Across much of the Northern Hemisphere, the weather through the first part of winter has been unseasonably warm, (perhaps prematurely) raising hopes that the worst of winter is already behind us.

The crypto market is experiencing a similar phenomenon, where despite November’s implosion of the FTX exchange in the depths of a “crypto winter,” prices made only an incremental new low before staging an impressive rally to start this year. Now crypto fans are (perhaps prematurely) raising their hopes that the worst of the crypto winter is already behind us.

There hasn’t been much in the way of truly market-moving bullish developments driving Bitcoin’s nearly 30% rally so far this year; rather the move has been driven by a combination of falling expectations for interest rate hikes by the Federal Reserve and relatively attractive valuations.

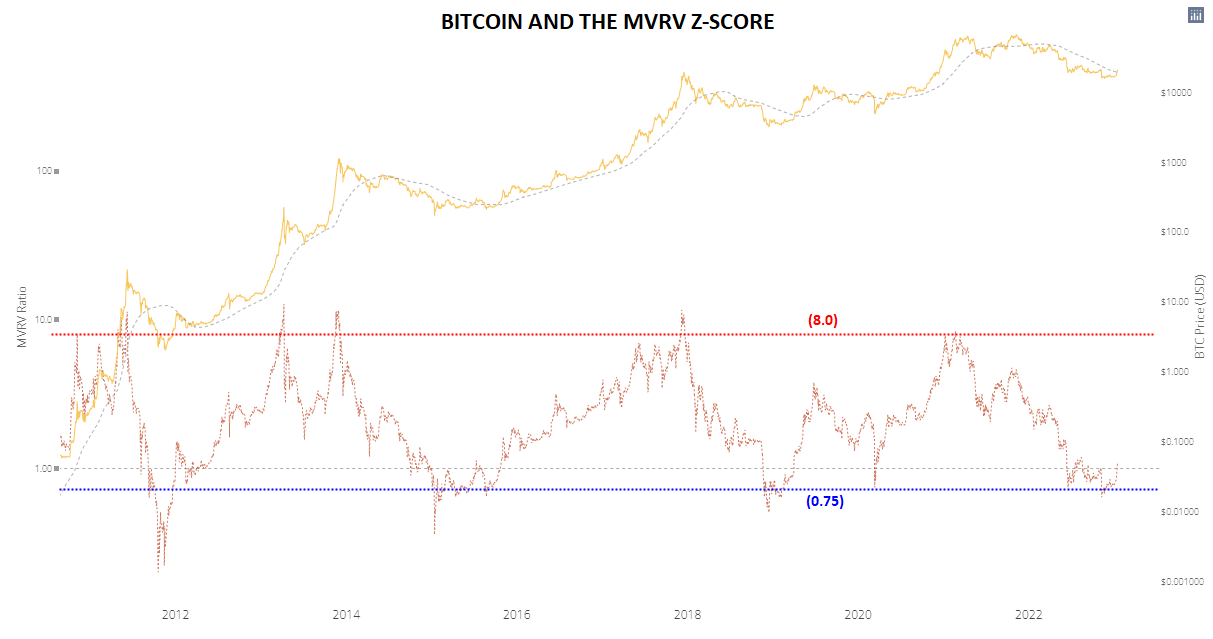

While the entire concept of cryptoasset valuation is still being developed, one measure that has reliably helped traders identify attractive entry and exit points in the past is the MVRV Z-Score. Developed by Murad Mahmudov & David Puell, the MVRV ratio compares a cryptoasset’s Market Value (market cap) by its Realized Value (the summation of the market value of all the network’s tokens the last time they moved on the blockchain). Adding a Z-score normalizes the ratio over time.

As the chart below shows, the MVRV Z-score has reliably indicated potential market bottoms when it has fallen below 0.75, as it did in November, whereas readings above 8 have marked elevated valuations and an imminent top:

Source: StoneX, Glassnode

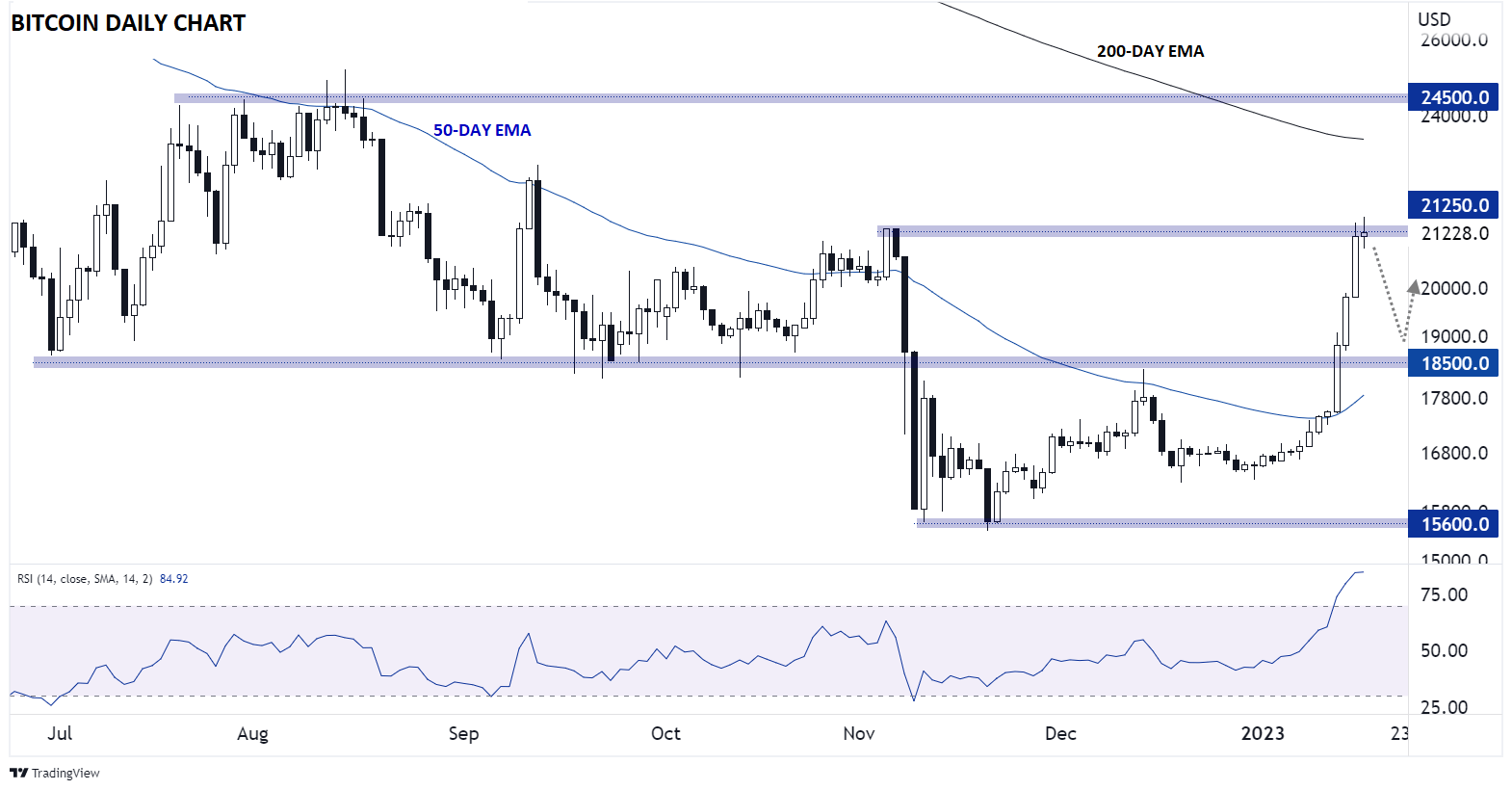

However, much like those in the Northern Hemisphere declaring a premature end to winter, we would also caution crypto traders against assuming Bitcoin and its brethren will be “up only” from here on out. Between the possibility of more turmoil among centralized entities like Binance or Tether and the looming risk of potentially strong regulation across the developed world, we wouldn’t be surprised to see Bitcoin retest its summer lows in the $18,500 area at a minimum before confirming that THE bottom for the cycle is in.

Source: StoneX, TradingView

In other words, even if the worst is behind us, there’s no guarantee it will be smooth sailing back to the halcyon days of 2021 from here!

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade