US inflation is expected to fall from a whopping 8.5% y/y to a (still very high) 8.1%. On the monthly basis the consensus is for a 0.2% gain compared with 1.2% previously. If this is the case, it’s likely we’ll see a slurry of ‘inflation has peaked’ headlines, and the dollar may even move lower as the Fed are presumably under less pressure to take runaway inflation. However, today we’ll take a bigger picture view on some of the dynamics behind inflation to gauge the strength of its underlying current.

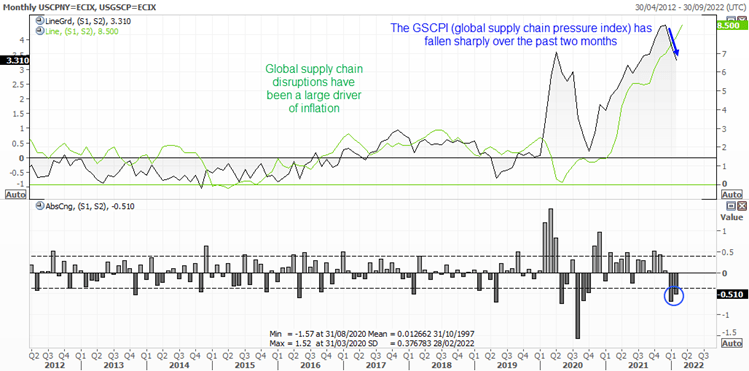

A well-known contributing factor to global inflation has been supply chain disruptions. We are therefore keeping a very close eye on the global supply chain pressure index (GSCPI) as it is showing the early signs of a top.

The below chart directly compares US CPI with the GSCPI and, whilst the general trends can agree, there are periods where the two moving in different directions for extended periods. Therefore, we do not view the GSCPI as a predictor of inflation on a month-by-month basis.

However, we think it is fair to assume that the impact of supply chain pressures on inflation has never been higher, which then makes this indicator more relevant for inflationary pressures than it has been previously. Inflation was clearly rising in lockstep with the GSCPI throughout 2021 and we have now seen two back-to-back months where the GSCPI has fallen quite dramatically. At the very least, we could deduce that supply chain pressures will have less of an impact on inflation over the coming months. At best, we could hope that inflation will begin to follow it lower.

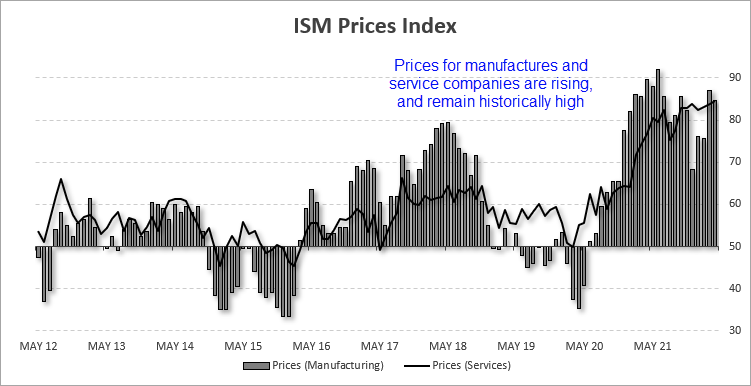

ISM prices continue to show elevated costs for the services and manufacturing sectors

A way to see if the abating pressures are being recognised along the supply chain can be found in the ISM report. And in short, pressures do not seem to be receding that much. Supplier delivery times for manufacturing and services rose in April – meaning delivery times from the supplier were slower across the economy overall. Furthermore, prices paid by manufacturers and services remain historically high and are once rising again.

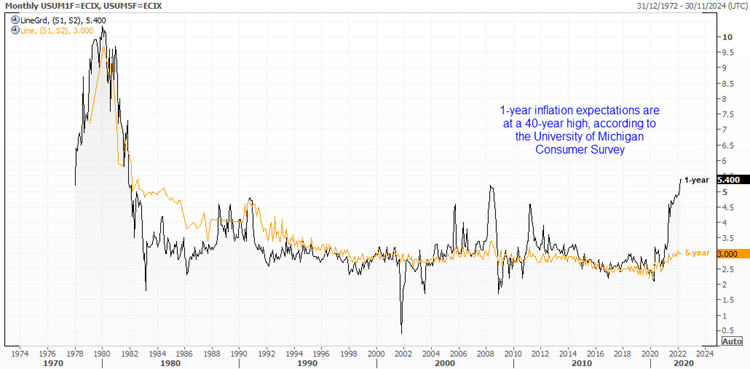

Consumer inflation expectations show no signs of easing

Consumers also expect prices to continue rising according to the University of Michigan report. Whilst it can be argued that consumer’s may not be the best at forecasting the economy, it could also be argued they plan their spending on their own fears for the future. Currently the 1-year inflation outlook is at a 40-hear high (just like underlying inflation) although consumer confidence is near multi-year lows, which makes it debatable as to whether consumer’s really will bring forward their purchases to beat the incoming inflation. If nothing else this chart shows how alarmed the consumer is, but we’d prefer to pay more attention to ISM prices and the GSCPI to gauge the likelihood that inflation has actually topped.

Inflationary forces may linger for a while longer

Whilst it’s encouraging to see supply chain pressures abating to a degree, there is still a long way to go before we can expect a ‘well-greased’ supply chain to be fully restored. ISM prices remain both elevated and rising, and supplier delivery times remain slow which suggests disruptions across the supply chain could prevail. So even if we do see CPI soften slightly on Wednesday, we’re not yet fully convinced we’ve seen the peak. And that is likely to keep the Fed on the back foot as they chase inflation higher with their measly 50-bps hikes.

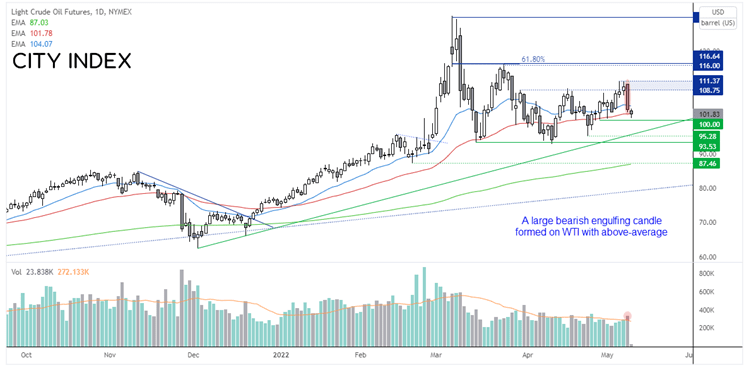

WTI considers a break of $100

Of course, we cannot really talk about inflation without mentioning oil. Lockdowns across China have sparked fresh demand concerns and sent oil prices markedly lower yesterday. On one hand lower oil eases up some inflationary pressures but, if the lockdowns persist, supply chains face further disruption.

An elongated bearish engulfing candle formed on WTI with above-average volume, so it’s possible we may see the market test $100 whilst demand concerns remain in place. But we remain mindful that the trend is bullish overall, so we suspect any losses from current levels are corrective. And that means oil prices could continue to be a key support for higher consumer costs.

$100 will clearly be a pivotal level this session, a break of which brings the December trendline into focus on the daily chart.

The hourly chart shows a strong bearish move alongside rising volumes. It is yet to test $100 and we suspect there may be some sort of volatile shakeout between $100 - $103 before its next directional move. We think a break beneath $100 is on the cards, where we would then target the $97 support zone, whereas a break above $103.38 assumes a deeper correction is underway on this timeframe.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade