy.

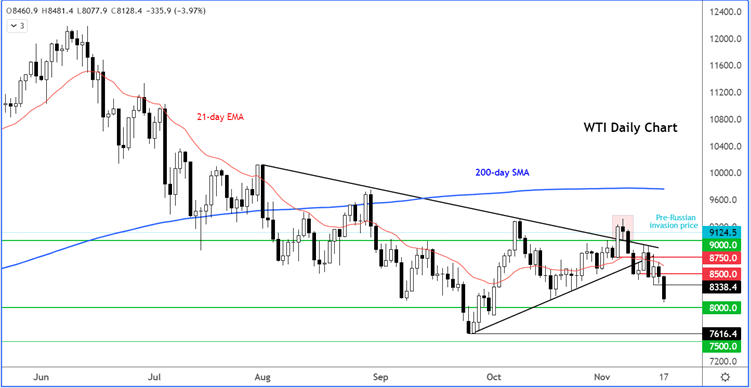

WTI heading to $80?

As I wrote on WTI the day before, oil prices could be heading down to $80 amid concerns over demand.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade